Indian economy, past the ‘Ides of March’?

After experiencing an estimated 6.9% GDP growth in 2022-23 despite global headwinds, India’s economy is projected to grow at a rate of 7% and expected to be the fastest-growing economy in FY ’24. IBT looks at important developments and policy changes at the close of 2022-23 and what the current fiscal portends.

Image Credit: Shutterstock

The economic situation across the world is facing a slowdown. Geopolitical tensions between major economies continue to be a risk factor that could negatively impact global economic growth. Ongoing trade tensions between countries have already had a negative effect on trade and investment. Global growth is expected to decline from 3.4% in 2022 to 2.8% in 2023, due to elevated inflation and financial tightening.

Despite the challenges posed by the pandemic, global recession and geopolitical tensions that caused global economic uncertainty, the Indian economy has performed well in FY ’23, with ICRA estimating a GDP growth rate of 6.9%. This is a decline from 9.1% in 2021-22 due to margin compression in some industrial sectors caused by rising commodity prices. The economy is projected to grow at a rate of 7%, surpassing the growth of other major economies and the typical trend rate. World Economic Outlook (WEO) projects India to be the fastest-growing economy in FY ’24.

The projection for India’s real GDP growth rate in 2023-24 is consistent across various sources including Economic Survey 2022-23, RBI, World Bank, and ADB. All of them estimate a growth rate of around 6.3-6.5%, indicating a positive outlook for the Indian economy in the upcoming fiscal year.

IBT spoke to Mr. Madan Sabnavis, Chief Economist, Bank of Baroda about the forecasted growth of the Indian economy. Commenting on the same, he said,

“Indian economy will definitely be a better-performing economy than the others. Being a domestic-oriented economy has helped this growth number as the global slowdown has less of an impact through the export route. However, growth of less than 7% is well below the potential of 8-8.5% which we have been used to in the past.”

Although when asked if the nation is on the right path to accelerate growth, Sabnavis stated that a big push is needed for this to happen and the country needs both the consumption and investment engines to propel the growth process. He added, “For this, we need more jobs to be created that will add to income and spending and hence investment. We also need a big push for the rural economy where demand has been sticky due to high inflation that has affected real consumption. This will happen over a period of time and is largely in the realm of the private sector.”

When it comes to FY22-23, the year ended with new policies and regulations, inflation ease and upliftment of several potential sectors. India introduced the New Foreign Trade Policy. And as per the Monthly Economic Review March 2023, there was a decline in inflationary pressures, as Consumer Price Index (CPI) inflation rate decreased to a 15-month low of 5.7% in March. The RBI has taken actions to counter inflation and support growth.

|

New Foreign Trade Policy 2023 |

| The new Foreign Trade Policy (FTP) aims to increase India’s exports to US$ 2 trillion by 2030 through a remission and entitlement-based regime that refunds taxes and duties paid in the process of exports. The FTP 2023 focuses on process re-engineering and automation to facilitate ease of doing business for exporters, with four key pillars:

1. Ease of doing business, reduction in transaction cost and e-initiatives. 2. Emerging Areas such as e-Commerce exports, Developing Districts as Export Hubs, and access to high-end technology items under SCOMET policy. • Process Re-Engineering and Automation The new Foreign Trade Policy (FTP) focuses on promoting exports and facilitating a paperless, online environment for easy access to export benefits. The implementation mechanisms include IT-based schemes and reduced fee structures to aid MSMEs. All processes under Advance and EPCG schemes will be covered online during FY24, and most applicants will fall under the ‘automatic’ route initially. Cases identified under the risk management framework will undergo manual scrutiny. • Recognition of Exporters Exporter firms recognised for export performance will partner in capacity-building initiatives to provide trade-related training based on a model curriculum. This will help build skilled manpower for a $5 trillion economy. Status recognition norms have been re-calibrated for better branding opportunities. • Promoting export from the districts The FTP aims to promote exports at the district level and develop the grassroots trade ecosystem through partnerships with state governments and the DEH initiative. Institutional mechanisms such as State Export Promotion Committee and District Export Promotion Committee will identify export-worthy products and resolve concerns. District-specific export action plans will be prepared. • Facilitating E-Commerce Exports FTP 2023 aims to create e-commerce hubs and streamline related aspects like payment reconciliation, bookkeeping, returns policy, and export entitlements. The cap on e-commerce exports has been raised to ₹10 Lakh, and integration with ICEGATE will allow exporters to claim benefits. • Merchanting trade FTP 2023 has introduced provisions for merchanting trade to develop India as a hub. It allows the shipment of goods between foreign countries through Indian intermediaries, enabling the creation of major merchanting hubs like GIFT City. • Amnesty Scheme The government aims to reduce litigation and build trust-based relationships with exporters. As part of this, a one-time Amnesty Scheme is introduced in the FTP 2023 to address default on Export Obligations. This scheme aims to provide relief to exporters unable to meet obligations under EPCG and Advance Authorizations and burdened by high duty and interest costs. It aligns with the “Vivaad se Vishwaas” initiative to settle tax disputes amicably. |

