Increasing India’s exports through integration in global value chains

The disruption of supply chains following the Covid-19 pandemic illustrated the complex nature of world trade and interlinkages between countries. Dr Saon Ray analyses India’s current integration into global value chains, the critical roadblocks and strategies to be adopted.

The disruption of supply chains following the Covid-19 pandemic is well documented. What it illustrated was the complex nature of world trade and interlinkages between countries. The phenomenon of production using global value chains underlines the above interlinkage. Global Value Chains are “cross border networks that brig a product or service from conception to market.”[1]

Emergence of global value chains (GVCs) has occurred with the fragmentation of production, whereby value is added in multiple countries, leading to an increase in trade in intermediate parts and components. The emergence of GVCs has coincided with international trade being dominated by trade in intermediate goods and services. This has occurred since the mid-1990s.

Intermediate inputs account for as much as two thirds of international trade and more and more imported parts and components are embodied in exports. According to Mitra et al. (2020), global export of goods and services increased from US$ 7.4 trillion in 2000 to US$ 21.7 trillion in 2017. GVC exports grew from US$ 5.2 trillion to US$ 15.7 trillion over the same period (accounting for nearly 70% of global exports).[2] Rapid expansion in GVCs led to an increase in participation rates globally: trade-based rates rose from 35.2% to 46.1% from 1995 to 2008. Similarly, production-based rates rose from 9.6% to 14.2%, with some slowdown after the global financial crisis.[3]

Data from OECD, WTO and World Bank shows that between 1995 and 2009, income from GVC-related trade increased six-fold for China and five-fold for India. More than half of developing country exports in value-added terms involve GVCs. The share of trade in parts and components between developing countries has quadrupled over the last 25 years.[4] However, the emergence of value chains has been uneven with a limited number of emerging economies taking the lead in supplying intermediate inputs and final assembly.

Participation in GVCs

Participation of a country in GVCs is defined by its engagement with a particular part of the production process i.e. trade in intermediate goods and services. Countries are integrated into these GVCs through backward or forward integration. GVC participation is defined as the sum of the share of foreign value added in gross exports (backward linkages) and the share of domestic value added in exports of intermediate goods (forward linkages). These linkages give a measure or ‘participation index’ of a country’s engagement in GVCs. The domestic value-added embodied in foreign final demand was 20% for India in 2011, while the foreign value-added in domestic final demand was about 25% in the same year.[5]

India’s participation index stands at around 40%, which is obtained by combining the two measures from the buyer’s and seller’s perspective. Its backward and forward participation has been low at 22% and 19% respectively in 2009.[6] India, however, has remained a fringe player, with only US$ 241 billion or 1.5% of global GVC exports in 2017.[7] The share of foreign value-added embedded in the production of exports of India is low even compared with the 20% average observed in developing and emerging market economies. [8]

India’s Exports

India’s export position was 27th in the world (accounting for 0.96% of total world gross exports) in 2007, while in 2017 it improved to 20th (accounting for 1.66% of total world gross exports). The country exported products worth US$ 475 billion in 2020,[9] out of which merchandise exports, (f.o.b) constituted about US$ 276, 302 million, resulting in a share of 1.57% and a rank of 21 in terms of World Total Merchandise exports. Exports of commercial services amounted to US$ 202,600 million in 2020, with a share of 4.12% and rank of 7 in terms of Total World exports of Commercial Services.[10]

The figure below shows the share of various sectors (in percentage) in the exports of goods in 2020. We note that ICT accounts for 33.88% of the total $475 billion exports in that year. The share of pharmaceuticals is high, and this is followed by agricultural products and petroleum oils, refined among exports of goods.[11]

Figure 1: Share of products in total exports by India, 2020[12]

The share of manufactures in merchandise exports was the highest (70.8%) followed by Fuels and Mining Products (17.3%) and Agricultural products (11.5%), the largest exported goods being in moderate and low complexity products, chemicals and agriculture respectively. India’s largest trading partners in 2020 were the USA (17.9%) followed by the European Union (14%) and China (6.9%). For exports in Commercial Services, exports of OCS (Other Commercial Services and Goods Related Services) constituted 83.1% of the total exports, followed by Transport services (10.3%) and Travel (6.4%).

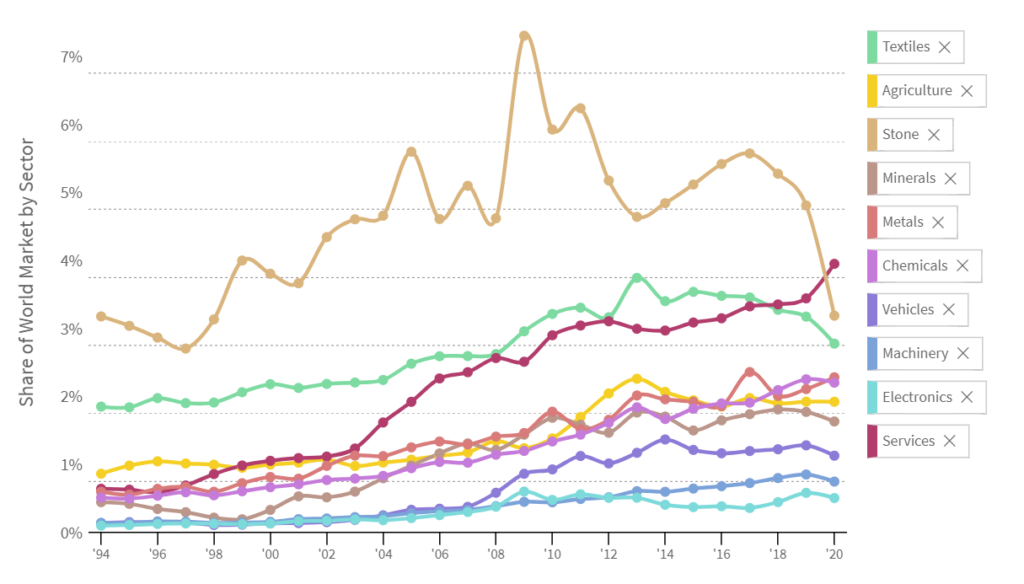

Figure 2 shows the share of Indian exports in world trade by industry from 1994 to 2020. We note that for many goods, India’s share is declining while the share of services is increasing.

