Indian electronics industry: Time to clean up!

It is widely recognized that e-waste is not only a major environmental pollutant but it is also a reason for major health hazards. This blog lays out the road map to a ‘green’ electronics industry. This business model is a win-win solution as it will curb environmental pollution & help companies boost their profits.

- Pandemic-induced higher consumption rates of electric and electronic equipment and design features like planned obsolescence are leading to the rising consumption of electronics and the ensuing menace of electronic waste (e-waste).

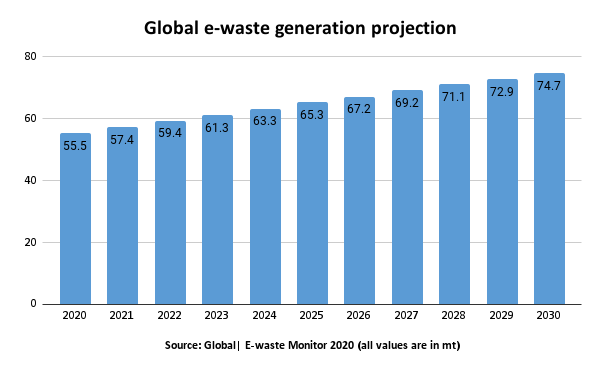

- The Global E-waste Monitor 2020 has found that in 2019, 53.6 million metric tonnes (Mt) of e-waste was generated worldwide, rising 21% in 5 years. China, USA & India were the top 3 contributors to this.

- A sustainable business model for the Indian electronics industry is a win-win solution as the country aspires to be a global manufacturing hub. Not only will it curb environmental pollution, it will also help companies attract more buyers, save costs & gain a positive brand recognition.

- Some approaches that could make the industry green include innovation in design to ensure greater shelf life for the product, a circular supply chain, changing the perception of consumers & carbon offsetting.

Image credit: Shutterstock

From smartphones, play stations & laptops to TV, washing machines, air conditioners (ACs) and fridge – electronics have become ubiquitous to urban life these days. This is evident from the data collected by the National Family Health Survey 5 (2019-21) that states that 68% households in the country own a TV while there are 18% households with a washing machine, 38% with refrigerators and 24% with ACs.

While it is certainly impressive to see the growing consumption of consumer electronics in the country, a storm is silently brewing too. This is the menace of electronic waste or e-waste, i.e., an electric device that is discarded, becomes obsolete, or breaks down. According to the Central Pollution Control Board, e-waste in the country rose 31% from 7.71 lakh tonnes in 2018-19 to 10.14 lakh tonnes in 2019-20. Uttar Pradesh, Maharashtra, Tamil Nadu, Haryana & Uttarakhand are the major contributors of e-waste in the county. Further, the data provided by the Ministry of Environment in the parliament in May’22 showed that around 78% of India’s e-waste is not being collected or disposed by the government.

Sadly, the problem of e-waste is not exclusive to India. The Global E-waste Monitor 2020 has found that in 2019, 53.6 million metric tonnes (Mt) of e-waste was generated worldwide, rising 21% in 5 years. China (10.1 mt), the USA (6.9 mt) & India (3.2 mt) were the top 3 contributors to global e-waste in 2019. The report predicts that global e-waste will reach 74 Mt by 2030, almost a doubling of e-waste in just 16 years. The graph given below explains this:

What is driving the rise in e-waste?

Higher consumption rates of electric and electronic equipment amidst rapid industrialization and rise in disposable incomes is one of the reasons for rise in the consumption of electronics. The pandemic, too, added fuel to this fire and led to a rise in demand for electronics. A Feb’22 Deloitte Survey shows that sales of computers (34%) and TV sets (12%) have grown much faster than smartphones (1%) in the past three years globally. Speaking specifically of India, Ministry of Electronics and Information Technology & India Cellular & Electronics Association (ICEA) expect domestic market to increase from US$ 65 billion to US$ 180 billion over the next 5 years.

Another factor responsible for rise in e-waste is the short life cycles due to built-in or planned obsolescence. This refers to the phenomenon of device manufacturers and developers reducing the performance and usability of devices (generally through software updates). The idea behind this is to encourage people to buy brand-new and more recent technologies. For example, smartphone manufacturers may introduce such updates and users may face issues such as the phone hanging frequently or users losing access to certain functions. It is not surprising that according to a study, the replacement cycle for smartphones has become on average shorter than two years.

Lastly, there are few options for repair for some of these products. Some of the barriers to repair include the design of products, availability of spare parts and information; access to trusted professional repairers; and the cost and convenience of replacing smaller items compared to getting an item repaired and consumer preferences and attitudes not favouring repair.

