Export volume of Basmati to Iran has dipped

Gurnam Arora, Joint Managing Director, JMD – Kohinoor Foods Ltd, states that the Government of India should institute a system whereby payment transactions between India & Iran can be entertained in any internationally free trade currency. Alternatively, there should be a 3rd Party payment mechanism which would help Indian exporters to secure their long overdue remittances.

IBT: What role does Iran play as a market for you? How do you view the potential of the market?

Gurnam Arora : For Basmati rice, Iran has been a prominent market and accounted for 34% share in the exports from India in 2018-19. In quantity terms Iran imported 14.83 lakh tonnes of basmati rice in 2018-19, which came down marginally in 2019-20 to 13.19 lakh tonnes (30% share). But during the period April-October 2020, the export volume to Iran has been a mere 4.43 lakh tonnes out of a total export of 27.44 lakh tonnes, reflecting a phenomenal dip in share to 16%.

Iranians prefer Indian Basmati rice to any other rice. Discounting for the problems that persist in export of Basmati rice to Iran, I would say that there is tremendous potential and the export could grow up to 20 lakh tonnes over the next three years. This is because if we look at year on year growth since the export to Iran has grown at a CAGR of 14% over 5 years from 2015-16. Thus the importance of Iran as a market for Indian basmati rice with high potential cannot be over-emphasized.

IBT: How has the imposition of sanctions on Iran by the US affected trade with your Iranian clients?

Gurnam Arora : The genesis of the current set of problems in trade of Basmati rice with Iran is a result of the imposition of sanctions on Iran by US. Because of these issues, India has not been able to import crude oil from Iran since May 2019. Both countries have an agreement to transact business in Rupee terms and accruals from oil imports would be utilized for remittances against export of Basmati rice apart from other non-sanctioned essential items.

IBT: Why is the Rupee-Rial payment mechanism not helpful in retrieving payments from Iran?

Gurnam Arora : As mentioned, both countries have an agreement regarding trade in Indian Rupees and the system has been functioning very well since its inception. It has been suggested to the Government of India to institute a system whereby payment transactions can be entertained in any internationally free trade currency.

As an alternative we have been suggesting the implementation of 3rd Party payment mechanism which would help Indian Exporters to secure their long overdue remittances against stuck up cargo at Iranian ports which amounts to around INR 1750 crore approximately.

IBT: What challenges are you facing in routing payments through other countries?

Gurnam Arora : The present system is bound by the mutual agreement between the two countries under which only rupee payments are the accepted norm. The Government of India has nominated UCO Bank and IDBI Bank for handling transactions.

Today the situation has come to a pass where remittances are not forthcoming from Iran because the Central Bank of Iran is not issuing currency allocations to local Iranian rice importers. Because of this large number of consignments have got stuck at Iranian ports for last several months and the funds of exporters are blocked. This has created an uncertainty because of which exporters are constrained to withhold further shipments for the time being.

IBT: How can the Government of India/banks step in to resolve this issue?

Gurnam Arora : The present crisis, as mentioned earlier, is aggravated by two factors: (a) There is accepted rupee payment norm through the two nominated Indian Banks and from Iranian side Central Bank of Iran (b) Due to non import of crude oil from Iran, the accumulations in the two Indian Banks have depleted to a drastically low level and cannot take care of the volume of Basmati trade.

From trade side, the only solutions that can be foreseen are, I reiterate, that either third party payment mechanism is instituted or the mutual agreement is immediately amended to incorporate a mechanism for payment in any internationally freely traded currently. But for the moment we are keeping our fingers crossed till a workable solution emerges.

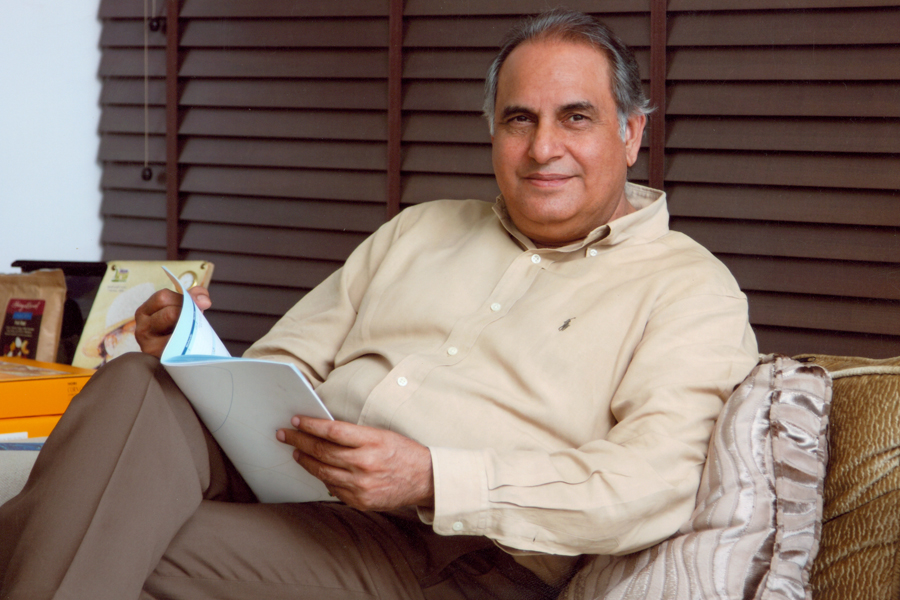

Gurnam Arora, Joint Managing Director of Kohinoor Foods Limited, is widely acknowledged for changing the way people look at commodity business. A Graduate in Business Management from Amritsar University, not only did he made ‘Kohinoor’, the most trusted & preferred brand in the industry, but also gave the Basmati Rice industry a line of innovations like convenient packaging options and many more value additions for universal consumers that most of the companies today follow.

Single minded in his zeal, Mr. Gurnam Arora is also a member of the Basmati Development Fund, APEDA, Indo American Chamber and Ministry of Commerce and has officiated earlier as the President of All India Rice Exporters Association. He is also a part of various industry associations like FICCI, ASSOCHAM, to name a few. Recently, he was also awarded as “Corporate Leader of the Year” among selected few at the PowerBrands Hall of Fame Awards in London.

With a keen interest in brand, in the current capacity, Mr. Arora takes care of Kohinoor’s brand development in all the 65 countries where the brand is presently available.

Leave a comment