Brazil’s private sector is actively looking at Indian companies for partnerships

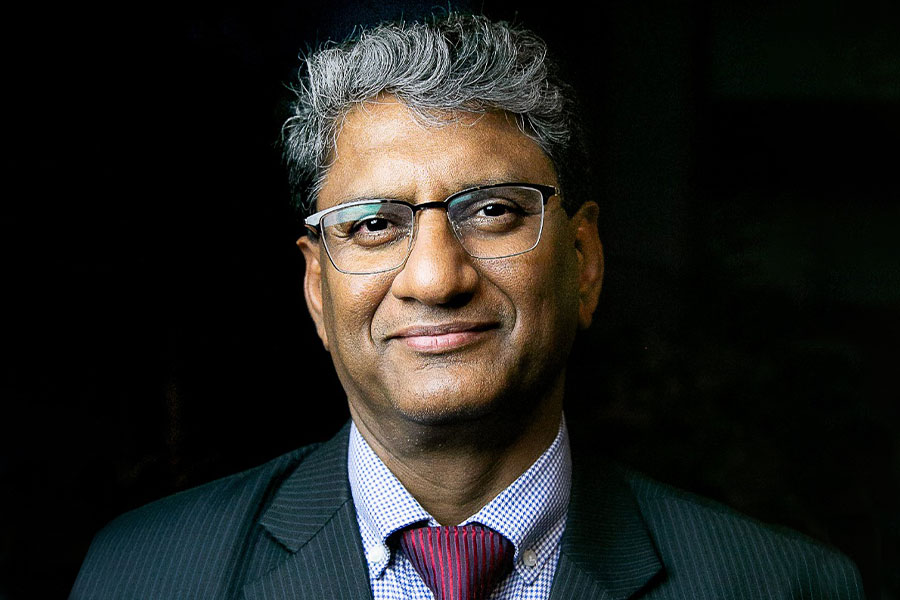

HE Suresh Reddy, Ambassador of India to Brazil, feels that as two large, intensely dynamic, and private sector-led economies, the economic engagement between India and Brazil is well below potential. But with technology reducing the barriers of both language and distance as well as growing recognition of mutual complementarities and synergies, he is positive that this should change for the better.

When you look at the potential of India-Brazil relations, it is very evident at the outset from the market size itself. India has got a population of around 1.35 billion people and Brazil has a population of 200 million plus. This combined market size of 1.55 billion people itself indicates the size and potential which exists. Along with that, we’re also talking of the size of the economy. India’s economy is now close to US$ 3 trillion and Brazil is also approaching US$ 2 trillion. So we’re talking of a combined economic size of US$ 5 trillion.

The question, therefore, obviously arises why our trade is still currently at around US$ 7 billion. In my understanding, Indians have been more concerned about the constraints of distance and language. We were therefore probably more comfortable with our neighborhood, and with English speaking countries, which are our traditional trading partners.

Similarly, Brazil was also more preoccupied with Europe, the US and neighboring countries. The country has some of the world’s biggest companies and a very successful, large scale private sector. The only challenge was that India was seen as that ‘wonderful destination, which was kind of at a distance’. But today, slowly the India growth story is building to resonate here. People are beginning to recognize opportunities provided.

Technology has played a crucial role, as we are now able to do this bilateral connect in a much more meaningful, strong, and beneficial manner. Imagine if we organize a trade delegation to visit here, that would be quite a challenging exercise. You’ll be flying for two days to come here, staying for 3-4 days to do business and again flying back. So a businessman has to devote at least around seven days just to come to this region to do business.

With digital technologies like Zoom and other platforms, we don’t need to spend that much time. In one hour, we can establish a contact, have a discussion, and arrive at a mutual understanding on how we would like to proceed on our trade partnerships. Similarly, thanks to technologies like Google Translate, you’re actually able to communicate and respond.

An underleveraged association

After I came here, I was particularly impressed with the strong and dynamic private sector of Brazil, which reminded me of the private sector in India. In fact, the private sectors in both countries are playing a catalytic role in driving their growth stories. When you look at the post-pandemic recovery, growth numbers of Brazil are being revised to 5.2% by the OECD in September 2021, compared to 3.7% in May. This makes Brazil one of the fastest recovering economies among the G-20 countries.

This, again, shows the depth and strength of this economy and amplifies the rationale for India to have a stronger partnership. São Paulo’s economy, alone, is estimated at around US$ 600 billion plus, which makes it larger than other countries in the region. When you look at essential trade numbers, you will find that Brazil has become a much larger market for India as compared to many of the traditional markets.