Ease in Inflation

In March 2023, there was a decline in inflationary pressures, as the Consumer Price Index (CPI) inflation rate decreased to a 15-month low of 5.7%. The moderation in inflation was mainly due to a decrease in both food and core inflation. This decrease was attributed to lower prices of certain food items such as vegetables, oil and fats, and cereal and products, which led to a reduction in food inflation from 5.9% in February to 4.8% in March 2023.

The core inflation in India dropped to a 23-month low of 5.7% in March 2023. The sequential growth of CPI-core during this period was the weakest since June 2022. This decline in core inflation is a result of the pass-through effect of declining Wholesale Price Index (WPI) inflation in consumer goods prices. A clear indication of this pass-through effect can be seen in the reduced inflation rate of personal care and effects category. This reduction in inflation suggests that FMCG companies are passing on the benefits of lower input costs to consumers.

Source: Department of Economic Affairs

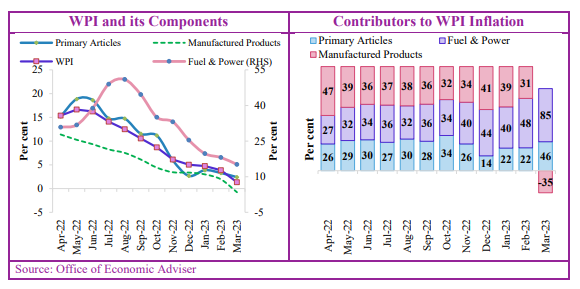

WPI inflation declined to 1.3% due to reduced prices of manufactured goods, fuel, and power In March 2023. The decrease in manufactured goods inflation is due to basic metals, food products, and chemicals while declining prices of mineral oils and electricity have reduced fuel and power inflation. WPI inflation for FY23 has fallen from 13.0% in FY22 to 9.4%. The decline is sharper in the second half, at 4.9%, as compared to 14.2% in the first half, tracking the falling value of imports into the country.

Impact of RBI Regulations

Despite attempts to address inflation and tighten monetary policy, financial weaknesses have surfaced. The failure of some regional US banks has created concern about a domino effect in the global banking sector and its impact on economies.

The RBI has taken actions to counter inflation and support growth. The RBI expects CPI inflation to decrease to 5.2% in FY24, lower than the 5.5% in FY22 which was unaffected by the Russia-Ukraine conflict. Indian banks appear well-placed to handle any stress emanating from the current tightening cycle.

To address vulnerabilities in the banking sector, several measures have been taken:-

- The creation of an investment fluctuation reserve (IFR) to shield banks from adverse yield movements, uniform application of capital and liquidity requirements to all banks regardless of their asset size and exposure, and guidelines on governance in commercial banks. The focus is on addressing the root causes of vulnerabilities.

- The IFR is a countercyclical macroprudential tool created by transferring gains from investments sold during an easing interest rate cycle. It acts as a shock absorber during tightening phases. As per the RBI’s Financial Stability Report (FSR) of December 2022, the system-wide IFR of scheduled commercial banks (SCBs) was 2.2% of the available-for-sale plus held-for-trading investment portfolio. This helped banks absorb losses associated with the rise in G-sec yields in Q1 FY23 and resultant treasury losses to the tune of 4.9% of their operating profit.

- Macro stress tests indicate that no commercial bank would fall short of its regulatory Capital to Risk-weighted assets Ratio (CRAR) for an increase of 250 basis points (bps) in yields of banks’ held-to-maturity (HTM) portfolios. The RBI has also stipulated that banks cannot place more than 23% of their deposit liabilities in their HTM portfolios. This means that a 10% loss in banks’ HTM portfolios will have only a deposit impact of 2.3%. These measures help to strengthen the resilience of the banking system and ensure its stability in the face of potential vulnerabilities.

The diverse regulatory initiatives by the RBI, the strengthened financial position of banks, and their ability to adapt to frequent interest rate changes bode well for India’s financial stability.

Final Word

The current economic outlook of the nation is positive, but it is crucial to remain cautious of potential risks. India needs to prepare itself for the upcoming challenges that could disrupt this favourable combination of growth and inflation outcomes. Factors such as El Nino-induced droughts leading to lower agricultural output and higher prices, unfavourable geopolitical developments, and increasing global financial instability must be monitored and addressed to maintain a stable economic environment.

Methyl Hydrazine Solution manufacturers in india