India-UK Enhancing Collaboration in Food Products: Status, Issues and Way Forward

Given that consumers in India and the UK are willing to adopt each other’s cuisines, there is a potential for enhancing bilateral trade both in terms of enhancing volume and diversifying products. This paper by Prof Arpita Mukherjee and Nibha Bharti presents an overview of the India-UK bilateral trade in the food sector, identifies some of the barriers and suggests the way forward to enhance bilateral trade, investment and collaborations in line with the enormous opportunities.

Image credit: India TV News

India is one of the largest producers of a number of agricultural commodities and has emerged as a leading exporter of food products given its strategic location, abundance of raw materials, and its cost competitiveness. It is the world’s largest producer of milk, pulses and spices and the second largest producer of rice, wheat and sugarcane. According to the Ministry of Agriculture and Farmers’ Welfare, in 2019-20, India was the largest producer of vegetables like ginger and okra and held the second rank in production of potatoes, onions, cauliflowers, brinjal, and cabbages. Also, India held the first rank in production of papayas (43.6%), mangoes (40.4%) and bananas (25.7%).

In terms of value of food and drink exports, India held the 13th rank (US$ 31,226 million) in 2019. Its share in global exports increased from 2.01% in 2015 to 2.23% in 2019. India’s top exports of food and drink products were rice (HS 1006; share of 21.78%), crustaceans (HS 0306; share of 14.98%), frozen meat of bovine animals (HS 0202; share of 9.81%), cane or beet sugar (HS 1701; share of 5.41%) and fixed animal and vegetable oils (HS 1515; share of 3.05%) in 2019. Indian agri-food produce is exported to over 70 countries, including the United Kingdom (UK).

The UK is not only a key importer of agri-food produce; it produces a diverse range of products including meat, seafood, baked goods, dairy, ready-made meals, soft drinks/non-alcoholic beverages and alcoholic beverages (such as malt, beer and spirits); which are/can be exported to India.

Globally, the UK held the 16th rank (US$ 29,016 million) in 2019 and its share in world exports increased from 1.92% in 2015 to 2.07% in 2019. In the same year, the UK’s top exports of food and drink products to the world included undenatured ethyl alcohol (HS 2208; share of 27.15%), food preparation (HS 2106; share of 6.1%), bread, pastry, cakes and biscuits (HS 1905; share of 4.18%), fish, fresh and chilled (HS 0302; share of 3.73%) and chocolate and food preparation (HS 1806; share of 3.39%).

In terms of imports, the UK is one of the largest importers globally and held the 5th rank (US$ 59,211 million) in 2019. Its share in world imports increased from 4.07% in 2015 to 4.14% 2019. The top imports from the UK included wine of fresh grapes (HS 2204; share of 7.47%), bread, pastry, cakes and biscuits (HS 1905; share of 4.88%), prepared or preserved meat (HS 1602; share of 4.18%), cheese and curd (HS 0406; share of 3.72%) and chocolate and food preparations (HS 1806; share of 3.52%) in 2019.

The UK has a negative trade balance in the food and drink sector and prior to the Brexit, a large part of its trade was with the European Union (EU). Post-Brexit, one of the focus areas of the UK government and businesses has been to expand in emerging markets, among which India has a prominent position.

Prior to the coronavirus (COVID-19) pandemic, India had a sustained high growth rate. Being the world’s second most populous country after China, India has a large market with a growing demand for processed food. Nevertheless, imports into India have been low. India held the 16th rank (US$ 18,227 million) in global imports in 2019 and its share in world imports has declined from 1.41% in 2015 to 1.27% in 2019. Some of India’s top imports include palm oils and its fractions (HS 1511) with a share of 29.67%; soya-bean oil (HS 1507) with a share of 12.44%; sunflower-seed oil (HS 1512) with a share of 9.86%; dried leguminous vegetables (HS 0713) with a share of 8.52% and coconuts, Brazil nuts and cashew nuts (HS 0801) with a share of 6.4% in 2019. Companies from the UK have not been able to export much to India and this has been one of their key concerns.

Given that consumers in India and the UK are willing to adopt each other’s cuisines, there is a potential for enhancing bilateral trade both in terms of enhancing volume and diversifying products. This paper presents an overview of the India-UK bilateral trade in the food sector, identifies some of the barriers and suggests the way forward.

