Designing Import Substitution policy for Developing Furniture Cluster in India

• India’s furniture sector is one of the promising industries with high export potential, though its market share in exports at present is barely 1% of the Global Furniture Market.

• Restricting imports may be the only viable option to provide support the domestic industry already in place. This will also help in setting up of proposed clusters as also the transformation of the unorganised sector to a more viable and prosperous organised segment.

• Initially, there could be an increase on the import tariff of those raw materials and intermediate products whose only usage is in furniture sector and does not have any intersection in usage with other sector.

• Restricting imports and bringing them under a licensing regime without a valid reason may be a difficult, if not impossible proposition. However, quality is one major aspect to facilitate imposition of NTMs.

The furniture sector in India is grossly under-developed and is largely dominated by the unorganised segment. Increase in domestic demand, however, is also driving growth in the organised segment. The Indian furniture market is projected to reach a size of US$ 61.09 billion by 2023; registering a CAGR of 13.38% during 2018-2023.

Technological advancements including the availability of high speed internet networks and proliferation of smartphones and low cost data are boosting the e-retail space. Players such as Pepperfry, Urban Ladder, etc are increasingly capitalising on these channels. The key factors driving an increase in demand for furniture are:

a. Growth of housing and commercial construction

b. Increase in income levels that influence customers to match global lifestyles, especially in urban affluent Indians.

The modernization of this sector with machine & technology is bound to facilitate growth of this sector. The Indian furniture market is now more customer friendly and moving as per their preference and supplying readymade, branded furniture with low maintenance, quickly installable and customisable options. The Indian furniture manufacturing sector mainly caters to home use and office & hospitality sectors. Though they try to meet domestic demand, India’s imports are growing at a rapid pace. With the rapidly growing and transforming retail sector, it is expected that large retailers will continue to expand their presence, leading to consolidation in furniture retailing in urban markets.

INDIA’S TRADE SCENARIO

Furniture is one of the promising industries with high export potential, though India’s market share in exports at present is barely 1% of the global furniture market, which is estimated to be US$ 258 billion. The global furniture market is estimated at US$ 1.1 trillion, out of which the Indian market size is less than 5% (approximately US$ 32 billion).

Currently China is the leading exporter of furniture products with global share of 37.5% followed by Germany, Poland, Italy and USA. Currently India’s top export destinations include US (39.2%), Germany (7.4%), France (6.6%), UK (6.3%), Netherlands (6%), and Australia (2.8%). The idea of setting up furniture clusters in India seems pragmatic to escalate India’s furniture exports and also increase the acceptability of high-end finished furniture products among developed nations.

According to ITC HS CODE, all tariff lines under HS Chapter 94 are finished products of the furniture and furnishing industry. All these tariff lines are mentioned along with its description in the last section of this document. Apart from the finished furniture products, several raw materials and intermediate products are categorized under HS Chapters 39 (plastic), 44 (wood) and 83 (metal).

Setting up of specialized furniture clusters in states where governments are willing to provide basic amenities and business incentives is important for the furniture sector. Government also needs to consider creation of SEZs with proper amenities required for the furniture players – wooden, plastic & metal alike – to develop a brand culture. Industry cluster for furniture should also be innovation-driven to encourage manufacturers to use latest technology that can pave the way for the industry to be more competitive globally. The setting up of furniture clusters will not only be able to meet local furniture demand in India, but also have huge scope of enhancing exports of finished products, especially to developed countries.

Approach to limit furniture imports

Restricting imports may be the only viable option to support the domestic industry already in place. This is also going to help in setting up of proposed clusters as also transformation of unorganised sector to a more viable and prosperous organised segment. To provide required cushion to Indian furniture sector, it is required to introduce certain kind of restriction instruments like increase in import tariff or introduction to NTMs. There are two kinds of approaches: one is top-down implementation of restrictions and second is bottom-up implementation of restrictions on furniture & furniture-related products. For example, if import restrictions are implemented on finished furniture products in ready to use form, it will be a top-down approach. If import restrictions are implemented on intermediate products like plastic, bamboo, metals, it will be a bottom-up approach.

Out of these two policies, top-down will be more efficient as it will restrict those products, which are meant for manufacturing at furniture clusters, mainly end-use furniture products. These products are majorly categorized under HS Chapter 94.