That is something, which Indian companies need to understand. Businessmen who took an active interest in the region have found strong success, buoyed by the relatively large untapped potential. Also, when you talk about Brazil, you’re essentially reaching out to a larger Latin American and Caribbean economy estimated at around US$ 5.8 trillion (2019 estimate, current US$ according to World Bank; which dropped to US$ 4.84 trillion in 2020). This is the kind of leverage that few trade partners can provide.

In that direction, India is naturally interested in expanding the existing limited PTA into a more broad-based agreement with Mercosur. We have been having discussions and hope to make progress. Currently, there are some internal discussions happening within Mercosur countries themselves. But at the same time, all the countries are committed to strengthening the bilateral arrangement with India and also the arrangement under Mercosur. It’s really a question of time before the framework is put in place, but it will be happening sooner if not later.

Business engagement opportunities

When you look at engagement between the two countries, it immediately brings the potential for joint ventures to the top of focus. Resilient companies are looking at the Indian market for joint ventures, because they recognize the size of the market. They also recognize that through India, they can reach out to the broader neighborhood, be it the Gulf nations on the West or the Southeast Asian countries towards the east.

Similarly, Indian companies can also keep Brazil as a base, from which they can tap all the neighboring countries. Brazil not only has the Mercosur agreement, but it also has a lot of trading arrangements with almost all other Latin American countries, and many more.

It is indeed interesting is that the private sector in Brazil is actively looking at Indian companies for partnerships. These partnerships are of two kinds – joint ventures for manufacturing and technology transfer. Conversely, I also find that Indian startups are beginning to look at Brazil more closely. They wish to establish all kinds of linkages – equity participation, technology partnerships, technology transfer etc. So there’s really a lot of diversified engagement happening, which promises a bright future of collaboration with the Brazilian economy, which is similar to India in terms of size as well as dynamism.

Key sectors of interest

Bilateral trade between India and Brazil was at US$ 7.2 billion in 2020-21. This included US$ 4.24 billion as Indian exports to Brazil and US$ 3 billion as imports by India from Brazil. Major Indian exports to Brazil include agrochemicals, organic chemicals, aluminium, synthetic yarns, auto components and parts, pharmaceuticals and petroleum products. Brazilian exports to India include crude oil, gold, vegetable oil, sugar and bulk mineral and ores.

We have also done an in-house exercise to identify some of the products that can be focused on to enhance trade between India and Brazil. One of the most prominent sectors is motor vehicles. Overall, India’s exports of two wheelers and motor vehicles are the highest to Latin America compared to all the other countries. Similarly, there is great scope for automotive components, because economies like Brazil, Argentina, Colombia, Chile, are large, so they have adequate manufacturing facilities in automotive vehicles.

And then, of course, we have the pharma sector. This pandemic has made every country reassess its approach to the public healthcare system, because when they keep depending upon traditional branded pharmaceutical suppliers, obviously they are not in a position to cater to the increasing demands of the public. It is not possible to keep increasing the budget allocation for national health care systems.

So that’s where the role of India becomes critical. Being the global pharmacy with established strengths in generics, its contribution to the national healthcare systems for these countries is quite huge. And we have the potential to increase it in a much more substantial manner. In fact, Brazil already has a good presence of many Indian pharmaceutical companies. But I believe it is not enough. Our companies need to be present much more, because this market deserves it.

Another sector that is very promising is packaging, be it for pharma or food processing industry. Brazil also has a very successful pharmaceutical industry. So, there’s a lot of scope of packaging related operations also. Then, of course, we also have plastics. It goes without saying that in an economy like Brazil, there is always a need for all kinds of plastic suppliers. Chemicals and ceramics are also very promising sectors. Brazil’s chemicals sector is among the top 10 globally, with sizeable imports of US$ 40.2 billion in 2020. With a booming construction industry, Brazil has a lot of demand for ceramics of all kinds.

And we have also been reaching out to encourage greater bilateral engagement. I’ve been traveling to all the key cities and meeting the local businessmen and business associations and addressing their queries. We need to remember that Brazil and India are somewhat similar as two large economies. But at the same time, we were probably not investor friendly initially. So it took some time for foreign companies to get used to the way of doing business in India as well as Brazil. To build on this positive trend, the role of trade and investment promotion organizations such as the TPCI and Invest India becomes critical in holding the hands of businesses on both sides.

The author is currently Ambassador of India to Brazil. Views expressed are personal.

Leave a comment