India-UK Economic Ties: Towards a Shared Prosperity

The marvellous successes that India and UK have exhibited all these years only scratch the surface of the exciting possibilities that lie ahead. Exciting developments wait to unfold that would bind the two countries together on a path of shared prosperity.

- The last few years witnessed a turning point in India-UK economic relations. Both of them are strong proponents of free trade and multilateral economic system, being fairly open economies themselves.

- In 2019, UK was India’s fifteenth largest trading partner and India was UK’s nineteenth largest trading partner in goods. The trade between the two nations stood at US$ 15.9 billion in 2019.

- The biggest success in India-UK economic dialogue has been marked by the announcement of an Enhanced Trade Partnership (ETP) at the fourteenth meeting of the JETCO, held in July, 2020. The partnership is envisaged to “address non-tariff barriers to trade and explore routes to remove tariff barriers”.

- Research indicates that the two nations have a tremendous untapped trade potential. India has the potential to export an additional US$ 104 billion worth of goods in which it has comparative advantage.

Image credit: PIB

From the time when the British first entered India in the sixteenth century to the present, trade and commerce have continued to play a vital role in strong bilateral relations between India and the UK. Having had rich historical ties in manufacturing, the two countries today, have transformed into service-led economies. Both of them are strong proponents of free trade and the multilateral economic system, being fairly open economies themselves. The past year saw the pandemic taking a toll on global cooperation, as nations started to isolate and look inward. However, in these trying times, India and UK’s partnership reached a new milestone with their collaboration to carry out large-scale production of the AstraZeneca-Oxford vaccine.

The last few years witnessed a turning point in India-UK economic relations. In 2016, the then UK’s PM Theresa May came to India on a trade mission to revitalise economic ties between the nations. The visit came at the time of UK’s decision to exit the European Union, hence signalling UK’s intentions to engage more closely with India in the post-Brexit era. Signing of agreements on Intellectual Property and Ease of Doing Business and deals worth over £ 1 billion symbolised the advent of this new partnership. During PM Narendra Modi’s visit to the UK in 2018, the beginning of a “new UK-India Trade Partnership” was officially announced.

As the two countries forge this new partnership, it is worthwhile to study their trade and investment relations

Trade in Goods – Current and Potential

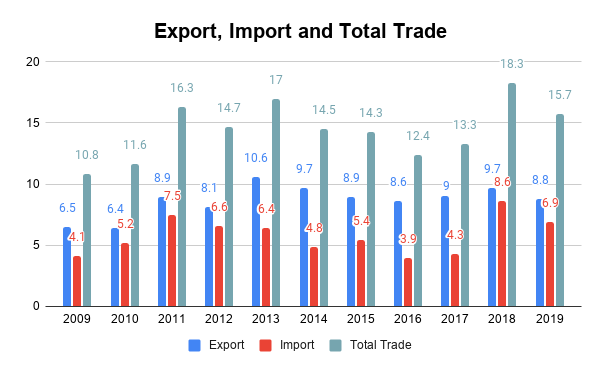

In 2019, UK was India’s fifteenth largest trading partner and India was UK’s nineteenth largest trading partner in goods. Trade between the two nations stood at US$ 15.9 billion in the year, of which India’s exports to the UK were US$ 8.8 billion and imports from the UK were valued at US$ 6.9 billion. India has maintained a favourable trade balance with the UK, albeit exports have risen at a snail’s pace in the last ten years (Figure 1). In 2019, UK accounted for 2% of India’s total trade with the world, while India’s share in UK’s total world trade was relatively less at 1.2%.

Source: WITS Database

Coming to composition of trade in goods, it is interesting to note that while India’s export basket to the UK consists of mainly final goods viz, consumer and capital goods, the import basket comprises of largely intermediate goods used in the domestic industry and capital goods. The top commodities that India has been exporting to the UK traditionally are clothing items, articles of jewellery, refined petroleum products and vehicles. Lately, exports of machinery parts like turbo jets and pharmaceutical products have picked up. India’s imports from the UK have been concentrated in certain products such as gold, silver, diamonds and other precious stones, iron and steel (mainly scrap), machinery, electrical equipment and petroleum.