There are, of course two viable alternatives to consider for restrictions,

i. WTO compatible Tariff Barriers

ii. More stringent Non-Tariff barriers.

i. Increasing the Tariffs from MFN to Bound Rates.

This is possibly easier to achieve considering the fact that India does not have a commitment to restrict the upper limit in terms of imposing tariffs on desired segments of the industry. It is interesting to note that apart from HS Code 940490, which includes {Articles of bedding and similar furnishing, fitted with springs or stuffed or internally filled with any material or of cellular rubber or plastics (excl. mattress supports, mattresses, sleeping bags, pneumatic or water mattresses and pillows, blankets and covers)}, all other HS Codes for furniture under Chapter 94 are unbound category.

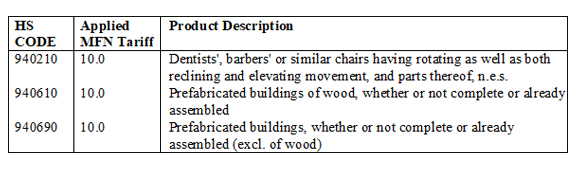

This means that out of 39 products in the six-digit HS category under chapter 94, 38 are categorized under unbound, and do not have a bound rate, and no commitment for India to follow a constraint. Thus, there is a scope to increase the import tariff and create a shield for our domestic furniture manufacturers and exporters. Currently, the applied import tariff that India levies on furniture products at HS Six digit is 20%, except for the following three, where it is 10%.

Thus, increase in the level of tariff on imports as a measure of restriction at the initial stage will help India to ascertain the degree of benefit that our domestic exporters can gain while operating in furniture cluster.

Final products in the furniture industry not used by any other sector as intermediate products, such as seats for motor vehicles, aircraft etc. and having an average high import (more than US$ 1 million) over the last 5 years, need to be identified at 8-digit tariff lines and classified as Special, High-end, Common-use, Medical-use and miscellaneous products. Final products in furniture industry not used by any other industry as an intermediate product could be excluded because change in tariff duty of such products may disturb the competitiveness of other domestic sectors like automobiles, construction, and tiles etc.

The category special and high end/non-essential imported final products can be considered for increase in duty in order to either increase the import revenue or restrict the import of high-end final products.

Similarly, common-use components could be considered for increase in tariff based on per unit cost of the product imported such as additional cess levied on import of high-end automobiles, such that the tariff does not become regressive.

Initially, there could be an increase on the import tariffs of those raw materials and intermediate products whose only usage is in furniture sector and does not have any intersection in usage with other sector. For example, if rubber or metal product is used in automobile sector and furniture sector with significant value, then those products need to be out of the purview of import tariff escalation. Thus, only furniture industry based raw materials and intermediate products are recommended to be considered for import tariff escalation to bound tariff rates.

Illustration:

Possibility of Imposing Non-Tariff barriers

Restricting imports and bringing them under a licensing regime without a valid reason may be a difficult, if not impossible proposition. However, quality is one major aspect that necessitates imposition of NTMs. There are many NTMs applied by major furniture importing economies of various types, which may not be applicable on domestic manufactures/stakeholders. Following are a few examples of NTMs applied by major furniture importing economies which India may consider.

• Hygiene Certificate Requirement:

Imported used and wasted items must be subject to hygienic inspection or hygienic treatment. Upon the acquisition of hygiene certificate, entry into the border shall be permitted.

• Non-automatic import-licensing procedures other than authorizations covered under SPS and TBT chapters

Units importing used and wasted items shall register at hygiene quarantine inspection agencies, and provide documents such as copies of Hygiene Quarantine Registration Certificate.

• Traceability Requirement

Consumer Product Safety Commission requires every manufacturer (including an importer), distributor, and retailer of a consumer product distributed in commerce to provide information on the origin 0f the product.

• Internationally various tests are used to scrutinise imports-

o Furniture chemical testing:

– Nickel release

– VOC (Volatile organic Compounds) emission

– Formaldehyde emission

– Phthalates

o Furniture Flammability Testing: It is a common fire rating/certificate test applicable in various countries such as US, Japan etc.

• Non-automatic import-licensing other than authorizations under SPS & TBT

A person intending to import waste (excluding navigational waste and carried-in waste) shall procure the Minister of Environment’s permission.

Leave a comment