Furniture Industry: Time for India to sharpen its edge

India is among the top five producers and the fourth largest consumer globally. However, the country is ranked 16th in exports, which were valued at US$ 2.86 billion in 2021-22. In order to establish a robust international presence, India must tackle various challenges that hinder its progress.

The research division of TPCI conducted an analysis of India’s thriving performance in the domestic market while investigating the reasons behind the industry’s lacklustre performance on the international stage.

Image Source: Pexels

India is the 5th largest producer and 4th largest consumer of furniture globally. In 2022, India’s furniture market is valued at around US$ 23.12 billion and it is further expected to grow at a CAGR of 10.9% (2023-28) to reach US$ 32.7 billion by 2026.

Major drivers of demand include increased urbanization, growing home decoration and renovation, rising disposable incomes, changes in lifestyle and consumer preferences post-COVID, rise in e-commerce, among others. Despite its gradual growth, India continues to lag in furniture exports and is currently ranked 16th in the global market.

India versus the World

The global furniture market size is projected to grow at a CAGR of 6% during 2021-30 to reach US$ 872.5 billion by 2030. When it comes to India, the contribution to global furniture export is around 1.12% (2022) standing at US$ 3.5 billion (2022) and is growing at a CAGR of 15% (2018–22).

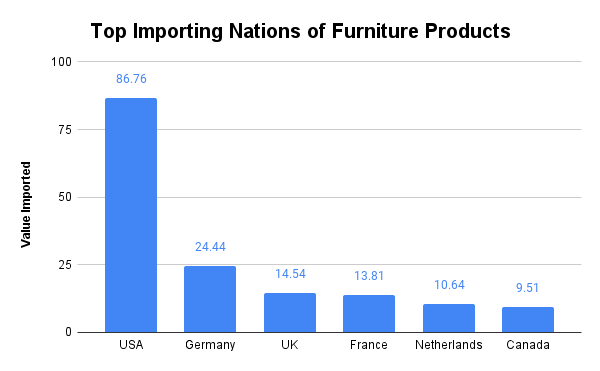

Based on records from 2022, leading importers of furniture in the global market include the US (US$ 86.76 billion), Germany (US$ 24.44 billion), UK (US$ 14.54 billion), and France (US$ 13.8 billion).

Source: ITC Trade Map 2022 (in US$ billion)

These figures indicate significant market potential for India to explore. Currently, India’s contribution to the total imports of furniture in the US, Germany and the UK stood at 2.48%, 1.99% and 1.66% respectively. These percentages highlight the opportunity for India to expand its presence in these potential markets and increase its market share.

Major Competitors and Scope of Growth

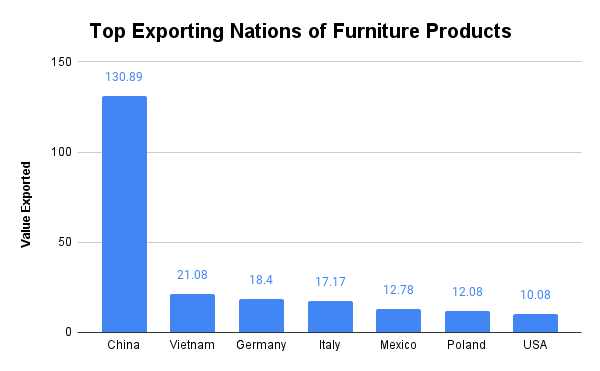

The leading exporters of furniture in 2022 (ITC Trade Map), were China (US$ 130.89 billion), Viet Nam (US$ 21.08 billion), Germany (US$ 18.4 billion), Italy (US$ 17.17 billion), Mexico (US$ 12.78 billion), Poland (US$ 12.08 billion) and the US (US$ 10.1 billion).

Source: ITC Trade Map 2022 (in US$ billions)

China and Germany actually represent two contrasting models of export dominance. In the case of China, low labour costs, rise in innovation and technology, as well as government incentives and support have played a major role in the growth of the furniture sector. On the other hand, Germany’s success can be attributed to its technological advancements, emphasis on sustainable practices, and reputation for high-quality craftsmanship.

