Expanding global reach of India’s horticulture sector

India is the second largest producer of fruits and vegetables in the world, but hasn’t replicated the same success in exports. Centre for Advanced Trade Research analysed the growth opportunities for the sector, and how it can leverage its strengths to enhance its export competitiveness and extract higher value.

- In India, fruits and vegetables constitute 90% of the total horticulture production. During past ten years, production of fruits and vegetables increased at a CAGR of 4%.

- The data shows shift in preference of farmers from food grains to horticulture crops. By 2017-18, the horticulture crops with a production of 311.7 million tonnes took over food grains production which stood at 284.8 million tonnes.

- However, in global exports of horticulture products, India has less than 2% share. In leading importing markets for fruits and vegetables such as US, Germany, UK, China and France, India’s share is less than 1.5%.

- There is need to monitor the uses of fertilizers and pesticides to improve the export performance of horticulture products.

Horticulture is a sub-branch of agriculture with products like fruits, vegetables, plantation crops, spices and flowers coming under this sector. In India, fruits and vegetables constitute 90% of the total horticulture production. Thus, among horticulture products this article narrows the focus on only fruits, vegetables and processed fruits and vegetables.

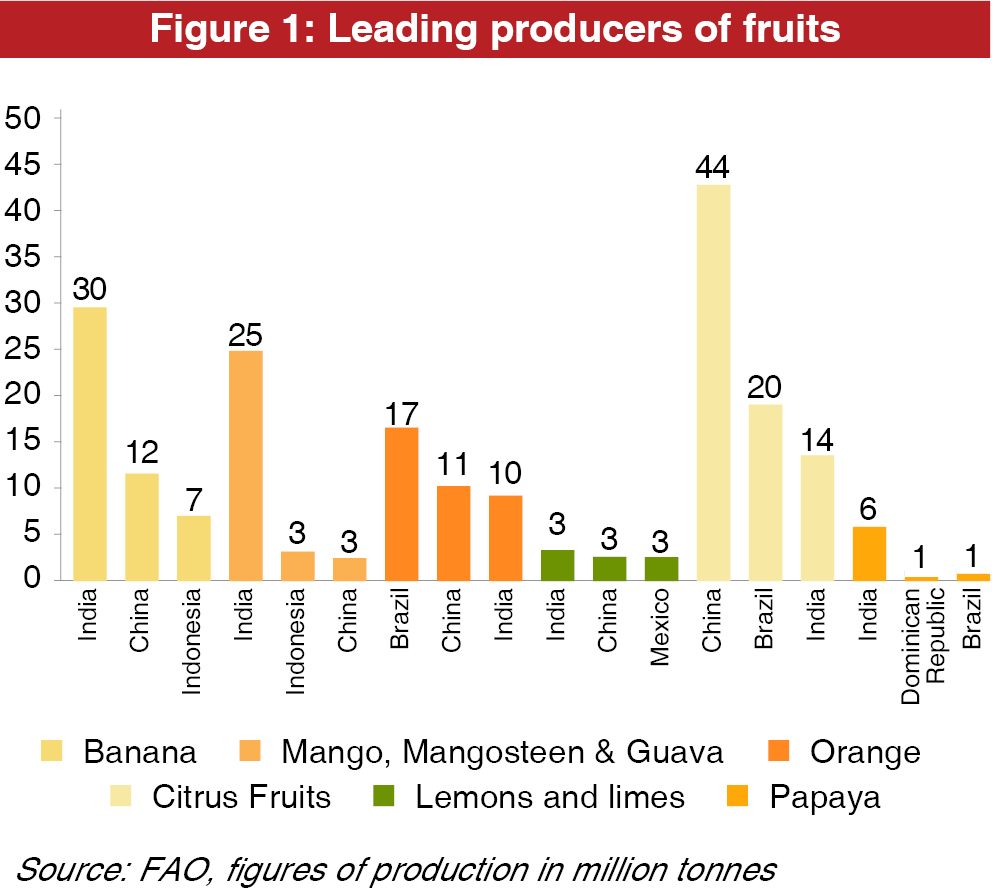

