A tangled web: Lockdown, e-commerce and smartphone sales

Regional lockdown curbs are creating major demand and supply side constraints for smartphone firms, which are expecting a sales shortfall of 5 million units. This necessitates interventions to address these issues to facilitate a quicker revival.

- With a spate of lockdowns across states as the country grapples with the second wave of COVID-19, e-commerce continues to have a dream run, being the only available mode for consumers in their greatly curtailed lifestyle.

- However, lockdown blues continue for non-essential categories, particularly smartphones that account for around 60% of e-commerce sales in India.

- To address these challenges, the government must consider the industry demand of putting smartphones within the essential category.

- At the minimum, inter-state movement of non-essential goods should be allowed under some broad guidelines.

Image Credit: freepik

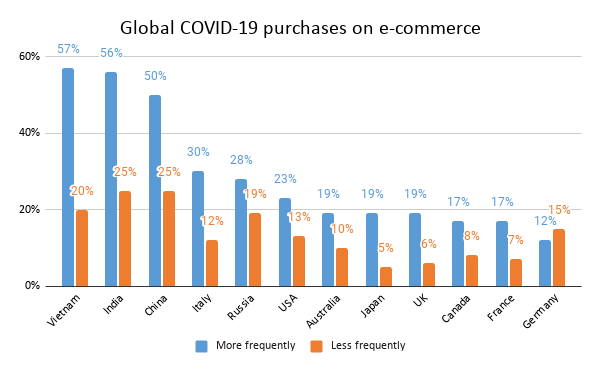

While it is an undeniable fact that COVID-19 wreaked a havoc across the globe in 2020, it was certainly a blessing in disguise for the e-commerce industry. Industry experts affirm that the pandemic has created a shift in the way consumers behave, directly affecting the e-commerce industry, as consumers shifted to this shopping channel to buy essentials amid national/regional lockdowns.

Closer home, it was predicted by some market researchers that India’s e-commerce industry is poised to grow 84% to US$ 111 billion by 2024 as it gains from demand created by the coronavirus pandemic’s impact. Mobile shopping is likely to be the driver of this growth.

However, lockdown blues continue for sectors that are marked as ‘non-essential’ in the retail ecosystem. The primary category in this context is that of smartphones, which account for 60% of the revenues of e-commerce sales and is the focus of this blog.

Source: WARC Data; Representative survey of adults under the age of 75 years between 12-14 March ’20

Online smartphone sales: Action replay or sales going stale?

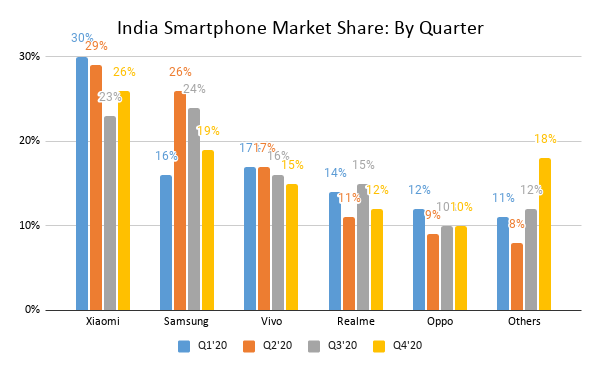

Amidst the local lockdowns & norms of social distancing, the e-commerce industry emerged as the backbone of the retail industry , and by extension, the smartphone sector. According to Counterpoint Research, India’s online smartphone market reached its highest-ever share of 45% in 2020, recording a seven% year-on-year increase in a pandemic-hit year. Xiaomi ruled as the most bought smartphone in the country throughout the year, followed by Samsung.

Source: Counterpoint Research

While the national lockdown with the first wave of the pandemic proved to be a catalyst for the growth of the e-commerce industry in India, dynamics seem to be different this time around with regional lockdowns. While their experience last year has definitely made them more prepared to deal with the possible challenges, the heterogeneity of state regulations has made this task more arduous and complex. Delhi government, for example, has put a curb on the inter- & intra-state movement of non-essential goods. Similarly, in Haryana, only essential goods are being sold. Such measures will indubitably hit the sales of smartphones in the city – both offline and online.

This has led to some e-commerce platforms and consumer electronics companies demanding smartphones and (other consumer electronics like air conditioners) to be labelled as essential. One argument that they cite is that ordering goods online is safer than visiting a general store and reduces the chances of proliferation of the virus. The second argument is on the definition of essential products. From entertainment to online meetings to keeping a tab of the number of steps that we take for exercise, smartphones have become an integral part of our daily lives. Kumar Rajagopalan, Chief Executive Officer, Retailers Association of India opines:

Citizens also need non-food products on a daily basis. To enable fulfilling these needs without hardships, all sizes and formats of non-food retail should be allowed to take orders over phone and other electronic means for home deliveries. This ensures social distancing and convenience to customers.

Further, there are many logistical and operational challenges. The second wave COVID-19 restrictions have been pretty stringent and ecommerce players have had to adjust and change their logistic operations to efficiently service retailers (B2B2C) and consumers (D2C). What complicates the situation further in case of smartphones is India’s high import dependency on China. In 2019-20, 45% of smartphone components were imported from China.

Moreover, the pandemic may also affect the production of smartphones. This accrues to the fact that many people in places like Delhi& Maharashtra are being affected by the virus and unable to work. There is also an apprehension in the industry that a steep surge in Covid-19 cases and fears of lockdowns may trigger another exodus of migrant workforce from cities, like the last year. These can lead to production delays.

In addition to these supply side barriers, it is also believed that the massive second wave of COVID-19 infections may dampen sales of premium phones/smartphones in the short term in this year. This outlook is attributed to the recent spate of job and salary cuts leading to deferred purchases. Mahesh Desai, Chairman, Engineering Export Promotion Council India, explains:

COVID-19 has affected the e-commerce industry. Earlier there was a good demand for consumer goods. But now there is a liquidity crunch. This has affected the purchases of electronics such as smartphones. Also, the demand from rural areas is tapering off.

Lastly, the demand associated with smart phone industry may continue to get affected due to increased GST rate of 18% on mobile phones (as opposed to 12% before April 2020). Harsha Razdan, Partner and Head – Consumer Markets and Internet Business, KPMG in India states:

Although the said increase in GST rate was introduced as a measure to correct inverted duty structure, various bodies have disagreed with the rationale and have accordingly requested for reduction in GST rate to upholster the demand.

The smart solution

The government has taken a number of initiatives to promote the domestic smartphone industry in the past – PLI, SPECS & EMC 2.0. While this is a step in the right direction, some of the problems that the industry faces are of a rather different nature (e.g. production delays due to the labor being infected and the inability to sell them as they don’t constitute ‘essential’ products). To address these challenges, the government should consider the industry demand for broadening the definition of essential goods. At the minimum, it could also frame some broad guidelines regulating inter-state movements of non-essential goods.

Another important intervention would be to facilitate quicker immunization of labour deployed at these production sites. Manufacturers should be encouraged to get their employees vaccinated through immunization at subsidized rates. This will help in ensuring an early revival for the sector, which is looking at a potential loss of 5 million smartphone shipments in the current phase of regional lockdowns.

Amazing insights. actually the need of the day is online. Thanks for the author for the perfect write up