EV battery: The roadmap to a greener future

In order to emerge a frontrunner in the EV race, India must first go back to the drawing board and create strong backward and forward linkages. For this, having a robust system of manufacturing EV batteries holds the key.

- The Government of India is moving towards accelerated adoption of electric vehicles (EVs) by 2030 so as to cut down its carbon emissions.

- However, India is not well prepared when it comes to having the right ecosystem needed for the success of EVs. For example, India depends on China, for its lithium-ion battery (LIB) requirements.

- This is significant as battery costs represent the largest single factor (up to 50%) in this price differential. As far as becoming self-reliant in the production of EV batteries is concerned, there are quite a few things where India lags behind such as the availability of ample supply of raw materials & limited investment in R&D. The idea of battery swapping further complicates the situation.

- This can be fixed by an array of solutions like offering incentives to spur production & demand, promoting R&D and looking for ways to secure the supply of raw materials.

Image credit: https://bit.ly/3apxJ1T

The Government of India is moving towards accelerated adoption of electric vehicles (EVs) by 2030 so as to cut down its carbon emissions. This effort has already started bearing fruits. According to Society of Manufacturers of Electric Vehicles (SMEV), there was a 20% year-on-year rise in the sales of all EVs (except e-rickshaws) in 2019-20 from 1.3 lakh units to 1.56 lakh units.

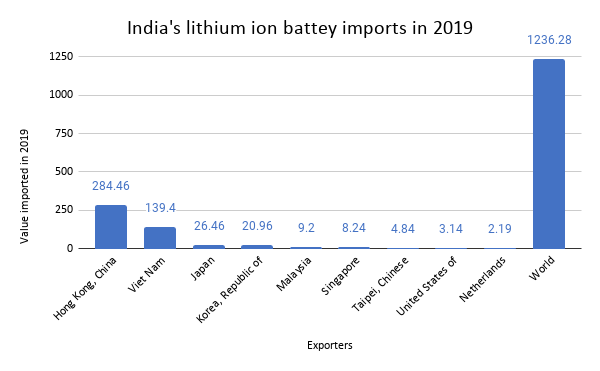

Any discussion on EVs, however, will gravitate towards the fact that India is not well prepared when it comes to having the right ecosystem needed for the success of EVs. For example, India depends on China, for its lithium-ion battery (LIB) requirements. According to ITC Trade Map, in 2019, India imported LIBs worth US$ 1.2 billion (up from US$ 384 million in FY17). This is significant as battery costs represent the largest single factor (up to 50%) in this price differential & are likely to play a vital role in the highly-electrified transport sector of the near future. According to industry estimates, the annual LIB market in India is estimated to increase at a CAGR of 37.5% to reach 132 GWh in 2030. Thus, India needs a robust component supply chain with a strong emphasis on domestic production of battery. As Road Transport and Highways Minister, Nitin Gadkari, says:

We are importing EV parts—lithium-ion battery, magnets—from China…Whatever we are importing, need to find out the swadeshi alternative in the country, without compromising the quality and cost. That is the main mission of Aatmanirbhar Bharat.

This blog attempts to explore the hurdles that LIB industry faces in India and how can a sound environment be created for their local production.

Source: ITC trade map. All values in US$ millions.

Domestic battery production: A rocky ride ahead?

One of the main reasons why India is forced to import lithium-ion batteries is the scarcity of raw materials needed to produce EVs – lithium, cobalt, manganese & nickel. India’s estimated lithium reserves – about 14,100 – tonnes are lower than those of Chile (8.6 MT), Australia (2.8 MT) and Argentina (1.7 MT). This figure is quite low considering the fact that if India has to meet its EV targets through 100% domestic manufacturing of batteries, it would require at least 3,500 GWh of battery storage at a wholesale cost of US$ 300 billion. The cost of imports drives up the cost of the vehicle.

Another issue when it comes to EV battery production in India is the lack of ample investment to promote research and development. Research directed towards developing break through technology which can make products using recycled materials or other substances (e.g. aluminium) and developing more efficient batteries are the need of the hour to compete with global prices and efficiencies. China, for instance, has an upper hand in the area due to its heavy early investments in R&D.

There are also some challenges related to performance of LIBs. These relate to maintaining the operational temperature. This could affect the performance and efficiency of the battery, along with lifetime and safety in exploitation. Added to this is the fact that even a small amount of moisture in the battery can ruin it completely as lithium is highly aggressive, corrosive and hygroscopic in nature.

At the same time, the EV battery makers need to take into account that the Ministry of Road Transport and Highways has decided to allow automobile makers to sell EVs without batteries at their discretion. Consequently, the batteries could be sold separately to the vehicle owner, or the owner could buy the battery from some other service provider. While this move will lead to the mushrooming of new batteries on lease business models and thereby facilitate greater adoption of EVs in the country, battery swapping has its own set of limitations. For example, battery swapping is reliant on predicting, managing and extending the battery life. What adds to the complexity of this process is the ability of one swapping station to cater to all types of EVs made by various companies. There are also concerns pertaining to safety & operations of these batteries. Questions related to cross platform / brand compatibility and how does any issue due to the battery impact the warranty benefits for the customer arise in this context. Another challenge relates to infrastructural inadequacies in the country. Battery swapping stations exert the same demand on the grid as in charging stations and they must have sufficient inventory to meet demand. Further, it raised the question of ownership – does it lie with the vehicle owner or the OEM?

Lastly, the country will also have to give a thought to the question of the disposal of EV batteries as the country transitions to them. Concerns pertaining to the contamination of ground water and heavy metal pollution seriously question the relevancy of LIBs as an eco-friendly mobility option.

Charging up the domestic battery landscape

In order to give fillip to EV battery manufacture ecosystem in the country, the government has taken quite a few initiatives. For example, The government has devised schemes like revamped the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme. Further, India plans to offer incentives worth US$ 4.6 billion to companies setting up advanced battery manufacturing facilities. This could make a huge difference when it comes to making EVs economically more viable.

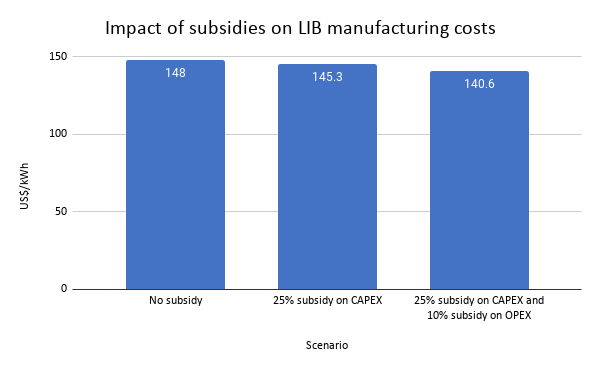

Source: Centre for Study of Science, Technology & Policy

Going forward, the industry, which is still in infancy, needs to consider alternatives to lithium and cobalt like sodium, aluminium & sulphur to produce batteries. Collaborations with academic research institutions is a must for this. It can also sign MOUs with nations like Australia, Chile, Brazil, Ghana & Tanzania to procure raw materials. Further, for battery swapping to grow in India, the following conditions should be met: identifying strategic locations, harmonising battery pack so one station can service all cars, a multi-stakeholder collaborative effort and addressing regulatory ambiguities. Offering capital & production subsidies to EV battery makers can also bring down the costs of the vehicle and spur demand for them. Lastly, India should also focus on creating the right charging infrastructure for EVs if it wants to provide a sustainable boost to this sector.

Leave a comment