Auto Industry: Identifying the path of least resistance

As the auto industry struggles to recover from the effects of the pandemic, it needs to also define its future direction in context of the shift towards emission friendly fuels and technologies. Stakeholder consultations need to focus on how this transition can be as smooth as possible for the Indian industry.

- The auto industry in India, with an investment of about Rs 8.3 lakh crore, is one of the largest contributors to the economy as well as employment.

- However, the industry was one of the worst hit by the slowdown in the economy. It was already going through a tough phase even before the COVID pandemic, growing at a negative CAGR of 1.9% during 2016-21.

- As the sector scripts its post-pandemic recovery, it faces multiple challenges like fuel prices, high taxation, shortage of semiconductors and the shifting priorities towards EVs.

- Government-industry consultations have to focus on smoothly managing this transition.

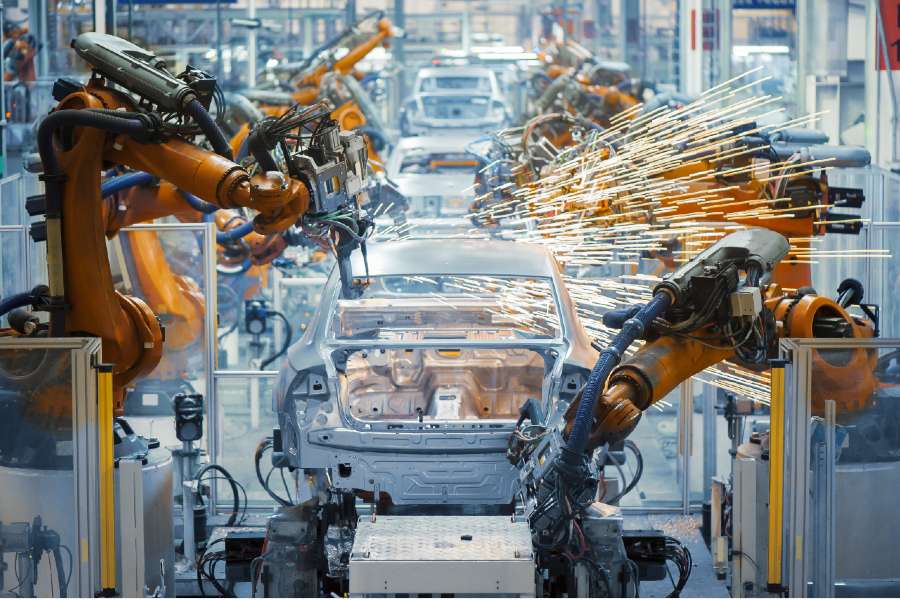

The auto industry in India, with an investment of about Rs 8.3 lakh crore, is one of the largest contributors to the economy as well as employment. Over 3 crore people are directly or indirectly associated with the sector. The industry currently contributes 7% to India’s GDP and 49% to its manufacturing GDP. It manufactured 22.6 mn vehicles including Passenger Vehicles, Commercial Vehicles, Three Wheelers, Two Wheelers, and quadricycles as of April-March 2021, while exporting 4.1 million units. Notably, India has a distinctive positioning in the heavy vehicles arena, as it is the largest tractor manufacturer, second-largest bus manufacturer, and third largest heavy trucks manufacturer in the world.

The Indian automobile market is the world’s fourth in terms of vehicle sales. Many reputed multinational automobile companies have understood the potential of the Indian auto market and invested heavily in the automobile industry, making it one of the key drivers of economic growth and enabling India to emerge as one of the top investment destinations.

The automobile industry was one of the worst hit by the slowdown in the economy, as it was already going through a tough phase even before the COVID pandemic. According to Society of Indian Automobile Manufacturers (SIAM), the current Indian automobile industry CAGR is in negative. The CAGR recorded in 2011-16 was 5.7%, which dropped to -1.9% during 2016-21. More so, sales of vehicles dropped by 32% since 2020.

A large number of skilled and semi-skilled workers have lost their jobs in automobile industry and its allied sectors, as many factories have closed down. This has a spin-off effect on related sectors such as ‘iron mining’, steel, medium and small manufactures of vehicle accessories & parts, service stations, dealerships, etc.

Apart from the COVID pandemic, there are host of other factors, which indeed are big setbacks to the already struggling auto sector. The industry is asking for relief measures, including on various taxes and cess levied by the government to bring down on-road prices of vehicles.

Challenges

Rising fuel prices not only hurt consumers, but also haunt governments. Personal vehicle users have to spend more on buying fuel that destabilizes their household budget. In turn, they have to reduce their spending on other products. Consumers voluntarily or involuntarily move towards the public transport system, and increase in ridership can cause the transport system to collapse. However, rising fuel price provides an opportunity for the automobile sector to work on more fuel-efficient vehicles or better alternatives. Hybrid and electric vehicles are the results of continuous R&D to reduce the dependence on fuel.

