Decoding the crypto market

Cryptocurrency is a decentralized virtual currency that is based on blockchain technology. There are various advantages of using cryptocurrencies and with time, the efficiency of crypto market is likely to get better.

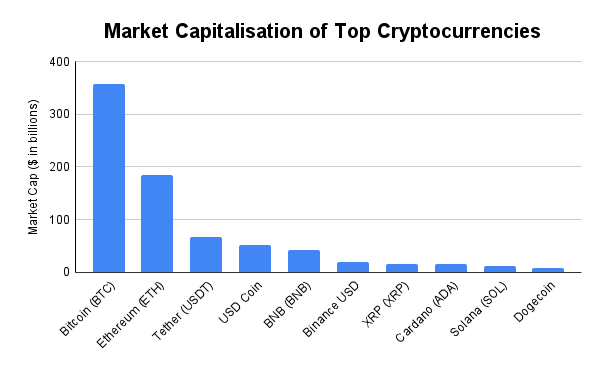

- The first cryptocurrency, Bitcoin, was released in 2008 by Satoshi Nakamoto. Although the market capitalization of this particular cryptocurrency is currently at 365.88 billion, it is still a dynamic digital asset whose value is always changing at a rapid pace.

- As of March 2022, over 9000 cryptocurrencies are available in the market and users can easily invest in them.

- However, a lot of traditional investors are still dubious about investing in them since, unlike fiat currencies, these digital assets do not have any intrinsic value.

- Due to the huge popularity of cryptocurrencies banks and government organizations are slowly recognising the influence of cryptocurrencies among the general public and implementing rules to regulate the usage of digital currencies and other digital assets.

Image credit: Shutterstock

Cryptocurrency is a special kind of currency that does not have any physical form but it can be used and stored digitally using digital crypto wallets. Just like any other fiat currency, cryptocurrency can be used to sell or purchase things. These digital currencies can be either purchased through online platforms or they can be mined using specific systems.

The most unique feature of cryptocurrency is the lack of a centralized authority to regulate it. Furthermore, cryptocurrencies are safeguarded by blockchain technology. Blockchain technology is a complex online network that is spread across multiple computers (called nodes). This technology has the ability to increase the trustworthiness, traceability, transparency and security of the shared data which makes cryptocurrencies secure.

How are cryptocurrencies manufactured?

One of the most popular ways of creating or generating cryptocurrencies is known as mining. Bitcoin, the world’s most valuable cryptocurrency, follows this process of currency creation. It is an extremely energy-intensive process in which computers try to solve complex mathematical problems and corroborate the originality of the transaction on a particular network. The method is commonly known as Proof of Work (PoW).

The owner of these systems (computers) earns newly mined cryptocurrency as a reward. There are also other ways of creating and distributing cryptocurrencies such as DeFi yield farming, airdrops, games, etc. Most people purchase cryptocurrencies using an exchange platform or from another cryptocurrency user.

Source: https://coinmarketcap.com/

Different types of cryptocurrencies

As per the reports of HDFC, there are more than 8,500 cryptocurrencies available in the crypto market and the number is still increasing. The current market capitalization of cryptocurrency is more than US$ 2 trillion which is equivalent to 18% of global gold holdings. By the year 2025, the cryptocurrency market is expected to grow up to US$ 2.73 billion.

Normally, cryptocurrencies have two distinct categories:

- Tokens: It is a programmable asset of a specific platform. This tradable asset or utility resides on its own blockchain and allows the holder to use it for investment or economic purposes like a legal tender. Reward tokens, currency tokens, utility tokens, security tokens, and asset tokens are the different categories of token. Tokens are usually dispersed as ICO or initial public offering (similar to the IPO in stock exchanges). They can be used as

- Utility tokens (used for specific purposes)

- Value tokens (such as bitcoin)

- Security tokens (very similar to stocks)

- Coins: These are a type of virtual, intangible, or digital computer code that can represent a project, asset, or concept. It has multiple uses and the value of the crypto coins may differ. The original function of these coins is to work as a currency. Crypto coins can also offer solutions to long-standing problems in multiple industries. Crypto coins are created on blockchain and these coins are mostly allocated using the mining process. A significant amount of funds as well as skills are required to create crypto coins. Then there are altcoins. Some of the extremely popular altcoins are Litecoin, Namecoin, Peercoin, etc. Altcoins use the same principle as bitcoin and some of them even copied its characteristics while others have moderately different features.