India-UK Bilateral Trade

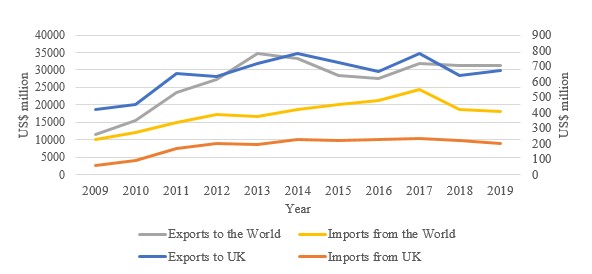

In 2019, in terms of value of food and drink products, the UK was India’s 12th largest exporting partner (US$ 674.51 million; share of 2.16%) and held the 17th rank among the importing partners (US$ 199 million; share of 1.09%). India was UK’s 22nd largest exporting partner (US$ 242 million; share in value in UK exports is 0.8%) and held 16th rank among importing partners (US$ 722 million; share of 1.2%). In the same year, India had a positive trade balance of US$ 475.30 million in food trade with UK. India’s total trade to UK increased from US$ 479.97 million in 2009 to US$ 873.72 million in 2019 (i.e, 82.04%, see Figure 1).

Figure 1: India’s trade with UK and the world (2009-2019)

Source: Compiled from UN Comtrade. Available at https://comtrade.un.org/ (last accessed on December 30, 2020)

In 2019, the top 10 food and drink products exported by India included crustaceans, rice, tea, grapes and vegetables and the top 10 items imported to India from the UK included ethyl alcohol, food preparation, crustaceans, cheese and curds and cereal grains. Tables 1(a) and 1(b) show that the current bilateral trade between the two countries has been concentrated in a few product categories. The volume of trade is also below potential.

A study conducted by the authors based on secondary data analysis and in-depth meetings with 150 stakeholders including businesses, their associations, and policymakers in the two countries found that with a rise in income in India, a large and growing population that is willing to experiment with international cuisine, and with policy initiatives such as “Make in India”, there is enthusiasm among companies in the UK to export and establish manufacturing facilities in India. They want to first test market their products and then establish their presence through local manufacturing.

Companies like Hindustan Unilever, United Biscuits Limited and GlaxoSmithKline have been operating in India for a long time and have successfully captured the market. Typhoo India established their retail and manufacturing base through an acquisition by the Apeejay Surrendra Group in 2005, subsequent to which they have grown manifold.

Diageo India, which is a subsidiary of Diageo UK, established its presence in the Indian market by acquiring Indian alcohol beverage company United Spirits Limited. There are some large UK companies, which are only importing to India. The UK supermarket chain Waitrose and Partners (which is the food retail arm of John Lewis Partnership) entered India in 2006 through a partnership with HyperCity Retail Limited, which was later acquired by the Future Group. As of date, Waitrose imports and sells its food products in India through Future Group’s “Food Hall”.

Table 1 (a): India’s Top 10 Export Food Commodities (HS 4-Digits) to the UK in 2019

(values in millions; share in %)

| Sl. No. | HS Code (4-Digit) | Commodity | Quantity (kg) | Trade Value (USD) | Share in Total Exports |

| 1 | 0306 | Crustaceans; in shell or not, live, fresh, chilled, frozen, dried, salted or in brine; smoked, cooked or not before or during smoking; in shell, steamed or boiled, whether or not chilled, frozen, dried, salted or in brine; edible flours, meals, pellets | 14.48 | 117.10 | 17.36 |

| 2 | 1006 | Rice | 123.25 | 111.46 | 16.53 |

| 3 | 0902 | Tea | 13.14 | 42.46 | 6.29 |

| 4 | 0806 | Grapes; fresh or dried | 20.45 | 34.16 | 5.06 |

| 5 | 0709 | Vegetables; n.e.c. in chapter 07, fresh or chilled | 15.87 | 26.07 | 3.87 |

| 6 | 2001 | Vegetables, fruit, nuts and other edible parts of plants; prepared or preserved by vinegar or acetic acid | 21.99 | 23.46 | 3.48 |

| 7 | 1905 | Bread, pastry, cakes, biscuits, other bakers’ wares, whether or not containing cocoa; communion wafers, empty cachets suitable for pharmaceutical use, sealing wafers, rice paper and similar products | 7.43 | 22.68 | 3.36 |

| 8 | 1515 | Fixed vegetable fats and oils (including jojoba oil) and their fractions, whether or not refined; but not chemically modified | 11.85 | 22.44 | 3.33 |

| 9 | 0910 | Ginger, saffron, tumeric (curcuma), thyme, bay leaves, curry and other spices | 11.19 | 22.10 | 3.28 |

| 10 | 0909 | Seeds of anise, badian, fennel, coriander, cumin, caraway or juniper | 8.17 | 18.35 | 2.72 |

| Total of Top 10 Export Commodities | 247.83 | 440.28 | 65.27 | ||

| India’s Total Exports to UK | 674.51 |

Source: Compiled from UN Comtrade. Available at https://comtrade.un.org/ (last accessed on December 30, 2020)

