India’s export surge, and the follow up act

India’s overall exports are estimated to have reached a new high, increasing by 13.84% YoY to US$ 770 billion in 2023. Seventeen of the 30 key sectors exhibited positive growth even as services remained robust. However, will the momentum sustain in the face of the ongoing economic slowdown conditions across the world?

Image Source: Shutterstock

Image Source: Shutterstock

According to the recently released trade data for FY23 on April 13, India’s overall exports are estimated to have reached a new high, increasing by 13.84% YoY to US$ 770 billion. Imports are also expected to have grown by 17.38% YoY to US$ 892 billion during the same period, indicating a widened trade deficit of US$ 122 billion.

Goods exports are estimated to have increased by 6.03% YoY to reach US$ 447.5 billion, while goods imports grew by 16.5% YoY to US$ 714.2 billion. Despite this, services exports are expected to have remained strong, with an estimated growth of 26.79% YoY to US$ 323 billion in 2022-23. This indicates a strong performance for the services sector despite the challenging global economic environment.

Sector Overview

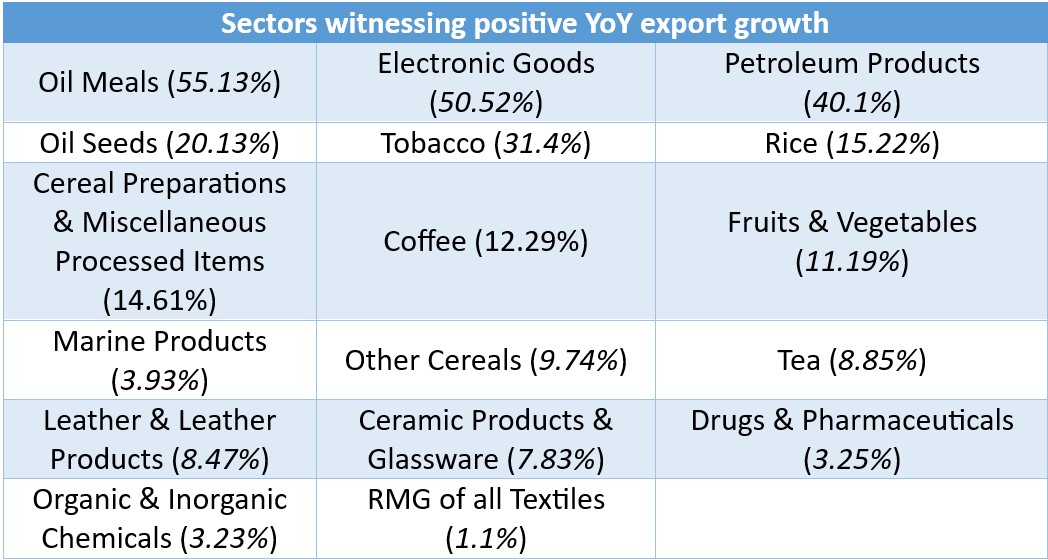

Under merchandise exports, 17 of the 30 key sectors exhibited positive growth YoY, as indicated in the following table.

Source: Ministry of Commerce & Industry

Moreover, 45 principal commodities have shown growth in both the value and volume of exports during the year.

- Export share of petroleum products in total merchandise exports has increased from 15.99% to 21.12% YoY.

- Exports of electronic goods registered a growth of 50.52% with US$ 23.57 billion as compared to US$ 15.66 billion.

- Exports percentage of cashew and iron ore declined sharply by 21.34% and 44.69% respectively. Textiles exports are showcased a steep fall.

- Non-petroleum and non-gems and jewellery exports were relatively flat at US$ 314.98 billion.

This is indicative of the fact that petroleum product exports witnessed a huge increase by 40.1% YoY to US$ 94.52 billion, thereby making them a major factor in the robust export data. Analysts have linked this trend to Western markets buying finished oil products from India, as they had put Russia under sanctions. Interestingly though, India’s crude oil purchases from Russia increased sharply in this period, making the latter account for 25% of its crude imports.

Agri and processed food categories have witnessed growth across the board led by Oil meals, Tobacco and Oil seeds and Rice. Cereal Preparations & Miscellaneous Processed Food Items have continued to show good performance, with a growth of 14.6% YoY. The only exceptions were Spices; Meat, Dairy & Poultry Products and Cashew. Exports of other cereals grew by 9.7% YoY to reach US$ 1.19 billion during the year. A highlight of the year was a surge in wheat exports in the initial months, due to the crisis arising from the Russia-Ukraine war. However, because of India’s own domestic supply issues in wheat, the government had put a ban on export of the commodity.

