Global Value Chains post-COVID: Paving the road to revival

• The concept of global value chains for international trade became imperative as the degree of competition surged now consumers had an eclectic product basket to choose from. Almost all economies participate in GVCs to gain the best of technology, price competitiveness, location benefits and higher market share.

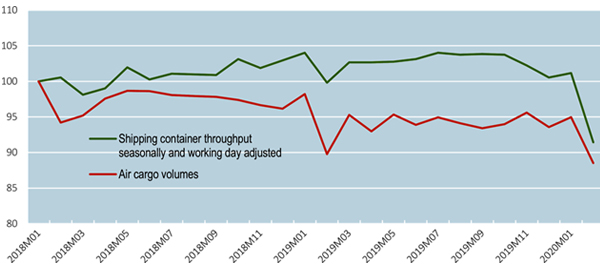

• Both sea and air cargo container index are dropping sharply post-COVID. Shipping container index plummeted from 104 in September 2019 to 92 in February 2020. Similarly, air cargo volume index also declined by 8% points.

• In its most recent forecast, UNCTAD estimates a 30-40% reduction in global FDI during 2020-21, based on the latest earnings revisions of major multinationals. Thus, a major GVC shock is estimated from the collapse in demand and production in many industrialized economies.

• The disruption of GVCs due to COVID-19 may therefore leave as a longer-term legacy, a significant reduction in developing countries’ potential to industrialize through linking into GVCs for many years to come.

As globalisation has increased in the past three decades, the world’s value chains have become substantially more interconnected and robust. As emerging market economies have steadily come to account for a greater proportion of global GDP, goods often have more stages to pass through before reaching the end consumer.

Raw materials and intermediate goods are shipped around the globe multiple times and then assembled in yet another location. The final output is re-exported to final consumers located in both developed and developing markets. The concept of global value chains for international trade became all the more imperative, as the degree of competition surged and consumers have an eclectic product basket to choose from.

Almost all economies participate in GVC to gain best of technology, price competitiveness, location benefits and higher market share. According to Paul Krugman, recipient of Nobel prize in economics, without participating in GVC, economies cannot escalate their global position in trade. The concept of new trade theory suggests that integration of economic activities under GVC is a must for ensuring value addition. Now the COVID crisis has led almost all economies to shut their international borders, causing major disruption in global value chains.

From national lockdowns to closed airspace and borders, COVID-19 has resulted in unprecedented disruption to the mechanics of most economies, regardless of their size or stage of development. In particular, the surge of these barriers has placed a major strain on global supply chains, including essential linkages relating to food and medicines. Even though economies are slowly opening up and moving towards the unlock phase, international borders are yet not active. Only national economic activities have started reviving like domestic manufacturing and inter-state mobility. Many significant economies have banned exports of major commodities to take care of domestic needs.

ARE GLOBAL VALUE CHAINS UNDER SIEGE?

For many products traded across the globe, China has been at the heart of such GVCs. It is both a primary producer of high-value products and components and a large customer of commodities and industrial products across global markets. Chinese authorities reacted to COVID 19 outbreak by imposing severe restrictions on movements of people, effectively imposing curfews and quarantines across the country. In fact, not just China, ASEAN nations, EU, US and Middle East countries have also restricted exports, labor mobility and services to other nations.

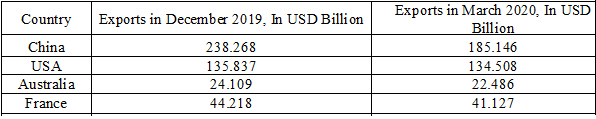

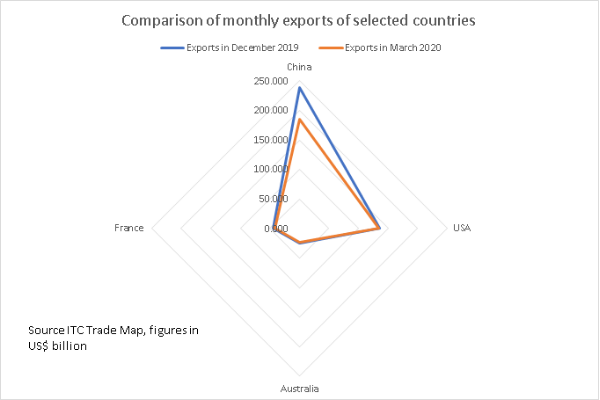

Source: ITC Trade Map

From the table, we can easily observe that China, US, Australia and France have experienced a decline in monthly exports between December 2019 and March 2020. This also signals that more or less, economies are shifting to operate in relative isolation as exports as well as also imports of non-essentials too are restricted. The resulting drop in demand, due to the imposed restrictions on movements of individuals, combined with concerns about health and safety of employees has led to factory closures. It is expected to adversely affect operations of entire GVCs at least till 2021.

Source: ITC Trade Map

Both sea and air cargo container index are dropping sharply post COVID outbreak 19. Shipping container index plummeted from 104 in September 2019 to 92 in February 2020. Similarly, air cargo volume index also declined by 8% points.

Source: OECD, drawing on data from Innovative Solutions in Maritime Logistics (www.isl.org/en/containerindex) and International Air Transport Association (www.iata.org).

In its most recent forecast, UNCTAD estimates a 30-40% reduction in global FDI during 2020-21, based on the latest earnings revisions of major multinationals. Thus, it is to be expected that this GVC shock from the collapse of demand and production in many industrialized economies and the divestment from developing countries will have far more long-lasting effects on global production than temporary supply chain disruptions caused by COVID-19.

Even when the virus was only limited to Wuhan, the supply of Active Pharmaceutical Ingredients (API) had become a source of apprehension for the Indian pharmaceuticals industry. When the virus started travelling to other countries, including India, substantial dependence on China for personal protective equipment and testing kits affected their ability to test their populations to contain the spread of virus. It is ironical that the country where this crisis originated has also become the main source country for the essential supplies needed to control the pandemic. It, thus, seems justified to question the unbridled enthusiasm with GVCs and globalisation that prevailed till recently.

Another fact is that, given India and China’s API production dominance in global markets, an immediate halt of global value chains will prove challenging for some countries. For example, Mexico relies on India and China for 90-95% of its APIs.

What does COVID-19 imply for the future of GVCs?

If economies need to abstain lengthy economic distress, a synchronized policy response, as advocated by the United Nations and other multilateral policy institutions, serves as possibly the most promising path out of a looming economic crisis. In a number of developed countries, leading policymakers have proposed for a rethinking of their companies’ approaches to international outsourcing of production, with a view to avoiding future supply hinderances.

The disruption of GVCs due to COVID-19 may therefore leave as a longer-term legacy, a significant reduction in developing countries’ potential to industrialize through linking into GVCs for many years to come. The COVID-19 pandemic calls for cumulative efforts towards strengthening multilateral approaches to policy making and assisting countries in opening up other ways to enable inclusive and sustainable industrial development.

Leave a comment