Table 1 (b): India’s Top 10 Import Food Commodities (HS 4-Digits) from the UK in 2019

(values in millions; share in %)

| Sl. No. | HS Code (4-Digit) | Commodity | Quantity (kg) | Trade Value (USD) | Share in Total Imports |

| 1 | 2208 | Ethyl alcohol, undenatured; of an alcoholic strength by volume of less than 80% volume; spirits, liqueurs and other spirituous beverages | 32.51 | 175.72 | 88.21 |

| 2 | 2106 | Food preparations not elsewhere specified or included | 0.56 | 5.31 | 2.66 |

| 3 | 0306 | Crustaceans; in shell or not, live, fresh, chilled, frozen, dried, salted or in brine; smoked, cooked or not before or during smoking; in shell, steamed or boiled, whether or not chilled, frozen, dried, salted or in brine; edible flours, meals, pellets | 0.42 | 1.86 | 0.93 |

| 4 | 0406 | Cheese and curd | 0.26 | 1.39 | 0.70 |

| 5 | 1104 | Cereal grains otherwise worked (e.g. hulled, rolled, flaked, pearled, sliced or kibbled) except rice of heading no. 1006; germ of cereals whole, rolled, flaked or ground | 2.28 | 1.25 | 0.63 |

| 6 | 1905 | Bread, pastry, cakes, biscuits, other bakers’ wares, whether or not containing cocoa; communion wafers, empty cachets suitable for pharmaceutical use, sealing wafers, rice paper and similar products | 0.54 | 1.13 | 0.57 |

| 7 | 1704 | Sugar confectionery (including white chocolate), not containing cocoa | 0.34 | 1.09 | 0.55 |

| 8 | 0802 | Nuts (excluding coconuts, Brazils and cashew nuts); fresh or dried, whether or not shelled or peeled | 0.20 | 1.02 | 0.51 |

| 9 | 0801 | Nuts, edible; coconuts, Brazil nuts and cashew nuts, fresh or dried, whether or not shelled or peeled | 0.48 | 0.80 | 0.40 |

| 10 | 0713 | Vegetables, leguminous; shelled, whether or not skinned or split, dried | 1.88 | 0.69 | 0.35 |

| Total of Top 10 Import Commodities | 39.48 | 190.25 | 95.50 | ||

| Total Imports from UK | 199.21 | ||||

Source: Compiled from UN Comtrade. Available at https://comtrade.un.org/ (last accessed on December 30, 2020)

In terms of India’s exports to the UK, a number of Indian companies supply to British food manufacturers and retailers. For example, Chamong Tee Export Private Limited supplies tea to Wessanen UK, for its brands such as Clippers Tea, which is sold through the retail outlets of super-market chains like Waitrose. Some UK-based companies have established plants in India to gain a physical presence. For example, VeeTee Rice Limited established a manufacturing plant in India in 1992, from where it sources Basmati Rice and sells it to retailers in the UK including Waitrose.

India-UK Collaborations: Select examples

Various initiatives have been taken to enhance bilateral trade by the Indian and the UK governments. For example, capacity building programmes have been initiated through the Foreign, Commonwealth & Development Office (FCDO), UK, with Indian government agencies such as the Food Safety and Standards Authority of India (FSSAI) for ease of doing business and for streamlining the food import and export processes by using technology. A core component of these initiatives includes sharing of knowledge about each other’s standards and processes and learning from each other’s best practices.

The UK and India are also collaborating on mitigating food losses and sustainable business practices. For example, British experts are developing a plan for a first-of-a-kind “Centre of Excellence” in Haryana, in partnership with the British High Commission in India and the agri-tech sector team at the UK’s Department for International Trade to support the roll-out of sustainable post-harvest management and cooling at scale in India.

There are product-specific collaborations as well; for example, in December 2018, the Indian and the UK governments have collaborated to facilitate the import of lamb products from the UK into India. Companies from the UK have taken several efforts to promote alcoholic beverages and address barriers related to imports through associations such as the International Spirits and Wines Association of India (ISWAI).