Fuel price in India depends on crude base price, freight charges, excise duty, dealer commission, VAT on dealers’ commission, etc. Currently, fuel price in India is the highest in the world when measured in terms of purchasing power parity. There has been a 74% increase in excise duty.

India is one of the largest manufacturers of tractors and the second largest two-wheelers and fifth largest car manufacturers in the world. GST Rate on automobiles in India is at 18% to 28% plus Cess ranging from 1% to 15% on two-wheelers and luxury level cars. Further, there is an additional 22% cess if vehicle exceeds certain body & engine size specifications. Besides the pandemic, disparity of GST has flattened the two struggling segments of the automobile industry – two-wheelers (80% market share) and passenger vehicles (14% market share).

To improve safety and reduce carbon emissions, regulators implemented numerous norms of safety and environmental regulations. While upgrading safety features and emission norms from BS-IV to BS-VI are important for safety of consumers and the environment, it has led to a steep hike in the cost of vehicles as automakers are forced to invest heavily in their production line. The industry has spent a lot of money in upgrading cars to BS-VI norms from BS-IV. Third Party Insurance cover is now mandatory. The clause of upfront payment for 3 and 5 years in the Insurance policy (for cars and bikes respectively) is not going down well among consumers, as they are always reluctant to pay overhead expenses.

The crisis of Non-Banking Financial Companies (NBFCs) is another concern for the auto sector. The demand for cars and two wheelers has fallen drastically by nearly 20%. Overall sales of automobiles for 2020-21 are forecasted to be lower than the units sold in 2015. Besides, the six-month moratorium on repayment announced by RBI is constraining liquidity in the market.

In the current festive season, auto sales have posted the most disappointing performance in a decade, declining by 18% YoY. While the demand was healthy, automakers have been unable to meet it due to the shortage of chips and supply disruption in semiconductors.

The government has announced the PLI Scheme with incentives worth Rs 26,058 crore for auto sector, auto components and drones. This is require investments of at least Rs 1,000 crore by existing players and Rs 2,000 crore by new players in these sectors over the next five years. Support of the government will not only boost the industry, but also give a new life to the medium and small enterprises, associated with the auto industry to contribute greatly to Aatmanirbhar Bharat.

A critical factor that impinges on the sector’s progress going forward is the changing policy orientation towards environment friendly vehicles in line with green commitments of nations.

Recently, the government has advanced its target of 20% ethanol blending (E20) in petrol by 2023 from 8% blending to increase India’s green energy credentials. This 20% ethanol blended petrol emits less carbon because it has a lower energy density. The E20 petrol will also reduce crude oil imports, saving significant amounts of forex, etc. in the long term. In order to upgrade engines to E20 fuel compatibility, automakers will have to infuse huge amounts of money to make several modifications in the current vehicles engine technology. Current vehicles’ engine are E10 compatible. The E20 fuel is highly corrosive in nature and can be damaging for metal parts of the engine. Another concern is that the E20 fuel could reduce the mileage by as much as 4-5%.

The other major unmissable focus is electric vehicles. Earlier this year, NITI Aayog CEO Amitabh Kant said at an industry conference that the shift towards electric mobility is inevitable. Based on industry feedback for the FAME 2 scheme, the Department of Heavy Industry revised the demand incentive for electric two-wheelers to Rs 15,000 per KWh as opposed to Rs 10,000 per KWh earlier, and capped incentives at 40% of the cost of vehicles as against 20% earlier. He also expressed optimism that the cost of EV batteries would drop significantly over the next 2 years, thereby improving affordability of EVs. But leading industry players like Maruti are not as enthused at the moment, as factors like price, charging stations, battery disposal and resale value play on the minds of both industry and consumers, making hybrid vehicles a more viable option. Import dependence of raw materials like lithium, cobalt and nickel keep this nascent industry vulnerable, and need to be

As India prepares for this pivotal transition, a possible alternative in the interim for the government is to have a broader focus on emission targets rather than pursuing a specific fuel/technology, in consultation with the industry. As the industry strives to recover from the impact of the pandemic, it would certainly benefit from a smoother transition ahead.

Nice information on auto sector

Very informatic

Excellent, very informative article on auto sector in India

Informative article but solution be lies with full EV n solar use, at least 90 percent usage

Automobiles n civilization are intertwined through some umbilical chord. One can not prosper at the cost of the other. The SWOT analysis done by Sh Sinandi is brief but apt and precise. Hope this reaches the decision making level.