Time to reboot the electronics industry

It is widely recognized that e-waste is not only a major environmental pollutant raising concerns about air pollution, water and soil contamination but it is also a major reason for health hazards. Substances such as mercury and lead damage the human brain and/or coordination system. To make things worse, much of today’s electronics contain data storage, which could be accessed after the item has been discarded and exploited by nefarious parties. Given the global clamour about climate change & concerns around human health, it is high time for the global electronics industry to rethink its way of operation & incorporate sustainability into its business model. Some of the approaches that can be applied to attain this include:

Innovation in design

Manufacturers need to stay away from the practice of planned obsolescence & ensure greater shelf life for the product. At the same time, innovation of components should not be so fast that damaged components are difficult to repair and customers have no choice but to buy new gadgets. Not only will this approach help the brand build loyalty among customers, brands can make money from the same item multiple times by offering resale and repair, despite selling fewer items.

Adopting a circular supply chain

E-waste can be an ‘urban mine’ for companies as it has several precious, critical, and other noncritical metals (estimated to be at approximately US$ 57 billion) that can be used as secondary materials after recycling. According to the UN, 4 Mt of raw materials could be easily made available for recycling. Using recycled metals is profitable for companies too. According to Toxics Link, 5 tonne of e-waste, would give profit worth of INR 1,78,308.

Changing the perception of consumers

Companies also need to educate their customers that products made from reused substances are not inferior in any way. They can use promotional strategies such as offering heavy discounts on exchange of old gadgets or selling refurbished devices at competitive prices can be deployed. At the same time, the government can disincentivise customers from buying first hand products by framing policies like “pay as you throw“.

Carbon trading

Last, but not the least, companies also have the option of buying certificates that someone else is reducing emissions on their behalf. While this will still keep a tab on carbon emissions, this is similar to the concept of greenwashing as buyers will source voluntary carbon credits against the total emission done by them instead of actually taking steps to cut down carbon emission in the value chain. Another issue pointed out by Shailendra Singh Rao, founder of Creduce, with this strategy is:

Carbon pricing is still an issue for many buyers across the world, because carbon credit has no fixed pricing mechanism and has no fixed process by which pricing can be done in the international market. Carbon credits, moreover, are the subject matter of bilateral trading.

Sustainable electronics industry: A win-win solution

The government aspires to transform India into a US$ 300 billion electronics manufacturing powerhouse from the current US$ 75 billion by 2026. This vision for the Indian electronics industry is in line with the government’s Aatma Nirbhar Bharat initiative It is taking quite a few measures such as enacting US$ 10 billion PLI Scheme for the semiconductor and display ecosystem to ensure that the country is a part of the global electronics value chain. At the same time, a sustainable business model is the need of the hour amidst the rapidly soaring temperatures and pollution. Explaining the importance of circularity, Tim Cook, Apple’s CEO said:

Every company should be a part of the fight against climate change, and together with our suppliers and local communities, we’re demonstrating all of the opportunity and equity green innovation can bring.

Given that around two-thirds of consumers across six international markets believe they have a responsibility to purchase products that are good for the environment and society, sustainability is a win-win solution. This is attributed to the fact that it will not only curb environmental pollution & check global warming, it will also help companies attract more buyers, save costs & gain a positive brand recognition. To illustrate this point, Apple has saved over US$ 6 billion by not providing chargers in the box of iPhones as not only did it save money by not producing chargers, it also saved money in packaging & shipping smaller boxes. Similarly, Intel achieved a 90% non-hazardous waste recycle rate by 2020 & recorded cumulative energy savings of 4 billion kWh from 2012 to 2020. HP has also adopted sustainable measures such as recycled plastic, third party certified recycled corrugated for packaging & reducing the amount of materials in the PC by weight. The brand has reported US$ 3.5 billion in sales associated with sustainability in the last three years.

To sum up, a green electronics industry is the way forward. Business & Sustainable Development Commission also emphasizes on this point. It predicts that sustainable business models related to the SDGs could open economic opportunities worth up to US$12 trillion and increase employment by up to 380 million jobs by 2030. Last, but not the least, investors are increasingly considering environmental, social and governance (ESG) risks when making investment decisions. According to UNCTAD, capital spending announcements for greenfield FDI projects amounted to US$ 134 billion annually on an average during 2015–2019, rising 18% from 2010–2014. So, companies that publicly commit to the SDGs create competitive advantages related to ESG performance.

Leave a comment