Can India’s apparel sector restore the balance?

• A recent research report by Clothing Manufacturers Association of India (CMAI) suggests that there has been an increase in garment imports by 47% and a 5% decrease in exports during April 2018-February 2019.

• Countries like Bangladesh are taking advantage of the free trade agreement with India to push their cheaper products into the country.

• However, even in the larger scheme of things, India’s textile and apparel industry is struggling with numerous structural disadvantages that prevent it from being competitive in global trade.

• Urgent interventions are necessary to both address structural gaps for the industry and provide it with improved market access opportunities.

Indian textile exporters are quite bullish on the prospect of rising exports in the backdrop of the US-China trade war. For instance, the Synthetic & Rayon Export Promotion Council has projected a potential gain of 25% in 2019-20 for textile exports to the US. Chapters 50-60 are part of the list of Chinese export products on which the US has hiked tariffs to 25%. India’s exports of these products to the US currently stands at around US$ 1.71 billion, according to CITI.

But past precedents cast severe doubts on India’s ability to capitalise on emerging opportunities in the global textile & apparel market. Apparel exporters have faced a string of reversals in trade over the past few years in particular. The industry has failed to exploit the advantage offered by the exit of China from the low price segment, and struggled to cope with the rising competition from the likes of Bangladesh and Vietnam. It has suffered another major setback with the reduced import from UAE, which has been a key market but is now building a number of manufacturing units in its free market zones.

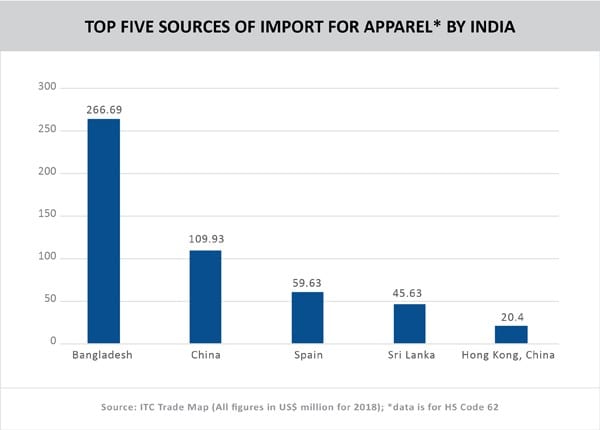

Moreover, a recent report by the Clothing Manufacturers Association of India reveals that apparel imports rose by almost 47% YoY to reach US$ 1 billion in 2018-19 (April-February), while exports declined by 5%. The report also indicates an increase in imports from countries like Bangladesh (96%), Sri Lanka (120%) and Hong Kong (171%). On one hand, direct Chinese apparel exports are decreasing, but it is also making huge investments in countries like Bangladesh and Vietnam due to availability of low cost manpower.

Strong production, struggling exports

It is very startling that although India features as the top producer in the world of crops like cotton and raw jute, it is dependent on other economies for meeting the requirements of garments. Moreover, this growing influx of cheap imports threatens India’s homegrown garment manufacturers.

Ms. Chandrima Chatterjee, Advisor at Apparel Export Promotion Council, explicates the reasons, which are driving Indian retailers to choose foreign brands over their Indian counterparts in her interview with TPCI, “Of late, there has been an increase in India’s garment imports, especially from markets like Bangladesh. India has a Free Trade Agreement with Bangladesh, which allows it to enjoy zero duty on imported garments. With a 20% lower cost of production, such imported products have a distinct price advantage, prompting retailers in India to choose cheaper imported garments over those manufactured within the country. The cost advantage is on account of lower wage cost, cost of other inputs and better access to imported fabric from China.”

However, there are other factors contributing to the relatively low competitiveness of the Indian apparel industry. Compared to its competitors, India is handicapped in terms of the time & costs involved in getting goods transported from the factory to the market. Regulations on minimum overtime pay, de facto taxes for low-paid workers & the lack of flexibility in part-time work also bring down India’s competitive edge of cheap labour. The high tariffs imposed on locally created yarn & fiber also increase the cost of production for the indigenous manufacturers.

CARE Ratings Ltd. has pointed towards the mismatch between the global demand for man-made fiber (MMF) and the domestic production predominantly of cotton. Consequently, tariff policies favour cotton production vis-à-vis MMF.

Discrimination in export markets has also impeded India’s apparel exports according to the findings of Economic Survey, 2016-17. Owing to their status of being a Less Developed Country (LDC), clothing exports from competitors like Bangladesh enter EU & USA (two of our major export markets) by paying zero per cent or relatively lower taxes. The conclusion of the Free Trade Agreement with EU, for instance, could give Vietnam a further leg up as compared to India.

India needs to cut down its dependence on cheaper imported raw materials & fabrics as well as increase its share of garment exports. Efforts need to be made diversify production and sync it with the global demand, rationalizing taxes, which promote the production of MMF and looking for newer markets where our products can be exported.

Conclusion of FTAs with key import markets is also a critical agenda for the Indian government. The Economic Survey 2016-17 projected that successful conclusion of FTAs with EU and UK would lead to increase in apparel exports by US$ 1.48 billion and US$ 603.3 million respectively.

The industry also continues to be dominated by the small-scale sector. Around 78% of apparel and leather firms in India employ less than 50 workers and only 10% employ more than 500. It is important for the players to scale up and incorporate technology inputs into their operations, while also integrating operations from farm-to-fabric to build competitiveness.

Leave a comment