Market Overview

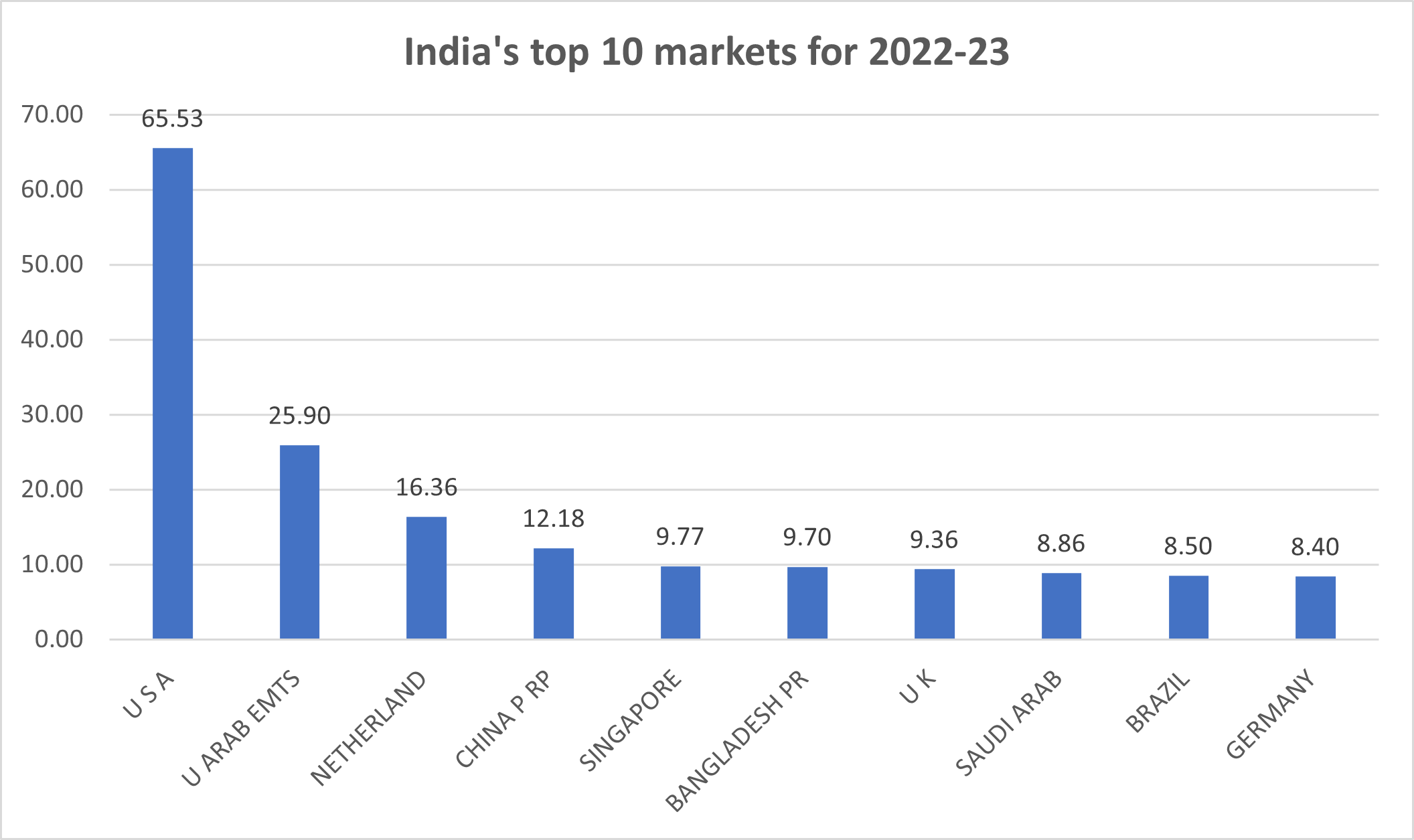

Notably, Netherlands has been an outlier this year in terms of export growth for India. The emergence of the Netherlands as India’s third-largest export destination has surprised many, with a 4.67% share in total exports during fiscal 2023. The country’s exports to the Netherlands increased from US$ 12.5 billion in FY ’22 to US$ 20.9 billion in FY23, indicating a 66.6% growth YoY. This was mainly due to the export of refined petroleum products to the European nation.

Source: Ministry of Commerce & Industry; figures in US$ billion for 2022-23

However, the US continued to be India’s largest merchandise export destination, with exports worth US$ 78.31 billion, up over 2% from the previous financial year.

During 2022-23, three out of the top ten export partners, namely China, Bangladesh, and Hong Kong, experienced declines in their imports from India by 27.9%, 27.7%, and 9.9%, respectively. On the other hand, despite a 4% increase in goods imports from China to US$ 98 billion in FY 2022-23, its share in overall imports to India declined from 15.4% to 13.8%. However, China remained the largest exporter to India, followed by the UAE and the US.

Russia moved up 16 ranks, overtaking Saudi Arabia and Iraq to become India’s fourth-largest import partner, with imports seeing a rise of 370%, majority of which was crude oil imports. In all, India’s top 10 markets accounted for 46.9% of its total merchandise exports.

Future trade outlook

As the recently released trade forecast by the World Trade Organisation reports, global merchandise trade volume is expected to grow by 1.7% in 2023, as compared to 2.7% in the previous year. Potential risks that could impact trade growth include “geopolitical tensions, food insecurity, potential financial instability stemming from monetary policy tightening, and increasing levels of debt”. According to the trade body, it is again expected to pick up in 2024 to 3.2%, although the ‘uncertainty’ is rated higher than usual.

As far as India is concerned, manufacturing sector exports are expected to show a greater pick up in 2024-25, according to an ADB report, which is more in line with global trends. However, as the pandemic fears recede further, contact intensive sectors like tourism are expected to boost the services export basket. Moreover, the impact of schemes like PLI is encouraging when it comes to enabling scale, as is visible for sectors like electronics and solar panels. Analysts are hopeful that the scheme will help enhance competitiveness of Indian players, helping them to expand their global footprint even in a difficult macro environment.

Leave a comment