In comparison, India has certain advantages over China, such as lower labour costs, which can make its products more competitive in terms of pricing. Additionally, India’s growing middle-class presents a promising market for furniture. Furthermore, the country has the potential to leverage its rich cultural heritage and design capabilities to offer unique and appealing furniture products in the international market.

By recognizing areas where India has a competitive edge, the industry can focus on further enhancing its strengths while addressing challenges and areas for improvement identified earlier. This strategic approach can help India position itself as a formidable player in the global furniture market.

Challenges that India faces in the global market

Availability of raw material: It has been discovered that the cost of raw materials (mainly particle board) is roughly 25% more expensive in India, making its furniture production about 27% more expensive than Chinese imports. Major barriers that contribute to the high cost of raw materials include limited domestic availability of certified wood, inadequate scale of commercial forestation practices, and higher import costs.

Dominant Unorganized Sector: The Indian furniture market is highly fragmented and has been predominantly driven by the unorganized segment with an 80% share of sales. The unorganized industry poses challenges such as a lack of standardization, inconsistent pricing, limited access to technology and innovation, the absence of industry regulations and limited export potential, further hindering growth and competitiveness.

High logistics costs: In the furniture sector particularly, the cost of transportation and logistics accounts for about 6%-8% of the total manufacturing cost, compared to China’s 4%, making the industry uncompetitive.

Ease of doing business: India has made significant progress towards facilitating and fostering an environment that is favourable for businesses to draw in more foreign investment, but it still lags behind China in several of the crucial areas, such as starting a business, enforcing contracts, and registering property.

Cost competitiveness: The high Goods and Service Tax (GST) rates on furniture in India (ranging from 12-18%) make it expensive for consumers, hinder demand, and encourage tax evasion. The requirement for phytosanitary certification and fumigation of processed wood products creates environmental hazards and adds regulatory burdens.

When speaking to IBT on how India can be a dominant exporter of furniture, Madhusudan Lohia, Director, Marino Groups, said, “The Indian furniture industry is highly fragmented with very few big players in the domain. Even the biggest player does not have as high revenues as many other sectors.”

He further added that furniture clusters should be made/helped via Government involvement in areas surrounding Large Particle Board Plants – this shall cut down the transport cost of raw boards, which form the highest share of raw material costs and transport is a major chunk of this cost. The government must ensure globally competitive, competent and compliant products are produced and for that, it needs to have global standards applicable in India also, PLI for furniture manufacturing is based on efficiency, growth and the use of appropriate technology.

Lohia further suggested that the government should support & incentivise the agro-forestry model* (it helps in India’s carbon sequestration and the fight against desertification also), so that good quality FSC grade Particle Board can be produced in India to make the industry more competitive.

When asked about the challenges the Indian furniture industry is facing currently, he said, “Cost of Raw Material – boards & hardware, no specific focus on furniture, and lack of specifications to drive globally acceptable products are critical deficiencies.”

To enhance exports of furniture from India, the government can consider implementing the following suggestions: export-focused incentives, reducing GST rates to bring down prices and stimulate consumer demand, amending plant quarantine laws for easing imports of processed materials and reducing import duty rates on finished goods. In addition to this, amending legal provisions for the proper use of FTAs, diversification and product development by promoting the usage of alternate sources, supporting commercial forestation and sustainable forest management can also boost exports.

Final Word

After thorough consideration of all the factors and findings, it is evident that India needs improvements in various areas to emerge as one of the leading exporters of furniture in the global market. Key areas requiring attention include attracting foreign direct investment, enhancing infrastructure, addressing duties and taxes, implementing government initiatives and providing support. Moreover, focusing on training and skill development to enhance efficiency and effectiveness is another crucial element.

*When woody perennials (trees, shrubs, palms, bamboos, etc.) are purposefully used on the same land-management units as agricultural crops and/or animals, in some kind of spatial arrangement or temporal sequence, these systems and technologies are referred to as agroforestry.

Another way to describe agroforestry is as a dynamic, ecologically based system for managing natural resources that diversifies and sustains agricultural production for greater social, economic, and environmental benefits for land users at all scales by incorporating trees into farms and agricultural landscapes.

It’s insightful!!