Black gold conundrum: India’s rising pepper imports

• Pepper is widely produced in India, especially in the states of Karnataka, Kerala and Tamil Nadu. India exports a significant quantity of pepper to the world.

• However, India also imports significant quantities of pepper, primarily due to the difference in the method of harvesting pepper, cost of pepper, demand-supply gap and the oleoresin content in pepper.

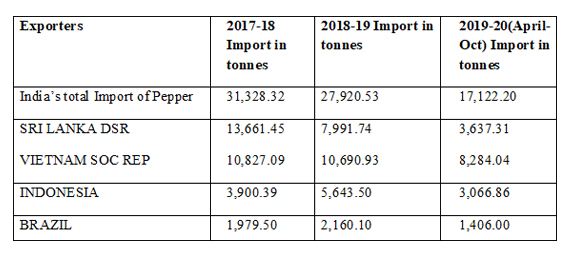

• The import of pepper decreased over the years due to initiatives taken to protect the interest of farmers from 2017-18 to 2018-19. However it increased again during April-October, 2019-20.

• Key focus areas towards greater self-reliance should be on increasing oleoresin or piperine content and also improving pepper yield.

India produces a wide range of spices and holds a prominent position in global spice production, owing to diverse climates – from tropical to sub-tropical to temperate. Hence almost all spices grow quite well in India. All the states and union territories of India grow at least one or the other spices.

India is the topmost exporter of spices, followed by Vietnam and China, while US is one of the largest importers of spices in the world. The top spice export of India to the US is crushed or grounded pepper.

Import trends of pepper

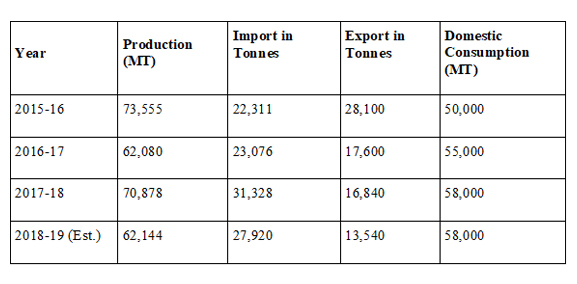

Pepper is widely produced in India, especially in the states of Karnataka, Kerala and Tamil Nadu. India exports a significant quantity of pepper to the world as evident from the table below. However, India also needs to import pepper. A brief overview of pepper trade and consumption data from the table below shows that from 2015-16 to 2017-18, pepper import has been on rise till 2017-18; however the import of pepper has declined from 2017-18 to 2018-19 as per Ministry of Commerce data, which may be attributed to several interventions of the government.

Table 1: Production, trade and consumption data for pepper in India

Source: Production: Directorate of Areca nut and Spices Development, Calicut, Kerala. Consumption: International Pepper Community, IPC, Jakarta, Spices Board: Export in tonnes, Moc: Import of Pepper in tonnes

Table 2: Statistics of pepper import

Source: Department of Commerce

The decline post 2017-18 may be attributed to the efforts taken by Ministry of Commerce namely-

1. The Union Government Vide Directorate General of Foreign Trade (DGFT) Notification dated 6/12/2017 fixed Rs. 500/- per kg as the Minimum Import Price for black pepper.

2. Subsequently, an amendment was brought in the Minimum Import Price (MIP) notification by making import of pepper at or above Rs.500/- per kilogram free and import below Rs.500/- per kg prohibited vide DGFT Notification dated 21/3/2018.

3. The Union Government Vide Directorate General of Foreign Trade (DGFT) Notification Notification No. 21/2015-2020, gave an exemption to the prohibition of import of pepper below CIF value Rs. 500/ per kg under Advance Authorisation Scheme, imports by 100% Export Oriented Units (EOUs) and units in the SEZ. The step was taken primarily to cater to needs of oleo-resin industry. India dominates the global market for spice oleoresin, which is in big demand from processed food and fragrance industries that now mostly prefer natural colouring and flavouring agents to artificial ones as consumers become increasingly health conscious.

Why does India import Pepper?

