India-EU Economic Relations: A New Chapter Unfolds

After an eight-year hiatus, India and the European Union have relaunched talks on trade and investment issues. The scope of India-EU partnership goes much beyond trade & commerce to cover digital, energy, transport and people-to-people connectivity.

- The European Union is India’s largest trading partner, while India is its tenth largest trading partner for merchandise trade. Germany, Belgium, Netherlands, France and Italy are India’s top trading partners in the EU.

- Merchandise trade between India and the EU has witnessed a lackluster performance, hovering around the US$ 90 billion figure since a decade. Trade in services between India and the EU, though, is gaining increasing importance in their economic ties. India is a net exporter of services to the EU.

- As India and the EU restart negotiations on trade, it is hoped that they will be able to leverage their trade potential better.

- The revitalized partnership could be a driving force for development in the Indo-Pacific. The scope of India-EU partnership goes much beyond trade & commerce to cover digital, energy, transport and people-to-people connectivity.

A new chapter is set to unfold in the history of India-European Union economic relations. The adoption of the EU Strategy for Cooperation in the Indo-Pacific in April this year implies deeper engagement between India and the EU as India is an important actor in the geopolitical framework. Secondly, the collective decision to relaunch trade talks at the recently concluded India-EU Leaders meeting is expected to give a fillip to the bilateral economic relations.

India and EU began negotiations on a Broad-based Trade and Investment Agreement (BTIA) first in 2007. However, the negotiations came to a halt in 2013 over a number of differences. Although dialogue continued in the subsequent years, yet it is only now that India and EU have decided to resume negotiations for a balanced, ambitious, comprehensive and mutually beneficial trade agreement. They will also be launching negotiations for two separate agreements on investment protection and geographical indications.

Merchandise trade

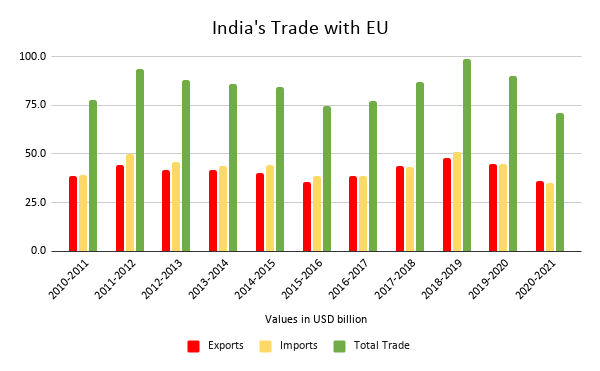

The European Union is India’s largest trading partner globally, while India is EU’s tenth largest trading partner for merchandise trade. India’s trade with the EU accounts for about 11% of its total trade with the world. In 2019-20, the bilateral trade stood at US$ 90 billion, of which India’s exports to and imports from EU were at US$ 44.9 billion and US$ 45 billion, respectively. Trade between India and the EU has witnessed a lackluster performance, hovering around the US$ 90 billion figure since a decade (Figure 1).

India’s trade with the European Union over the last decade (in US$ billion)

Source: Ministry of Commerce and Industry

Within the EU, Germany is India’s most important trade partner, accounting for almost a quarter of India’s trade with the grouping. The other top trade partners are Belgium (16%), Netherlands (13%), France (13%), Italy (11%) and Spain (6%).

Table 1- India’s top trade partners in the EU in 2019-20 (in US$ billion)

| Country | Exports | Share in total exports to the EU | Imports | Share in total imports from the EU | Total trade | Share in total trade with the EU |