Considering that the current trade in goods has been somewhat stagnant in the last decade, an exercise was carried out to estimate the additional trade that is possible between the two nations. The results were promising: total bilateral trade amounting to US$ 175 billion is possible if the two countries were to import from each other what they are importing from the rest of the world. India has the potential to export an additional US$ 104 billion worth of goods, in which it has a comparative advantage. The sectors having the highest potential are refined petroleum products, medicaments, gems and jewellery, automobiles, apparels and mechanical parts. Similarly, UK has an additional export potential of US$ 71 billion to India with opportunities present to export more of petroleum, iron and steel, copper, mechanical and electrical machinery, medicaments and medical and surgical apparatus.

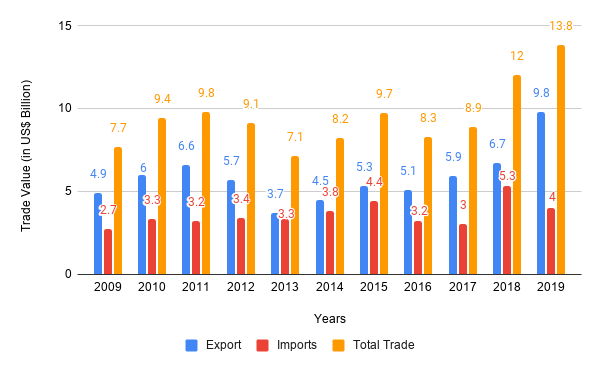

Trade in services

Both UK and India are net service exporters with trade in services contributing a share of 25% and 12% in their GDP, respectively. India’s trade in services with the UK has seen more impressive growth than trade in goods. Total trade between the two nations has almost doubled over the last decade and touched US$ 13.8 billion in 2019. Like trade in goods, India has maintained a favourable trade balance in services with exports to the UK amounting to US$ 9.8 billion and imports at US$ 4 billion in 2019 (Figure 2).

Figure 2- India’s trade with the UK in services (in US$ billion)

Source- UNCTAD STAT

UK is a vibrant market for India’s exports. “Other business services”, which include research and development, professional and management consulting and technical, trade-related services dominate India’s service exports to the UK followed by travel, telecommunications, transport and financial services Likewise, India is among the fastest growing markets for UK’s service exports with the top services imported being travel, other business services, air transport, intellectual property charges, financial and telecommunication.

With both the countries having global competitiveness in similar skill structures, scope for collaboration is high. This is already translating in certain areas such as research and development, where UK is India’s second largest collaborator. Their joint research in science and innovation is estimated to reach £ 400 million by 2021. The increasing engagement between the two countries is also gauged by the fact that UK issues more skilled work visas to India than the rest of the world combined. Furthermore, the UK governments’ decision to create a Graduate Immigration route for enabling international students to stay back in UK for two years post-completion of studies presents huge opportunities for deeper engagement in education. Efforts should also be put in to build greater synergies in financial; telecommunication; maintenance and repair; construction; information; and insurance services.

Investments

United Kingdom is the sixth largest investing nation in India with its total investments summing up to US$ 27.9 billion. Traditionally, UK’s investment in India has been concentrated in sectors like chemicals, drugs & pharmaceuticals, services, food processing and petroleum and natural gas (8%). In 2019, there were FDI inflows worth US$ 1.4 billion from the UK into India. Financial services and other services, which include inter alia, accommodation, food and beverages, real estate, education and health, attracted the biggest chunk of investments, followed by metal and machinery products, professional, scientific and technical services, information and communication and computer and electronic products. Currently, more than 400 British companies operate in India. These include well known names such as Vodafone, HSBC, Standard Chartered, Unilever and new entrants such as Dyson.

India too boasts of being among the largest investors in the UK. It recently became the second largest source market for FDI projects in the UK, having invested in 120 new projects. In 2019, India’s FDI outflows to the UK equalled US$ 409 million, largely directed towards services. Firms selling professional, scientific and technical; information and communication; and administrative and support services were the top recipients. There are around 842 Indian companies operating there, few of the biggest being Tata, Reliance, Accord Healthcare, Wipro, Infosys and Genpact. The companies have a combined turnover of £ 48 billion and support over one lakh jobs.

It is evident that investment relations between the two countries are scaling unprecedented heights. This has been aided by consistent bilateral efforts such as the setting up of a Fast-Track system for British companies facing operational bottlenecks in India and launching the UK-India Tech Partnership to strengthen the investment ecosystem.