Cryptocurrency: Pros & Cons

Crypto users and investors have varied opinions on this virtual currency. In this section we discuss the advantages and disadvantages of this transformational technology:

Advantages of cryptocurrency

Cost-effective: With the help of cryptocurrencies, people can conduct both national and international transactions without paying a hefty sum as transaction fees. Furthermore, they also don’t have to pay any third parties (such as Mastercard, VISA, etc.) for verifying and processing their transactions. Users can easily conduct national and international transactions at nominal rates. They also won’t have to pay third parties such as Mastercard, VISA, etc. to verify the transaction.

Self-manageable: For the development of any currency, its maintenance and administration is an important factor. The transactions made using cryptocurrency are stored by the miners in their system or hardware for which they are compensated with a transaction fee. The miners keep the ledger updated with accurate records and maintain the integrity of the virtual coins.

Decentralized: Another major advantage of crypto market is its decentralization. With the help of the decentralization process, these virtual currencies are not free from external influence and not a single individual entity or organization can decide the value or worth of these coins. As a result, cryptocurrency remains secure and stable, unlike fiat currencies which are controlled by governments.

Not affected by inflation: Due to inflation, the value of fiat currencies declines over time. On the other hand, cryptocurrencies are extremely limited in nature. For example, there can only be 21 million bitcoins in total. Therefore, with the increase in demand, the value of these virtual currencies will also increase.

Private and secured: The security and privacy features of cryptocurrencies are top-notch as cryptocurrencies rely on blockchain technology and it maintains a blockchain ledger that is dependent upon complex mathematics. That is why cryptocurrency transactions are safer than any ordinary transactions.

Easy and convenient transaction process: Transferring funds has become extremely easy with the help of cryptocurrencies. Be it a domestic or international transaction, the entire process can easily be completed within seconds in the crypto market. Unlike fiat currency transfers, the verification process of cryptocurrencies takes a very nominal amount of time.

Disadvantages of cryptocurrency

Illegitimate transactions: Since cryptocurrency transactions are extremely secure, governments cannot track the individual transactions completed through user wallets. Bitcoin along with other cryptocurrencies has already been used for illegal transactions. In 2021, illegal wallet addresses received more than US$ 14 billion through cryptocurrencies. A lot of people also use cryptocurrencies to convert illegal money and cover their tracks with the help of a clean intermediary.

Data loss risk: If any user loses their private wallet key then they won’t be able to get their money back. This is because the developer has strengthened the security of cryptocurrencies using impassable authentication protocols. According to research, over 3.7 million Bitcoins have been lost forever.

Controlled by limited people: Although a lot of cryptocurrencies offer decentralization, the crypto market is controlled by developers or a handful of organizations. These organizations have the authority to manipulate these cryptocurrencies. For example, due to external manipulation, the price of bitcoin doubled multiple times in the year 2017.

No chance of cancellation or refund: If a cryptocurrency user accidentally sends money to another or unknown wallet then they will not be able to retrieve their money. There is no refund option available in cryptocurrency and that is why some fraudulent individuals can cheat others (by selling products or services that the customers will never receive).

Excessive energy consumption: Mining any cryptocurrency requires a lot of computing power which in turn makes it an energy-intensive process. For example, Bitcoin requires a huge amount of computing power as well as an enormous amount of energy to support the process.

Indian crypto market

In India, the regulation of cryptocurrency was declared in the Union Budget 2022 where the country’s current Finance Minister, Nirmala Sitharaman announced that a 30% tax will be applied on income from virtual assets such as cryptocurrency, NFT, etc. More importantly, people will have to pay 1% TDS for digital currency transactions in India. Gifts in the form of cryptocurrency and digital assets are also taxable while no deduction is allowed. These steps have been taken by the government to make investors aware of the risk involved in dealing with cryptocurrency.

Further, Indian government is working on ‘Cryptocurrency and Regulation of Official Digital Currency Bill’, while the RBI is slated to introduce a digital currency in 2023. The bill is expected to allow for innovation, while ensuring that it is able to build consumer and investor confidence in cryptocurrencies, and more importantly, the underlying technology of blockchain.

Leave a comment