| Germany | 8.3 | 18% | 13.7 | 30% | 22.0 | 24% |

| Belgium | 5.8 | 13% | 8.9 | 20% | 14.7 | 16% |

| Netherlands | 8.4 | 19% | 3.4 | 8% | 11.8 | 13% |

| France | 5.1 | 11% | 6.2 | 14% | 11.3 | 13% |

| Italy | 5.0 | 11% | 4.5 | 10% | 9.5 | 11% |

| Spain | 3.9 | 9% | 1.6 | 4% | 5.6 | 6% |

| Poland | 1.5 | 3% | 0.8 | 2% | 2.4 | 3% |

| Sweden | 0.7 | 2% | 1.1 | 2% | 1.9 | 2% |

| Denmark | 0.7 | 2% | 0.6 | 1% | 1.4 | 2% |

| Ireland | 0.5 | 1% | 0.6 | 1% | 1.1 | 1% |

Source: Ministry of Commerce and Industry

Coming to the composition of trade, in 2019-20, product categories having the largest share in India’s export basket were petroleum oils; organic chemicals; machinery and mechanical appliances; gems and jewellery; electrical machinery; and apparels. It is worth noting here that about 13% of the total exports to the EU were of the commodity “other petroleum oils and oils obtained from bituminous minerals’ (HS 271019) alone. As regards India’s import basket from the EU, the top products are machinery and mechanical appliances; diamonds; aircrafts; electrical machinery; and instruments used for optical, photographic, checking precision, medical and surgical purposes.

Trade in Services

Trade in services between India and the EU is gaining increasing importance in their economic ties. Particularly for India, EU is an important export destination, accounting for more than 25% of its total service exports. India is a net exporter of services to the EU. In 2019, India exported services worth € 17.7 billion (US$ 21.5 billion) to the EU and imported € 14.8 billion (US$ 18 billion) worth of services, thereby running a trade surplus of € 2.9 billion with the grouping.

Similar to the case of merchandise trade, India’s top trading partners in the EU in services are Germany, Netherlands, France, Sweden, Belgium, Italy, Ireland and Finland. Globally, Germany was India’s top destination for exports of transport and logistics services, Netherlands for engineering and construction services and France for maintenance and repair services.

In 2019, other business services, which include research and development, legal, accounting, management consulting, technical and trade-related services was the largest exported service category by India to the EU, running a huge positive trade balance. The other top exported categories were telecommunications, computer and information; transport; and travel. Coming to imports from the EU, the top service categories were telecommunication, computer and information followed by transport; other business services; travel; and charges for the use of intellectual property.

Table 2- India’s services trade with the European Union in 2019 (in € million)

| Services | Exports | Imports | Balance |

| Other business services | 8,471.9 | 2,861.3 | 5,610.6 |

| Manufacturing services on physical inputs owned by others | 297.1 | 144.9 | 152.2 |

| Insurance and pension services | 136.4 | 56.8 | 79.6 |

| Construction | 250.1 | 176.5 | 73.6 |

| Financial services | 249.3 | 206.1 | 43.2 |

| Government goods and services | 39.5 | 60.3 | -20.7 |

| Personal, cultural, and recreational services | 54.4 | 185.8 | -131.4 |

| Maintenance and repair services | 163.8 | 398.3 | -234.5 |

| Travel | 1,322.2 | 1,591.0 | -268.8 |

| Telecommunications, computer, and information services | 4,537.2 | 5,087.8 | -550.6 |

| Charges for the use of intellectual property | 187.9 | 1,084.7 | -896.8 |

| Transport | 2,038.3 | 4,242.0 | -2203.70 |

Source: Eurostat

Stumbling Blocks

A study[3] estimates that a Free Trade Agreement between India and EU in goods and services would lead to additional gains in the range of € 8 billion (US$9.72 billion) to € 8.5 billion (US$10.32 billion) for both the EU and India. So, what has kept India and EU from realising these gains?

- High tariffs: Around 42% of India’s exports to the EU enjoy low tariffs under EU’s General GSP scheme. India’s highest exports to the EU under this preferential arrangement are of apparels, machinery and appliances, footwear, articles of leather and plastics.

This is, however, a temporary arrangement as the preferences are withdrawn when it is felt that those products no longer require EU’s preferential treatment. In 2019, many of India’s product categories- mineral products, inorganic and organic chemicals, textiles, precious metals, iron and steel, railway locomotives and automobiles graduated from the GSP.

India, maintains high tariffs on primary products and food items, wines and spirits, automobiles, auto components and dairy products. Protection is high in order to protect the domestic industry and labour. But since all these product categories are of great interest to the EU, it demands reduction of duties which leads to negotiations hitting a roadblock. - Non-Tariff Barriers: A report by the European commission claims that with 23 reported barriers on imports from the EU, India is the fifth most restrictive country with respect to Non- Tariff Measures for the EU. It imposes quantitative restrictions, import licensing, anti-dumping duties and follows complicated and lengthy customs procedures. For example, India has the third largest number of anti-dumping investigations against products originating from the EU out of all its cases.