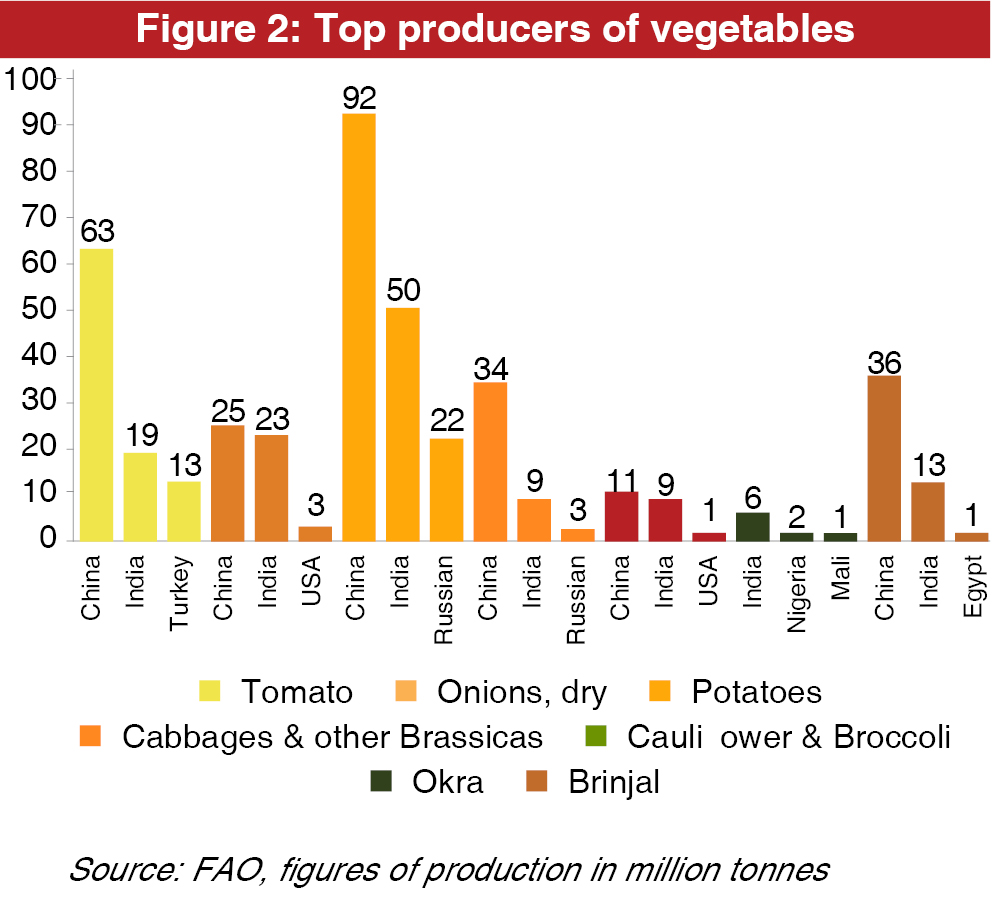

As per the Food and Agriculture Organization (FAO), India is the 2nd largest producer of fruits and vegetables, behind China. The diversified climate has supported availability of the various fruits and vegetables in India throughout the year. Other countries which are leading in the production of fruits are Brazil, the United States of America (US) and Turkey, whereas leading producers of vegetables include Vietnam, US, and Turkey.

There are many fruits in which India leads in terms production. Figure 1 below shows that for fruits like bananas, mangoes and guava, lemons and papaya, India holds first rank among the list of producers. For mango, states like Uttar Pradesh, Karnataka, and Andhra Pradesh account for 40% of India’s production. In case of bananas, some Indian states such as Tamil Nadu, Gujarat, and Maharashtra lead in production and in papaya, states like Andhra Pradesh, Gujarat and Odisha are the best performing states. Furthermore, in the production of orange and citrus fruits, the country is only behind Brazil and China.

Some of the vegetables in which India is among leading producers are presented in figure 2 below. Except for okra, India is the 2nd largest producer of all the vegetables presented in the figure, behind China which is the leading producer for all these vegetables. For okra, the country ranks 1st in the world. Uttar Pradesh and West Bengal in 2018, accounted for around 30% of the production of vegetables in the country.

