Indian Economy- What has Quarter 2 brought?

- India has entered into recession for the first time since 1996, registering a growth of -23.99% in Q1 2021 and -7.5% in Q2 2021.

- The manufacturing sector has grown at a rate of 0.6% in Q2, with the PMI index showing the signs of expansion in the sector since August 2020.

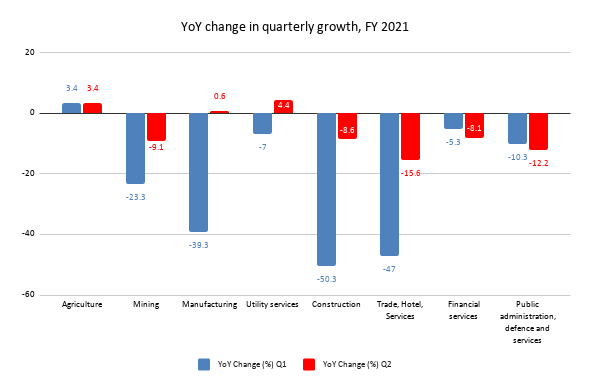

- Other sectors also, except financial, real estate & professional services and public administration, defence & other services have shown an improvement performance in Q2 than in Q1 2021.

- Moody and Goldman Sachs have revised their estimates upward for India’s FY21 growth to -10.6% and -10.3% respectively, thereby implying a stronger recovery for the economy.

Image credit: https://bit.ly/33x7Okf

The COVID-19 pandemic has hit the economies hard across the globe. For fiscal year 2021, the July-September growth has been negative for many countries including US (-2.9%), Japan (-5.8%), and Singapore (-7%). Spain and United Kingdom have experienced deepest contractions at the growth rates of -8.7% and -9.6%, respectively. For India also, the overall picture has been dark. Prior to pandemic, based on the nominal GDP ranking, India rose to the 5th rank in 2019 from the 9th rank in 2010 as per International Monetary Fund’s (IMF) estimates. Furthermore, the Indian economy had the highest growth rate in the world at 7-8% in 2017-18. However, in fiscal year 2021 the country has slid into recession after facing contraction of 23.99% in Q1 and 7.5% in Q2. Based on quarterly data on GDP growth, since 1996 it is the first time that India has entered into recession.

In Q1 2021, all the sectors in the economy faced negative growth, except agriculture. However, in the Q2 of FY2021, there has been a positive turn in events with the country performing better than RBI’s projection of -8.6% for this quarter.

Source: Ministry of Statistics and Programme Implementation, figures in %

All sectors except financial services and defense services have performed better in Q2 in comparison to Q1. The manufacturing industry experienced positive growth of 0.6% in GVA. The growth of this sector has also been evident from the IHS Markit’s manufacturing PMI index for India which has been above 50 since August 2020, standing at 58.9 in October 2020. However, in November the PMI index for manufacturing stood at 56.3 representing less increase in exports, output, orders, and buying levels. Commenting on the growth of this sector, Aditi Nayar, Principal Economist at ICRA Ltd, opines that:

“While manufacturing volumes had continued to contract, the GVA of this sector posted a marginal 0.6% growth in Q2 FY2021, on the back of aggressive cost-cutting measures, a pared-down wage bill and benign raw material costs.”

The agriculture sector has maintained its positive growth in Q2 2021 as well on account of good monsoon and timely rain. Furthermore, an increase in the sown area has also led to the positive performance of the sector, with a YoY rise of around 121 lakh hectares as of July 2020. Utility services have come out to be the best performing sector in Q2 2021. The construction sector has also improved in Q2 but still contracted at a rate of -8.6%. Nayar added that recovery in key inputs such as steel and cement and healthy central government awards in railways and roads have narrowed down contraction in the construction sector.

Trade, hotel, transport, and services related to broadcasting has seen a decline of 15.6% but still, the contraction has eased in comparison to Q1 2021. The financial services have experienced a greater decline in Q2 with a contraction of 8.1% which shows that the sector is not in good health. The public administration and defense services also faced a deeper contraction in Q2 2021 at -12.2%.

When it comes to the trade of India with the rest of the world, the exports of India have contracted by 1.52% in Q2 2021 in comparison to a contraction of 19.48% in Q1 2021. This means that exports have contracted but at a lower rate. One possible reason for this is that many trading partners faced the pandemic earlier than India and thus are gradually getting back on track. The imports have also contracted at a lower rate of 17.16% in Q2 2021 YoY in comparison to the contraction of 40.38% in Q1 2021. One reason for contraction in imports is the fall in imports of oil and oil products as a result of the decline in crude oil prices and consumption. With a share of more than 30% in the total imports, the imports of oil and oil products between April’20 and September’20 have declined by 50% YoY. Another reason for contraction in total imports is the hit on incomes of domestic consumers amid the pandemic.

Some big agencies have revised their projections for the growth of the Indian economy for FY21. Moody’s investor services, for example, has revised their forecast from -11.5% to -10.6%, whereas Goldman Sachs has revised the estimated contraction to 10.3% from 14.3%. Nayar opines that for the latter half of the fiscal year 2021, a stronger revival in Indian economic activities is expected with unevenness in the regional and sectoral recovery. Specifically, the services sector is expected to recover at a modest pace due to social distancing norms and fear among the consumers. However, S&P Global has kept intact its forecast for India’s growth in FY2021 at -9%. The cases are threatening to bring the third wave in many states which are creating uncertainty for the future path of recovery. Thus, the brighter picture for the economy would be more promising with a reduction in the number of COVID-19 cases. With the trials of vaccines, it is a possibility that the optimistic recovery also might not be that far.

Leave a comment