Indian aviation sector: Can 2021 stem the turbulence?

It is being hoped that India’s domestic civil aviation sector will show signs of a revival over the coming months. But given developments like the emergence of a new mutant of COVID-19 virus, is this really possible?

- The COVID-19 induced travel curbs since March 23, 2020, have significantly dented the performance of Indian aviation industry.

- However, some industry experts believe that there have been gradual signs of revival in domestic travel.

- But this will depend on various factors like containing the spread of COVID-19 virus, the creation of demand for air travel in the country, curbs on travel & ATF prices.

- To support the sector, the government may consider bringing ATF under the purview of GST, while the industry must embrace the concept of touchless travel.

Source: https://bit.ly/2Xo2KLG

The civil aviation sector has emerged as one of the fastest-growing segments in the country, according to the industry sources. Growing at a compound annual growth rate (CAGR) of 11.13% during FY16-FY20, its passenger traffic stood at 341.05 million (- domestic: 274.50 million & international: 66.54 million) in FY20. The sector is expected to grow at a healthy pace with India likely to be the third-largest air passenger market by 2024. However, COVID-19 played a spoilsport for the domestic aviation industry.

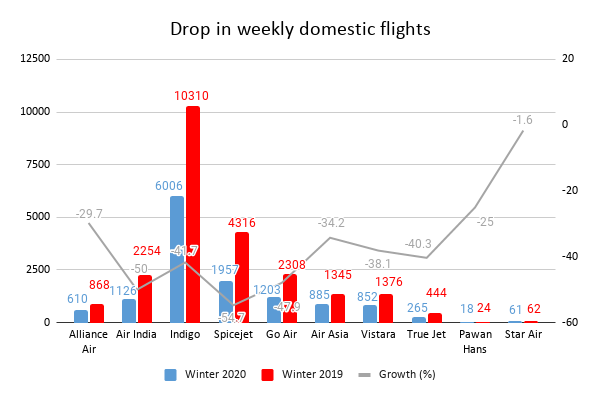

The COVID-19 induced travel curbs since March 23, 2020, significantly dented the performance of Indian aviation industry. Even after the easing of travel curbs over the month, the recovery in domestic passenger traffic has been rather subdued. According to media reports, there has been a 44.3% dip in the total weekly domestic flights from 23,307 in winter 2019 to 12,983 in winter 2020. Thus, during FY2020, Indian airlines had reported net losses of Rs 12,700 crore. Will 2021 be the much-needed light at the end of the tunnel for the Indian aviation industry? Read on to find out:

Source: Media Reports

Blown by the winds of change

Some industry experts believe that there have been gradual signs of revival in domestic travel. Albeit Indians have significantly curtailed on travel this year in comparison to 2019, a majority of those who travelled, undertook journeys within the country. A survey by Booking.com found that around 67% of the total distance travelled by Indians between 1 June and 31 August 2020 was within the country, compared to only 34% during the same period of 2019. This marked a seismic shift in the country’s travel habits. Further, New Delhi, Bengaluru, Gurgaon, Mumbai, and Hyderabad emerged as the most booked destinations during this tenure.

Similarly, exuding confidence in the domestic civil aviation sector, Civil Aviation Secretary, Pradeep Singh Kharola, stated that India’s domestic civil aviation sector is expected to return to normalcy in the next 3 months. Others, however, have their doubts. Rajiv Mehra, Vice President, Indian Association of Tour Operators states:

Presently, there is uncertainty in the tourism business. There is no demand and hardly any queries from overseas. With regard to the growth outlook, if everything goes as per government plan and vaccination is done, we may start inbound tourism by October 2021 but it will definitely take at least 2-3 years to reach to the level of Pre-Covid 19.

Credit rating agency ICRA Ltd expects “FY2021 to witness a higher decline of 62-64% in domestic passenger traffic, than its earlier estimates of 41-46% decline. With this, the domestic passenger traffic will reach much lower than the FY2011 levels.” Similarly, it expects the FY2021 international passenger traffic for Indian carriers to witness a significant YoY [year-on-year] decline of about 88-89%. It, therefore, concludes that the overall airline industry debt is expected to increase to about Rs 50,000 crore, excluding lease liabilities by FY 2022.

Mixed signals for the industry?

There are a number of developments which are likely to impact the process of recovery for the country’s civil aviation sector. One of the most crucial ones is the success of a COVID-19 vaccine. Pran Dasan, Director, Commercial Operations South East Asia, flydubai, opines that:

The biggest driver of domestic travel will be how soon the vaccine is introduced and how many people manage to get inoculated. Bearing in mind that the aged, those with co-morbidities, health workers etc. are going to be the first to be targeted, we may safely assume that by the time the largest chunks of travellers – up to 50 years old – get the vaccine, it will probably be a year if not more. The vaccine will be a major confidence booster.

However, the emergence of a new strain of COVID-19 virus is indeed a cause of worry. For example, India had temporarily banned flights to India from the United Kingdom amid concerns of the new strain of the coronavirus that was recently detected in the UK. (This was lifted on 6th January 2021.) such travel curbs are likely to hurt the arrival of foreign travellers in India and further impact the revenues of the domestic air carriers.

Another factor which is going to impact the industry is the recovery of the economy and the nature of travel. Hinting at a resilient recovery, the National Statistical Office (NSO) forecast on Thursday projected India’s real gross domestic product (GDP) in FY21 to be 7.7% lower than in FY20 and 3.9% lower than even the FY19 level in absolute term. Further, corporate travel may not see as many takers as leisure travel.

What adds to the woes of the aviation sector is the rise in fuel prices, which will enhance the operating costs for aircraft. Satyendra Pandey, Partner at AT-TV, an aviation advisory firm, states:

After historic lows in the middle of 2020, ATF prices are up by 25%. On a year over year basis, these are still within a reasonable range, however, but they could trend either way. The volatility depends on geopolitical aspects, economic recovery and demand. And as of now, the jury is out on that. For airlines, fuel makes for 27% – 35% of the cost base and thus the impact will be detrimental to margins.

Reviving the stuttering sector

One of the key measures to revive the domestic civil aviation sector is to revive the demand for travel, which eventually boils down to the economy’s growth rebounding soon. The government is already taking necessary steps such as rolling out the Atma Nirbhar Package to support the economy. It also devised the LTC Cash Voucher Scheme to entice people to undertake domestic travel.

In addition to this, the government may also consider the idea of bringing ATF under the purview of GST as this will certainly help as will limiting the increase in airport costs. Another option before it, as Vasudevan S, Partner and Global Sector Lead – Airports Business, Infrastructure, Government and Healthcare (IGH), KPMG in India suggests is:

The immediate relief that state governments can provide is to reduce VAT on ATF which ranges from 0-29 per cent across airports. It is also time for the government to bring ATF under GST with a flat rate of 5 per cent or lower, which will provide substantial relief to airlines and also help improve profitability in the long-run, given that it constitutes a significant part of airlines’ operating cost.

Last, but not the least, efforts must be made to instil traveller confidence. One way to do this is by offering a COVID-19 insurance. Another solution is to make the process of travelling touchless. From biometrics to baggage management to plexiglass screens & digital passports – the possibilities are endless. For this, organizations will have to reimagine the customer experience from the viewpoint of health and re-engage with customers in novel ways.

Leave a comment