Indian electronics industry: Time to be an exports hub

The current position of the India electronics industry in terms of the production and export is not something to boast about. However, as the Government recognizes it and is putting in place the necessary investments and making the policy changes to accommodate, it is only fair to assume the best days are yet to come.

- The electronics sector has become the 6th largest Indian export sector in 2021-2022. Globally, though, India is nowhere in the top 10 electronics exporters in the world.

- The Government has taken many initiatives to help increase electronic manufacturing and exports.

- They have also built a roadmap of how they will achieve US$ 300 billion in manufacturing and US$ 120 billion in exports through various initiatives like Assemble in India, ‘First Globalise, Then Localise’, Gati Shakti, etc.

- However, if India has to emerge as a dominant player like China and South Korea, it needs to have the design capability coupled with manufacturing resilience and a developed tooling industry.

Image credit: Shutterstock

In recent years, the Indian Government has been pushing hard to present the country as a force to be reckoned with in the electronics export sector. Initiatives like National Electronic Policy (2019), Scheme for Promotion of Manufacturing of Electronics Components and Semiconductors (2020), Electronics Manufacturing Clusters (2020), and PLI scheme for large-scale electronics manufacturing (2020) are steps in this direction.

Going a step further, Rajeev Chandrasekhar, the Union Minister of State for Electronics and Information Technology and Union Minister of State for Skill Development and Entrepreneurship, launched a report (in August, 2022) titled ‘Globalise to Localise: Exporting at Scale and Deepening the Ecosystem is Vital to Higher Domestic Value Addition’.

The report elaborated on the issues India was facing in achieving a position in the global electronics supply chain. While there are a variety of reasons behind this, the important question is that how can India become a big exporter and achieve a considerable production target in the next few years. That is something that this blog will discuss next.

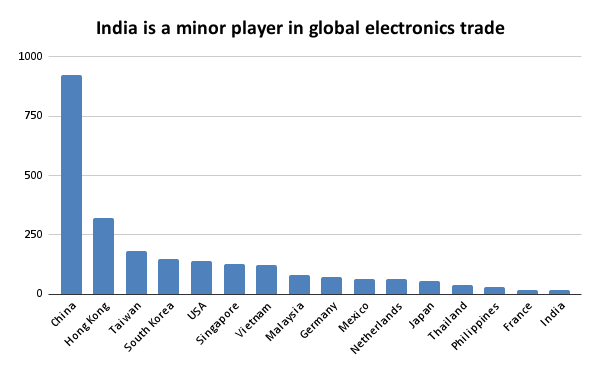

Who’s leading the global electronic race?

In 2021, China (US$ 925 billion), Hong Kong (US$ 320 billion) and Taiwan (US$ 183 billion) were the global leaders in the electronics sector. Apart from these, most of the leading nations in this race are from Asia – South Korea (US$ 148 billion), Singapore (US$ 126 billion), Vietnam (US$ 123 billion), Malaysia (US$ 81 billion), Japan (US$ 57 billion) & Thailand (US$ 37 billion). The USA (US$ 138 billion), Germany (US$ 71 billion), Mexico (US$ 64 billion), the Netherlands (US$ 62 billion), the Philippines (US$ 31 billion) & France (US$ 18 billion) are some of the other non-Asian leading players in the global electronics trade. India (US$ 16 billion) was at the 16th place as an exporter of electronics products. That is because the Indian electronics industry has still not realized its potential.

Source: Financial Express

Why is India not a leader in the global electronics value chain?

There are many reasons why India is lagging in the global electronics race. But, primarily, the biggest factor is that we have not changed the prevalent practices in our industrial manufacturing system, which has hampered the growth of the Indian electronics sector. The FTAs with ASEAN and S Korea have contributed to a surge in imports of electronics in the country. For example, under the CEPA with Korea, 8 non-Information Technology Agreement products were made duty free in 2010, 60 tariff lines were made duty free in 2014 and 277 tariff lines were made duty free in 2016. This caused a severe blow to the Indian electronics industry’s manufacturing capabilities. Further, FDI inflows into electronics manufacturing are meagre. Between April 2000 – March 2021, FDI inflows into this sector amounted merely US$ 3.16 billion.

Compare this to the electronics export of China: from 2000, the exports have risen from US$ 44 billion to over US$ 900 billion in the year 2021. Vietnam’s case is even more shocking. Despite being equal to India in exports of electronic items, it has managed to eke out over the last decade. As a result, Vietnam’s exports are now 9X of India’s exports. On the other hand, India just manages to contribute 1.2% of its electronics manufacturing in the national output share. And it has remained like that for 20 years.

To make matters more complicated, recently, there has been a considerable change in global value chains. The minister, Mr Rajeev Chandrasekhar, has also stated that after the COVID-19 pandemic, the electronics value chains are undergoing profound historical changes that can’t be undone. This will help the sector to gain the necessary momentum for 2026.

Fixing the glitches in the Indian electronics industry

To become a global hotspot in the electronics value chain, the Indian Government needs to identify and target the challenges in the system and remove the bottlenecks. The report suggests that India should adopt the mantra of ‘first globalise, then localise’, a strategy used by China and Vietnam. Dr Sunitha Raju, IIFT, opines a strong correspondence between trade and industrial policies has led to the development trajectory of the electronics industry in China, South Korea and Taiwan. Focusing infrastructure development on cost savings, speed and flexibility would go a long way in fostering the development of the Indian electronics industry. She suggests:

If India has to emerge as a dominant player like China and South Korea, it needs to have the design capability coupled with manufacturing resilience and a developed tooling industry. Particularly with high rate of obsolescence and evolving technology in this industry, the investment climate needs to be conducive. Further, integration of the SME through cluster development with appropriate technology support can result in cost benefits of agglomeration and scale economies.

Some other steps that India can take are:

- The integration of ‘Assemble in India for the world’ into ‘Make in India’. Here, the gadgets that are imported into India draw higher taxes and create a huge trade deficit in return. To overcome this, India can import the parts required to make the component, and then can assemble the parts to form a gadget. This will reduce the bulk of electronic imports in the country.

- A result of this ‘Assemble in India’ strategy will help the country to increase its market share in exports to 3.5% approximately. Achieving these figures is feasible by 2025, and it could very well become 6% by 2030. Around 4-8 crore jobs will also be generated by 2030. The exports would also achieve a target of $248 billion in 2025, contributing around 25% of the national output.

- Raising our exports will create a robust supply chain and bring in investments that will add variety to the Indian electronics segment. There is also a real relationship that exists between exports and the domestic value addition share in the countries that have a successful exporting system. In the mid-term, there is a positive correlation between the two variables.

- The next aim should be to raise local sales. This will deepen and help to build a strong foundation for a broad electronics ecosystem within the country. Government policies like ‘Gati Shakti’ will boost India’s competitiveness in the global market.

Quite informative.