Bilateral Economic Cooperation Framework

India and UK have established a robust structure for cementing bilateral economic relations. The two important frameworks are the Joint Economic and Trade Committee (JETCO), which holds a dialogue at the Commerce minister-level and the India-UK Economic & Financial Dialogue (EFD) held at the Finance-Minister level. Both the frameworks were established in 2005, post India and UK upgrading their relations to a “strategic partnership” in 2004.

Over the years, the deliberations at JETCO have led to formation of various Joint Working Groups, inter alia, on technological collaboration, advanced manufacturing and engineering; smart cities; animal husbandry, dairying and fisheries; and trade. The Joint Working Group on Trade was set up at the eleventh meeting of the India-UK JETCO in 2016 to “identify practical ways to broaden and deepen trade relations”. Both the countries completed a Joint Trade Review in 2018, which is expected to serve as a roadmap for the new UK-India Trade Partnership announced in 2018.

The Trade Review identified five sectors of interest: aerospace; chemicals; automotive; food and drinks; and life sciences. Under the JWG on Trade, government-to-government dialogues on food and drinks, information communications technology (ICT), life sciences and services statistics have been initiated to eliminate non-tariff barriers to trade.

In the food and drinks sector, considerable progress has been made already with the regulatory bodies of both the nations starting to work on issues that hinder food and drinks trade and sharing best practices on regulatory and clearance processes. The Memorandums of understanding in the fields of Telecommunications and Information and Communication Technologies (ICTs) and medical product regulation are also being finalised.

Perhaps, the biggest success in India-UK economic dialogue has been marked by the announcement of an Enhanced Trade Partnership (ETP) at the fourteenth meeting of the JETCO, held virtually in July, 2020. The partnership is envisaged to “address non-tariff barriers to trade and explore routes to remove tariff barriers”. It is expected to be implemented in the immediate future and segue into a full-fledged Free Trade Agreement later.

The tenth Economic and Financial Dialogue was another landmark event as it saw the Finance Ministers of both the nations reinstating their commitment towards free trade, devoid of unnecessary barriers. They also announced a new partnership on Infrastructure Financing and Policy to support knowledge sharing and assistance for India’s National Infrastructure Pipeline and the establishment of UK India Development Cooperation Fund, a Fund of Funds for managing UK Government’s future development capital investments in India.

A shared future

The marvellous successes that India and UK have exhibited all these years only scratch the surface of the exciting possibilities that lie ahead. In goods, there lies vast untapped potential for India to export medicaments, gems and jewellery, apparels, automobiles and refined petroleum and for the UK to export iron and steel, copper, mechanical and electrical machinery and medical and surgical apparatus. In services, there is incredible scope for collaborations in financial, telecommunication, construction, information and insurance sectors.

The recently introduced Production Linked Incentive Scheme in India opens up a plethora of opportunities for investments from the UK in sectors like apparels, pharmaceuticals, food products, automobiles and electronic and technology products. By strengthening and deepening value chains in the identified sectors, India and UK can reap huge economic benefits. The early fruition of Enhanced Trade Partnership, which lays the ground for identification and elimination of unnecessary tariff and non-tariff barriers, would also play an instrumental role in facilitating greater trade and investments.

The future of India-UK economic ties looks extremely promising. Exciting developments wait to unfold that would bind the two countries together on a path of shared prosperity.

Nisha Taneja is Professor at Indian Council for Research on International Economic Relations. Her broad areas of interest include WTO issues, regional trade, industrial economics, and institutional economics. In recent years she has worked on tariffs, non-tariff barriers, and transport issues related to India-Nepal, India-Sri Lanka, India-Pakistan, India Bhutan, India-Korea, IndiaJapan, India-China and sub-regional cooperation between India, Bangladesh and Myanmar. She has served on committees set up by the Government of India on Informal Trade, Rules of Origin and Non-tariff Barriers and was recently appointed as Transshipment Adviser to the Government of Nepal. Her research papers have been published in several journals and have been disseminated widely in India and abroad. She has worked as a Consultant with the Asian Development Bank, The United Nations and The World Bank on regional integration in South Asia and South East Asia.

Sakshi Garg is a researcher with about two years of experience in international trade. She has worked with ICRIER on areas pertaining to economic integration in South and South East Asia. She holds a master’s degree in International Business Economics and Finance from Gokhale Institute of Politics and Economics. Her research interests include Trade and Development and WTO issues.

Leave a comment