Avenues for Indian agri-exports in post-pandemic US

• During the pandemic, US agriculture sector has been hit hard as production capacity for most commodities has plummeted, thereby boosting prospects for Indian agri-exports.

• Overall, US agricultural exports in FY 2020 are projected at US$ 136.5 billion, which is US$ 5.5 billion lesser than FY 2019, primarily due to reductions in exports of bulk commodities including soybeans, cotton, corn, and wheat.

• US is expected to increase its imports for pork meat and broiler in coming third quarter of 2020. For pork meat, increase in imports will be from 1,600 million pounds to 1,875 million pounds, which is a 17% increase.

• Besides this, Indian agri exporters can also explore the void left by the US in its destination markets (due to reduced production capacity), especially EU nations, China, Canada and Mexico.

While announcing the economic package of Rs 20 lakh crore, the Finance Ministry has aggressively focused on strategies to propel India’s agriculture sector. Impetus for development of farm-gate & aggregation point, affordable and financially viable post-harvest management infrastructure and a focused capacity building programme will increase India’s acceptability of agricultural consignments. At the same time, India needs to be cognisant of the emerging opportunities in international agri trade. As India’s largest export market for agricultural products, the US definitely merits consideration in this regard.

During the pandemic, US’ agriculture sector has been hit hard as production capacity for most commodities has plummeted. This has severely impacted the ability to be competitive and cater to global markets. The US consumer is a driving factor in the economy, and the effects of negative income shocks and the resulting shifts in spending patterns will have ripple effects. Real per capita GDP growth for the US for FY 2020 is adjusted down from 1.1% to -7.1%. The adjusted forecast amounts to a reduction in economic activity of US$ 1.8 trillion during FY 2020. Now, with this kind of scenario, US’ production activities will fall too, which will compel it to import more. This will also leave a void in US export markets, thereby opening up opportunities for Indian agri-exporters.

Since early April, COVID-19 infections of animal processing plant labor forces have disrupted beef, pork, broiler, and turkey production in the United States. Estimated pork production in April was 2.3 billion pounds, which fell by more than 11% on YoY basis. COVID-19 contagion of poultry processing plant employees caused year-over-year reductions in broiler and turkey production in April, as well. On similar lines, dairy, grains, fruits, vegetables, soybean, maize, cotton and sugar production have plummeted in US, which is going to impact its exports.

Overall, US agricultural exports in FY 2020 are projected at US$ 136.5 billion, which is US$ 5.5 billion lesser than FY 2019, primarily due to reductions in exports of bulk commodities including soybeans, cotton, corn and wheat. Projections by USDA for soybean exports are reduced by US$ 1.9 billion from the previous year to US$ 16.5 billion for FY 2020. This means that Indian exporters can think about catering to US’ export markets for the mentioned products, including EU countries, China and the North American region.

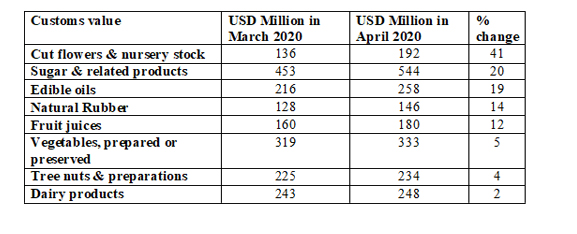

Also, we have monthly trade statistics for March and April 2020. Going by import figures of agri products by US, there are some products, which experienced positive growth in imports. These could be focused products, which Indian exporters can target.

Imports of agri products for the US

Source: USDA Statistics, figures in US$ million

Focussed products for promotion in US market.

Dairy

According to the forecast provided by USDA, production of milk in US is going to plummet in third quarter by almost 2 billion pounds. In Q2, 2020, production of milk is forecasted at 56.8 billion pounds, which will decrease to 54.9 billion pounds by the third quarter of 2020. Thus, their imports of milk and dairy products will escalate at least for coming four to six months.

The issue of traceability mandated by USFDA (United States Food and Drug Administration), seems more implementable now as livestock will be tagged after compulsory vaccination for Foot and Mouth Disease (FMD) and Brucellosis. Previously, this used to be the major challenge for Indian dairy exporters to USA, but now it will act as a catalyst in proliferating our dairy exports.

For Milk-fat (billion pounds milk equiv) forecasted imports of US in third quarter of 2020 are expected to increase by 12%, i.e. from 1.5 billion pounds of milk fat in Q2, 2020 to 1.7 billion pounds of milk fat in Q3, 2020.

Pork meat: US is expected to increase its imports for pork meat and broiler in coming third quarter of 2020. For pork meat, increase in imports will be from 1,600 million pounds to 1,875 million pounds, a 17% increase.

Sugar and sugar confectionery: In the month of April 2020, US imports of sugar and sugar confectionery increased in volume terms by 37% compared with March 2020. From 425 thousand metric tonnes of sugar and confectionery imports in March, the figure went up to 583 thousand metric tonnes. Furthermore, India has permitted exports of 9,169 tonnes of raw sugar to the US under TRQ during FY 2020. It enjoys duty-free sugar exports to the US for up to 10,000 tonnes annually under preferential quota arrangement.

Preserved Fruits and Processed Grains: For preserved fruits and processed grains, US imports in terms of volume surged by 6% and 5% respectively for April, compared to March.

To summarise, the list of potential products, which have an opportunity in US are as follows:

i. Sugar & related products

ii. Edible oils

iii. Natural rubber

iv. Fruit juices

v. Vegetables, prepared or preserved

vi. Tree nuts & preparations

vii. Dairy products

viii. Pork meat

ix. Preserved fruits

x. Processed grains

xi. Floriculture (cut flowers & nursery stock)

xii. Peanut Butter

Leave a comment