Figure 2: Share of India’s world market by sector[13]

However, services trade was very badly affected by the Covid pandemic and only recently has it picked up. Recent data shows that exports of certain items (mostly raw materials) have been affected and this could be due to disruptions that are being witnessed across the world. From the point of view of GVCs, exports of higher value-added products (processed goods) are better than exports of raw materials.

On the other hand, trade deficit has been a concern for a long time in India. It is on account of merchandise trade and not services. In 2020-21, the country posted a current account surplus after 17 years. To understand the components of trade deficit, we must analyse what we are importing and exporting. India’s backward integration is higher, which means that our GVC integration is through imports (that could be used for exports or domestic consumption). It is important to understand that imports of certain goods are critical – especially if they are imports of intermediate goods and not produced in the country.[14]

In our book Global Value Chains and the Missing Links, we have highlighted some of the important barriers that are preventing India from integrating in GVCs.[15] These include logistics, timeliness (including turnaround time at ports), infrastructure as well as sector specific problems.[16] It is heartening to note that some of the barriers have been removed in the budget this year and the issues addressed effectively. For e.g. the issues of timeliness and turnaround at ports have been addressed through the GATI Shakti. The PM Gatishkati National Master Plan will lead to development of Multimodal Logistics Parks at four locations. Cargo terminals under the PM Gatishkati Cargo Terminals by the Railways for multimodal transport have been proposed in the next three years.

Budget 2022-23 has underscored the importance of GVCs and the necessity of linking with value chains to promote exports. It has rationalized the customs duty on items of chemicals, electronics, and gems and jewellery to give a fillip to domestic manufacturing. To promote the manufacturing of capital goods, exemptions are being introduced on inputs, like specialised castings, ball screw and linear motion guide. Tariff of 7.5% on capital goods and project imports has been proposed. The exemptions for advanced machineries that are not manufactured within the country shall continue.

The budget also recognized the importance of barriers in improving our export competitiveness and has addressed these barriers e.g. logistics, SEZ etc. The recent proposal on the rebranding of the SEZ Act through Development of Enterprise and Service Hubs (DESH) is another example.[17] The new criteria suggested for SEZ units are growth which could include investment and employment rather than net foreign exchange earnings (which was the earlier criteria).

Conclusion

To integrate into global value chains and also promote employment in the country, a two- pronged strategy is required. In sectors, where there is comparative advantage, the promotion of exports is needed. Identification of such sectors with export potential will be important in this context. Barriers to integration are being removed for all sectors. For sectors, where there is no comparative advantage, but which could potentially generate jobs, investment is needed and more units need to be set up. The production linked incentive (PLI) scheme is such a scheme, and which has been introduced for several sectors. Recognition of the linkage between services and goods export is also important and needs to be recognised.

References

ADB, 2021. Global Value Chain Development Report. Asian Development Bank, Research Institute for Global Value Chains at the University of International Business and Economics, the World Trade Organization, the Institute of Developing Economies – Japan External Trade Organization, and the China Development Research Foundation. DOI: http://dx.doi.org/10.22617/TCS210400-2.

Mitra, S., Sen Gupta, A., and A. Sanganeria. 2020. Drivers and Benefits of Enhancing Participation in Global Value Chains: Lessons for India, ADB Working Paper. Link:

[1] ADB (2021)

[2] Mitra et al. (2020)

[3] ADB (2021)

[4] WTO, (2014)

[5] Taglioni and Winkler (2016)

[6] OECD (2013)

[7] Mitra et al. (2020)

[8] https://www.business-standard.com/article/economy-policy/india-s-low-score-on-gvc-a-starting-point-for-recovery-from-pandemic-aiib-121120701314_1.html

[9] Latest data that is available

[10] Data from https://atlas.cid.harvard.edu/data-downloads

[11] ibid

[12] Ibid

[13] Ibid

[14] Excessive imports put pressure on the exchange rate

[15] This article does not focus on the role of RTAs in increasing GVC participation, which could be an important source as well.

[16] India’s lags behind its peers on several aspects of competitiveness as well.

[17] The Development of Enterprise and Service Hubs (DESH) Bill will be presented in the monsoon session of Parliament. The government has proposed to create developmental hubs, whose focus is not limited to exports, but also to cater to the domestic markets. Customs duty would only be paid on the inputs used and not on the final goods. https://www.business-standard.com/podcast/economy-policy/what-is-the-desh-bill-122072700076_1.html

Dr. Saon Ray is Visiting Professor at ICRIER. She has a Ph.D. in Economics from the Jawaharlal Nehru University. She has been Ford Foundation Fellow at Jawaharlal Nehru University at the International Trade and Development Division. After completing her Ph.D. she was awarded the Sir Ratan Tata Fellowship at the Institute of Economic Growth and joined the Institute as a Post Doctoral Fellow. She then joined Research and Information System for the Non-Aligned and other Developing Countries (RIS) as a Research Associate. Subsequently she was Associate Professor and Head of the Department of Policy Studies at TERI University. Views expressed are personal

Leave a comment