Auto components: Rumble under the hood

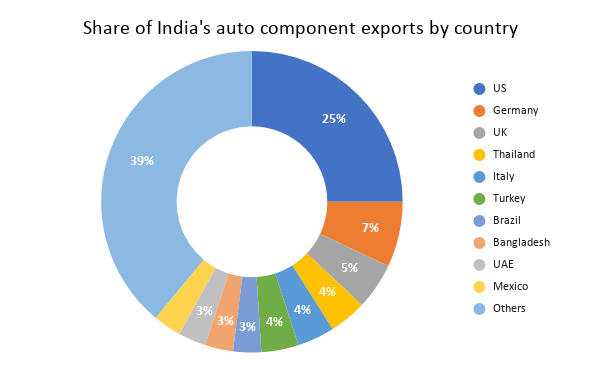

COVID-19 has further compounded problems for the Indian auto component industry, which was already coping with a slowdown in the automotive sector across domestic and export markets. The industry needs to carefully strategise its business growth plans for the immediate and long term, considering the effects of the pandemic, transition to BSVI and the pace of the eventual transition to EVs. Moreover, the pandemic and the recent issues with China have highlighted its dependence on critical imports.

Recently, Commerce & Industry Minister Piyush Goyal met senior auto industry representatives to discuss possibilities of greater localisation across the Indian automotive sector. During the meeting, they discussed opportunities for increased localisation, particularly for steel, tyres, electronic components and parts of electric vehicles.

To their credit, most of the key domestic and foreign original equipment manufacturers (OEMs) across vehicle segments, have been able to manage growing localisation levels. This implies that the industry is capable of producing a diverse portfolio. Top selling models across vehicle segments—hatchbacks, SUVs, premium sedans, commercial vehicles—have achieved localisation levels of 85% or higher, according to a McKinsey report – The auto component industry in India: Preparing for the future. Market leaders in two-wheelers have achieved upto 100% localisation. In tractors, they are almost near that benchmark.

However, while the Indian auto component sector is well recognised now as a vibrant and dynamic export oriented industry, it is still constrained due to import dependence for a number of critical components. On the back of slowing automotive sales due to the COVID-19 pandemic, the auto component sector is expected to undergo heightened consolidation going forward; given the experience of the 2008 recession. Players will have to carefully strategise their immediate and long-term survival strategies, while also considering the transition to BS6 norms and the impending shift towards electric vehicles. We take a deeper look at the dynamics playing out under the hood…

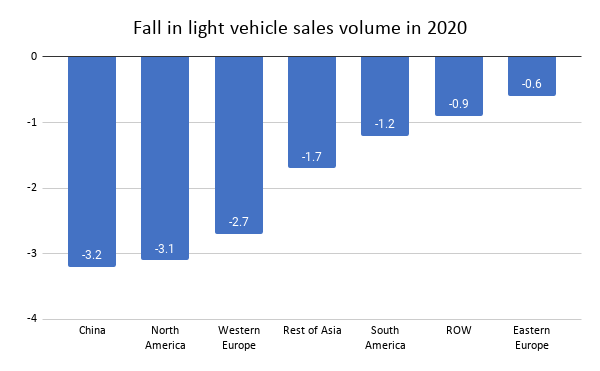

Fall in vehicle sales post-COVID

Source: LMC; figures in million units

The global automotive industry is expected to suffer substantially in the immediate term due to the COVID-19 pandemic. Automotive forecasting company LMC projects light vehicle sales to fall by almost 14 million units, or 15% YoY. The drop is expected to be led by China (-3.2 million), North America (-3.1 million) and Western Europe (-2.7 million).

SIAM expects that the Indian automotive industry will take 3-4 years to reach the peak sales achieved in 2018, thanks to the COVID-19 pandemic. Sales of passenger vehicles dropped by 78.43% YoY in the April-June, 2020-21 period, even as players like Maruti Suzuki saw a surge in used car sales. With encouraging signs of some momentum, the industry is looking towards the festive season for a possible revival. On the back of the COVID-19 induced lockdowns, this presents an extremely worrying scenario for auto component players.