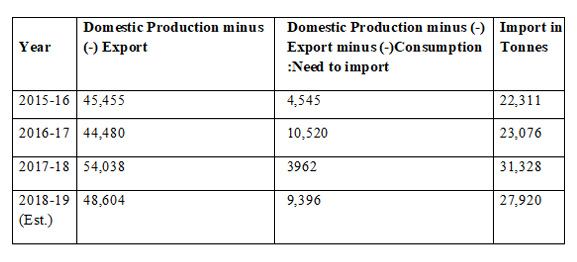

The difference in the production and export (which shows total produce left for domestic consumption in India), when compared with the domestic consumption data calculated by International Pepper Community show that the domestic produce left after export falls short than the total consumption demand for pepper in India, as shown in the table 3 below. However the actual import far exceeds the estimated need for import based on the calculation of domestic production, export and estimated consumption, primarily because the consumption data calculated by International Pepper Community does not take into account the demand by oleoresin extraction industry.

Hence the consumption data of pepper in India, as calculated by International Pepper Community shown in Table 1, is not the correct estimation of the demand-supply mismatch of pepper in India. Hence one can say that domestic production post export is not sufficient enough to meet the demand of domestic industry.

The other reasons for such high imports are the difference in the method of harvesting pepper, cost of pepper and the oleoresin content in pepper. In India, mature berries of pepper are harvested, which are not suitable for oleoresin industry. Hence, the industry is dependent on imports from Sri Lanka and Vietnam, where the immature berries are harvested, which yield higher oleoresin when processed compared to mature berries. Additionally Indian as well as Sri Lankan pepper have very high (>6%) oleoresin content, hence the industry has a very high preference for Sri Lankan pepper. The Vietnamese pepper has a piperine/oleoresin content of 2-6%, but despite the disadvantage in terms of oleoresin content, the method of harvesting i.e. immature berries along with cheaper costs help Vietnamese exporters compensate for this disadvantage.

Table3: The actual and estimated import (tonnes)

Source: Production: Directorate of Areca nut and Spices Development, Calicut, Kerala. Consumption: International Pepper Community, IPC, Jakarta, Spices Board: Export in tonnes, MoC: Import of Pepper in tonnes

Price trends in pepper

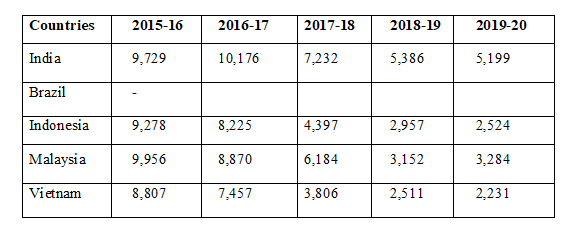

The comparison of international prices of pepper with domestic prices shows that the price of black pepper for India has always been higher vis-a-vis other competitors, primarily because of the premium that Indian spices command in the global market. Rising imports coupled with increased global production of pepper have resulted in a fall in the price of pepper. The price of black pepper has been showing declining trend since the year 2017-18 in India.

In fact, global prices of pepper across Vietnam, Indonesia, and Malaysia has been on decline since 2017-18, hence the data does not show that major contributor to the fall in domestic pepper prices is because of sui generis circumstances/issues in India since the decline is not restricted to India. In case of Malaysia the magnitude of fall in price is even higher than India.

Table 4: Price of black pepper in terms of US$/Tonnes across countries

Source: Spices Board

Current status of import of pepper:

The import of pepper decreased over the years due to the initiatives taken to protect the interest of farmers from 2017-18 to 2018-19. However , the import from 2018-19 to 2019-20 for the months of April-October as shown in table 6, has increased by 14.09%, which remains a cause of concern.

Table 5: Import of pepper-090411 in India in tonnes

Source: Department of Commerce

An overview of yield growth also reveals that Vietnam has been able to get higher yield than both the world average as well as the India average.

Trend of yield in Black Pepper Production: Major producers

Source: FAOSTAT

Conclusion:

There exists a need to import pepper, especially by the oleo-resin extraction industry primarily because of difference in the method of harvesting pepper, cost of pepper, total demand-supply gap and the oleoresin content in pepper. The comparison of international prices of pepper with domestic prices shows that the price of black pepper for India has always been higher vis-a-vis other competitors, primarily because of the premium that Indian spices command in the global market.

Hence the key focus should be on two important factors i.e. oleoresin or piperine content of pepper and pepper yield i.e. production per area under cultivation. The adoption of scientific cultivation practices, GAP, IPM, etc, focus on increasing area under cultivation with high piperine content of pepper and devising a mechanism to control price fluctuation in annual spices’ crop will go a long way in addressing the challenge faced by pepper producers and exporters.

Leave a comment