“Stringent” NTMs imposed by the EU remain a persistent challenge for India as well, particularly for SMEs. Exports of food products face the maximum number of Sanitary and Phytosanitary (SPS) measures. Indian exporters claim that the NTMs are often discriminatory, unpredictable, lack transparency and are much more stringent than the accepted international standards. This is particularly true for food products like mangoes, meat, diary products, shrimps, spices, groundnuts, tea and Indian whiskeys. - Disagreement on liberalisation of services: As per OECD, India has a high Service Trade Restriction Index (STRI) with the sectors of rail freight transport; legal; accounting; air transport; insurance; architecture; and courier being highly restrictive. The EU demands liberalisation of commercial presence (Mode 3) in banking, insurance, telecommunications, legal, energy and transport services through the FDI route.

However, in India, there is high domestic pressure for keeping some of these sectors protected. On the other hand, India demands greater access to cross-border service trade such as for outsourcing of business and consulting services (Mode 1) and freer movement of professionals (Mode 4). The EU remains wary of relaxing its migration rules. - Investment agreement: The EU is eager to secure, what it refers to as a ‘sound, transparent, open, non-discriminatory and predictable regulatory and business environment for European companies trading with or investing in India’. The EU has been deeply concerned with India’s ‘unilateral removal of bilateral investment treaties with 23 European countries. Moreover, after the Vodafone and Cairn disputes, EU is particularly keen on an investment protection agreement that includes a strong dispute settlement mechanism.

- Other issues: Due to differences in perspectives, India and EU couldn’t agree on various other issues in the previous rounds of FTA negotiations. The EU asks for strengthening of the Intellectual Property Rights regime in India. This stands to put India’s market of generic drugs and chemicals at risk. India’s data security standards also do not match that of the EU’s. Difference of opinion also lies in clauses related to human rights, environmental and social standards. Furthermore, the EU wants to strongly incorporate sustainability standards in the trade framework.

Pushing Ahead

The landmark decisions taken at the India-EU Leader’s meeting, held this month, demonstrate that India-EU’s partnership is stronger than ever. These include revival of talks on the trade agreement, launching of negotiations on investment protection and GIs agreements, creating joint working groups to intensify regulatory cooperation on goods and services and on resilient supply chains and setting up an India-EU Senior Officials’ Dialogue for bilateral cooperation on WTO issues. They also formally launched the sustainable and comprehensive Connectivity Partnership envisioned in Roadmap 2025. Earlier this year, the first EU-India Dialogue on IPR was held too and an IPR SME Helpdesk was launched.

India and EU’s partnership stands apart owing to its unwavering commitment to a rules-based, multilateral system that is governed by dynamic institutions and abides by the principles of “democracy, freedom, rule of law and respect for human rights”. The EU and India, in their negotiations have laid great emphasis on the bilateral trade and investment agreements being balanced, mutually beneficial and ensuring a level playing field on both sides.

To achieve this, both sides will have to let their guard down. Several studies have concluded that although India will gain from the FTA in services sector, the prospects seem bleak in goods sector. The approach here should be to focus on the total net gains and not see it as a zero-sum game. Therefore, India should reduce its tariffs on merchandise exports from the EU in return of greater access to EU’s service markets.

The CAMM framework has set out impressive goals such as promoting migration of highly skilled workers for fostering innovation, efficient grant of visas and working towards recognition of foreign qualifications. However, despite five rounds of India-EU High Level Dialogue on Migration and Mobility, nothing substantial has happened on the ground. To enhance trade in services, it is essential to intensify discussions in this forum. Market access and SPS and TBT related issues also need to be aggressively pursued to reach a breakthrough.

An influx of EU investments into India and other collaborations would result in huge positive externalities besides the obvious benefits of knowledge and information transfers. It is thus important for India to continue to reform its IPR protection and enforcement regime, its digital sector and the related data protection laws.

With the second wave of Coronavirus hitting India hard, making rapid strides in the partnership is all the more important for a faster recovery. The partnership will also play an instrumental role in ensuring peace and prosperity in the Asia Pacific.

Leave a comment