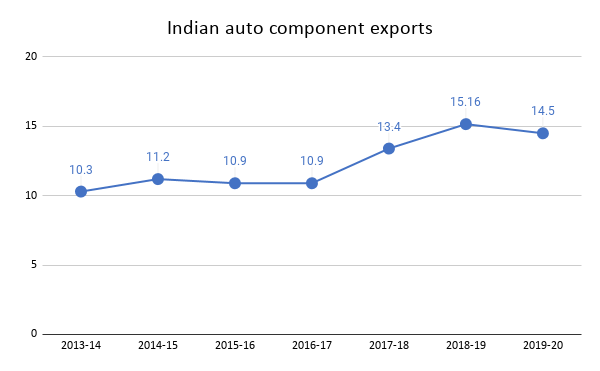

Exports impacted by weak market sentiment

Source: ACMA; figures in US$ billion

Source: ACMA; based on data for 2018-19

The proliferation of global original equipment manufacturers has led to a significant increase in localisation of components in the country. Auto component exports are expected to increase to US$ 80 billion by 2026. The industry’s maturity and global competitiveness is exemplified by the high share of developed markets like US, Germany and UK in its export basket. Key factors behind this success include ability to customise as per requirements of different OEMs, scale economies, strong consumer sentiment, and a growing end-user market.

Overall, engine, transmission and steering parts continue to account for over half of all component (53%) exports from India. On the other hand, electrical & electronics and interiors have registered above 20% y-o-y growth in 2018-19.

However, according to latest reports, auto parts exports have suffered a decline by 3.2% in 2019-20 to Rs 1.02 lakh crore (US$ 14.5 billion). The decline was led by Europe, where exports fell by 11%. However, North America and Europe remained stable. Overall, the Indian auto component industry witnessed a decline in turnover by 11.7%. Deepak Jain, Director General, ACMA, commented:

“The automotive industry faced a prolonged slowdown in FY 2019-20 with vehicle sales in all segments plummeting significantly. Subdued vehicle demand, investments made for transition from BSIV to BSVI, liquidity crunch, lack of a clarity on policy for electrification of vehicles and slow-down in key export markets, among others, had an adverse impact on the performance of the components sector in India as also on its expansion plans”.

Import dependence a critical challenge

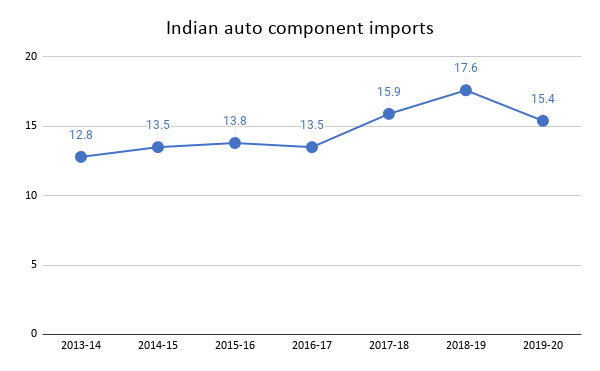

Source: ACMA, figures in US$ billion

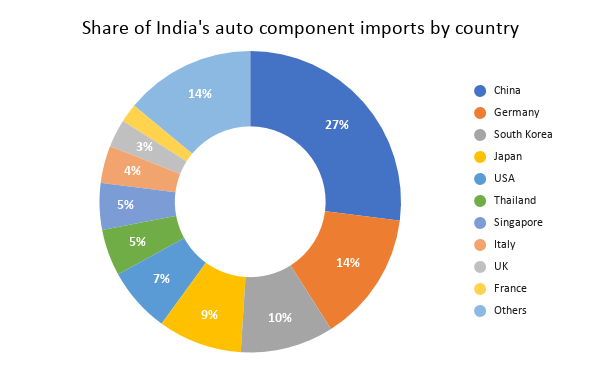

Source: ACMA; data for 2018-19

India’s auto component industry shows a substantial dependence on China, which accounted for around 27% of imports in 2018-19. Post the COVID-shock, the industry is looking for ways to cut reliance on China, and look for alternate sources/indigenisation. The major components for which India is dependent on China include drive transmission, steering parts, electronic and electrical items, cooling systems, suspension and braking parts. Overall, imports in 2018-19 were led by drive transmission & steering (30%), engine components (17%), electricals & electronics (14%), and body chassis (10%).