Production performing better now

Past trends show India’s increased production of horticulture products over the years. The production of vegetables during 2009-10 was 161 million MT which increased to 193.6 million MT during 2020-21. For fruits, the production was 82.5 million MT during 2009-10 which increased to 103.23 million MT in 2020-21. The area under production has also seen an increase. The area under production of fruits increased from 6,383 thousand hectares during 2009-10 to 6,963 thousand hectares during 2020-21. For vegetables, the area has increased from 8,494 thousand hectares during 2008-09 to 10,711 hectares during 2020-21.

Data further shows shift in preference of farmers from food grains to horticulture crops. During 2007-08, in India, the production of horticulture products was 211.2 million MT and food grains was 230.8 million MT. However, by 2017-18, horticulture took over food grains with production at 311.7 million MT compared to 284.8 million MT for the latter. In 2020-21, the production of food grains was 159.3 million MT where as for horticulture crops was 326.5 million MT.

One of the reasons for growing penetration is that the crops can be grown on small farms, which allow such farmers to cultivate them with quick returns. Small and marginal farmers who own less than 2 hectares of land have a share of 86.2% in total farmers of India. The demand for these products has also been rising due to factors like improving income, health consciousness, growing consumption and urbanization. Furthermore, diversified climatic conditions have supported availability of the various fruits and vegetables in India throughout the year.

Exports of horticulture products

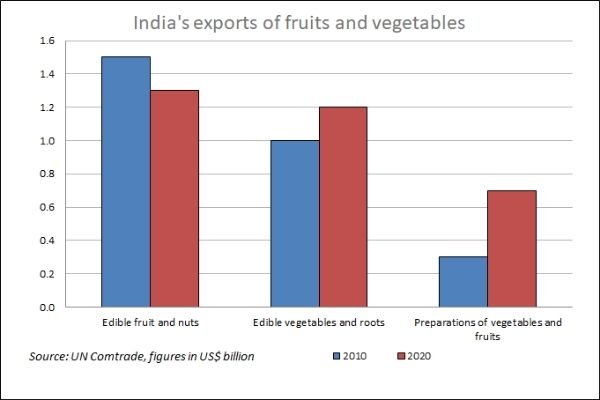

Despite leading in production of fruits and vegetables, India’s exports of these products have not replicated the same success. During 2010-20, there has been an increase of US$ 2.8 million in the exports of India’s horticulture products, with export value of US$ 3.19 billion in 2020. Some of the major destinations for country’s exports are UAE, Netherlands, US and Saudi Arabia.

There are certain products which have outperformed the average export performance of horticulture products. These include onions, potatoes, chilled or fresh vegetables n.e.s., grapes etc. Various factors have contributed in the growth of exports of these products. For instance, the export of fresh grapes have increased from US$ 102.5 million in 2010 to US$ 307.9 million in 2020. Initiatives like Agri-export zones (AEZs) and GrapeNet have helped in catalysing this growth.

Similarly, in fresh potatoes, exports increased from US$ 26.9 million in 2010 to US$ 70.7 million in 2020. For potatoes, exports have increased along with a significant increase in the production. However, in global exports of horticulture products, India has less than 2% share. In leading importing markets for fruits and vegetables such as US, Germany, UK, China and France, India’s share is less than 1.5%. With the large base for production of horticulture products, the country has potential to export the products to these countries.

What can be done further?

Centre for Advanced Trade Research developed a research paper on Market Expansion of Indian Horticulture Products, which used Revealed Competitive Advantage analysis to ascertain some of the horticultural products that can be tapped in the short run by India to enhance its exports.