Issues in enhancing trade

As discussed earlier, the bilateral trade between India and the UK on food products is not diversified and is much below its potential. The UK’s share in Indian exports to the world has declined from 3.62% in 2009 to 2.34% in 2014 and 2.16% in 2019. The UK’s share in India’s imports from the world increased from 0.60% in 2009 to 1.20%, but has declined to 1.09% in 2019. This is due to multiple barriers on both sides.

A number of food items that are exported to the UK are stopped at the border for not meeting the food safety standards. For example, data from the RASFF (the Rapid Alert System for Food and Feed) portal of the EU shows that the UK had 34 notifications in 2020 on sanitary and phytosanitary (SPS) issues for food and drink products imported from India.

These include unauthorised substance ethylene oxide (0.16 mg/kg – ppm) in black sesame seeds from India, aflatoxins (B1 = 9.5; Tot. = 10.1 µg/kg – ppb) in chilli powder from India, unauthorised substances methamidophos (0.17 mg/kg – ppm), monocrotophos (0.04 mg/kg – ppm), acephate (0.24 mg/kg – ppm), propargite (0.04 mg/kg – ppm) and triazophos (0.05 mg/kg – ppm) in frozen diced red chilli puree from India, etc. India is not able to export honey to the UK and there are restrictions on milk and milk product exports from India to the UK.

In India, the survey participants pointed out that the restrictions are mostly related to labelling requirements and the lack of consistency in clearance processes across ports due to the limited use of technology. Given that alcoholic beverages and its raw materials are key export items of the UK, businesses from the UK operating in India reported issues associated with state-specific regulations related to alcohol, which include pricing restrictions and foreign entity related discriminatory taxation and regulations.

Alcoholic beverages are not covered under the GST (single goods and services tax) and they face high import tariffs, even on raw materials for domestic production. The industry has to comply with the labelling requirements of the FSSAI, Legal Metrology, and since alcohol is a subject under the State List of the Seventh Schedule of the Constitution of India, alcoholic beverage companies have to also adhere to the labelling requirements of 25+ state excise departments.

Apart from this, there is need for more marketing initiatives. For example, survey participants pointed out that while Indian food like vindaloo, bhuna tikka masala are well known and have long been a staple in the UK, knowledge about UK cuisine in India is limited unlike Italian, Chinese or Thai cuisines.

The Way Forward

The survey found that while several initiatives have been taken on both sides and studies have identified the barriers, there is a need to focus on sector-specific value chains to identify the issues in-depth and address them. For example, there is a need to examine the issues faced by the alcoholic beverage sector in India with a specific focus on trade.

It is also important to focus on product diversification. Of late, there has been an increase in demand for organic food in both India and the UK; this can be an area of future trade and collaboration. India holds the top rank in number of organic farmers and has the ninth rank in terms of area under organic farming. With the simultaneous thrust given by the Agri-export Policy 2018, India can emerge as a major player in global organic markets. The Soil Association of the UK has reported that current consumer trends in health and sustainability are rapidly driving the organic sector in the UK; almost £45 million a week is spent on organic products. There is a need to examine how both countries can enhance trade in organic produce.

There is need to enhance collaboration across MSMEs of the two countries and facilitate their trade through platforms like e-commerce. The survey found that companies from both countries are yet to explore the potential of enhancing trade through online channels and by using technology.

Indian export promotion councils have to work closely with their counterparts in the UK to understand the standards and requirements. Further, joint capacity building initiatives may be undertaken to make businesses market ready. There is need for the UK to organise more food and drink exhibitions and shows in India to popularise its food in the country. Indian companies, on the other hand, have to build strong brands and adhere to quality and food safety standards. There is need for more business-to-business (B2B) collaboration on sustainable business practices with the support of the government to mitigate losses in the value chains and for enhancing productivity. If these measures are taken, bilateral trade, investment and collaborations will increase.

Dr Arpita Mukherjee is a Professor at ICRIER. She has several years of experience in policy-oriented research, working closely with the Government of India and policymakers in the EU, US, ASEAN and in East Asian countries. She has conducted studies for international organizations such as ADB, ADBI, ASEAN Secretariat, FCO (UK), Italian Trade Commission, Konrad-Adenauer Stiftung (KAS), OECD, Taipei Economic and Cultural Centre (TECC), UNCTAD and the WTO and Indian industry associations such as NASSCOM, FICCI, IBA, IDSA and EICI. Her research is a key contributor to India’s negotiating strategies in the WTO and bilateral agreements. The views expressed here are her own. Usual disclaimers apply.

Nibha Bharati is Research Assistant at ICRIER. Views are personal.

Leave a comment