An ICRA analysis affirms that over 70% of crucial auto component importers and exporters have faced, or are likely to face supply chain disruptions due to the COVID-19 crisis. This is expected to generate a demand shock that could last for several quarters. Around 35% of respondents in ICRA’s survey admitted that there are no alternatives in the event of such a supply chain disruption in China, particularly in electronics. While 47% did say there were alternatives, they said it required at least three months, with substantial validation and re-tooling costs as well as OEM approval.

This was further validated when Indian customs started manual inspection of imports from China. ACMA commented at that time that the industry continued to depend on China for critical components like parts of engines and electronics items, so such disruptions were not in their best interests. The shift to BSVI has also impacted the localisation levels, as testing and validation of localised products is expected to take some time.

Transitioning to the future

Source: KPMG

When we look at revenue-wise breakup of the Indian auto component industry, around 29.09% of the companies have a revenue less than Rs 50 crore. Another 22.21% of the companies have a annual revenue between Rs 50 crore and 150 crore, while 25.93% have a revenue between Rs 150 crore and Rs 500 crore. Just about 9.89% of the companies have a turnover between Rs 500 crore and Rs 1,000 crore, and 12.89% had a turnover of over Rs 1,000 crore.

A report by KPMG analyses the medium to long term impact of COVID-19 on large, medium and small auto component companies. The report concludes that players with strong balance sheets could benefit from this revival. They would look for value buys to consolidate their position, diversify their product portfolio and even explore new OEM relationships. Mid-sized companies with attractive fundamentals and/or strong market presence and OEM relationships could be attractive targets. On the other extreme, KPMG estimates that around 60% of small companies will struggle for liquidity and find it tough to survive without capital infusion.

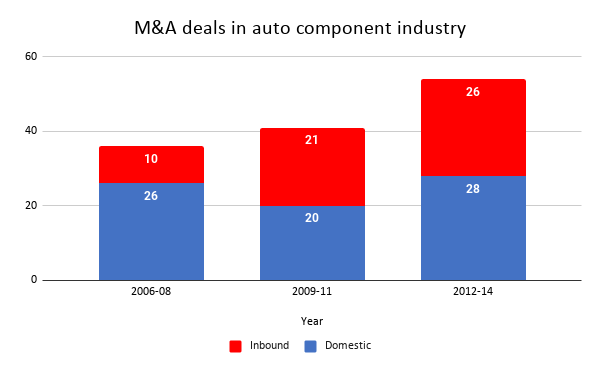

A past analysis of the industry post the 2008 recession saw a rise in the combined number of domestic and inbound M&A deals from 36 during 2006-08 to 54 during 2012-14. Average EV/EBITDA multiples saw a decline from 16.7 in the pre-2008 period to 12.6 post-2008. Considering the scenario post-COVID, one can definitely expect a similar trend.

On the positive side, India offers strong credentials in terms of cost, resource base and relationships to emerge as a viable alternative to China for global OEMs. Distributors are expected to follow suit, with the scenario offering domestic players an opportunity to access global technologies.

Lastly, it is pertinent to mention the impending wave of electric vehicles. Pre-COVID, an estimate by McKinsey had put 55% of 800 auto component players (ACMA members) at risk in the face of an anticipated EV revolution, as they are in the powertrain business. Leading players like Ricoh Auto and Bharat Forge had already begun expanding. However, EVs may be pushed back by quite a few quarters, as players struggle with liquidity, inventory and supply chain issues. In addition there is an expected fallout from currently low crude oil prices on buyer sentiments towards EVs as well. Consequently, the automotive industry’s progression towards EVs is expected to be slower, thereby also impacting the strategic orientation of the auto component sector as well.

Leave a comment