| Table 1: Products that can be immediately tapped by India to increase the exports | ||

| Product | Product Name | Importing countries |

| 071140 | Cucumbers and gherkins provisionally preserved | France, Japan, Belgium, Russian Federation, Spain |

| 071220 | Dried onions, whole, cut, sliced, broken or in powder | Germany, Japan, UK, Indonesia, Canada |

| 200110 | Cucumbers and gherkins, prepared or preserved | Canada, Germany, USA, Netherlands, France |

| 080119 | Fresh coconuts, whether or not shelled or peeled | Thailand, USA, Malaysia, UAE, Hong Kong |

| 080132 | Fresh or dried cashew nuts, shelled | USA, Netherlands, UK, China |

| 071360 | Dried, shelled pigeon peas “Cajanus cajan” | USA, UAE, Nepal |

| 070310 | Fresh or chilled onions and shallots | China, Bangladesh, USA, Pakistan |

| 071320 | Dried, shelled chickpeas “garbanzos” | Pakistan, Bangladesh, UAE |

| 071390 | Dried, shelled leguminous vegetables | China, Pakistan, UAE, Saudi Arabia, Bangladesh |

Source: CATR Analysis and UN Comtrade

These products can be focused while improving the exports of the horticulture products. Also, the importing countries are the markets that should be focused to expand the exports of these products.

The report concludes that India should focus on the following measures to enhance its horticulture exports to target markets:

- Being a part of the Global Value Chains (GVCs) has helped economies significantly in improving their horticulture sector and gaining a position in the world market. Kenya is a great example to showcase how a few players played a significant role in boosting a country’s export of horticulture products. Major exporters and producers of Kenya own large packaging and storage facilities at the Kenyan international Airport complex.

- India needs to develope requisite infrastructure to curb losses across the value chain. An educative case study is cooperative firm ‘MAHAGRAPES’, which was formed by the Maharashtra State Grape Growers’ Association in January 1991 with the purpose of boosting the export of grapes from Maharashtra. MAHAGRAPES’ has provided pre-cooling and cold storage facilities.

- For the long run, the sector would need to be supported by the government. A good example that can be looked for evidence of growth in the long run is the EU with the help of CAP.

- Import of technologies will also help in enhancing the productivity and skills in the horticulture sector. For instance, in the past, through the Indo-Israel project, Israeli technology “plastic mulching” has improved the yields of tomato farms in Tamil Nadu. Similarly, India should adopt Israel’s drip irrigation system which has been proven to be efficient in avoiding water wastage.

- Consolidation of farm holdings is considered a very vital step in boosting demand of horticulture products. Azhar Tambuwala, Director, Sahyadri Farms, notes that in India, a farmer is typically farming for the purpose of sustenance and is not running it as a business. Marketing must be supported by integration at the back end. The need of the hour thus, is to consolidate, because it’s impossible for farmers to have huge land bank holdings due to the law as well as the division of property when handed down from generation to generation. It is only then that standardization and fair management can be brought into the production process where farmers coming together can take bigger and bolder decisions.

- To build scale and sophistication in the value chain, the Centre’s Horticulture Cluster Development Programme could act as a game changer. Official estimates expect it to benefit about 10 lakh farmers and move closer to doubling their income as they benefit from access to a common pool of resources and by building last-mile connectivity. Gopal Naik, Professor in Economics and Social Sciences at the Indian Institute of Management Bangalore opines:

Clustering helps in creating needed ecosystem development such as storage, packaging, quality assaying, labeling, and transportation. Clusters can have a dedicated power supply and strong broadband connection apart from other infrastructures such as roads. The cluster approach also helps in getting trained manpower and information and knowledge transfer. They help to forward and backward integrate the supply chain.

- The adoption of Good Agriculture Practices (GAP) will also help in boosting the exports. These practices help in improving the quality standards, which are essential for exporting the fruits and vegetables products into the major importing countries.

- The sector urgently needs private investments to grow and build scale. Dr Arpita Mukherjee, professor at ICRIER, opines, “Horticulture export can grow by attracting private players into the sector through right incentives. The government should promote farms for third-party certified organic produce, by supporting them during the conversion of land from conventional to organic farming as is done by countries such as the UK.”

- Another major factor that impacts India’s export growth for horticulture products is the numerous SPS and TBT measures from top exporting countries. One suggestion to deal with this issue is to have harmonisation in non-tariff measures across the markets, which can be possible by adopting the standards defined by Codex Alimentarius.

To view the CATR report on Global Market Expansion of Indian Horticulture Products, click https://www.tpci.in/resources/publications/

Leave a comment