A roadmap for Indian exporters

Prof Harsh V. Verma, Faculty of Management Studies, Delhi University, believes that for Indian exporters to expand their global footprint, it is very important for them to compete with China while looking inward and becoming centers of excellence.

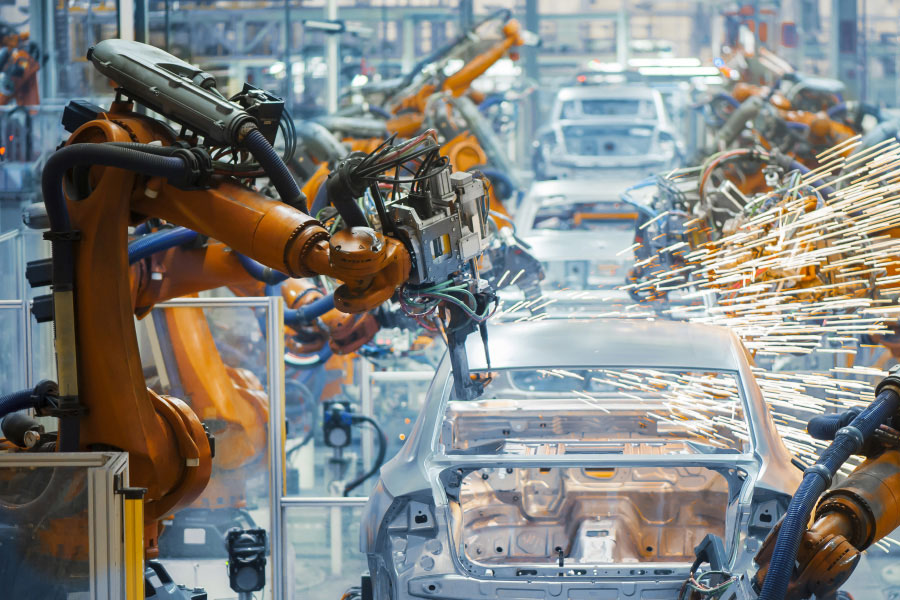

Image credit: Shutterstock

An analysis of top markets for Indian exporters would reveal that nearly 50% of India’s exports are accounted for by just its top 10 export destinations. These include the USA, the UAE, China, Bangladesh, Singapore, the UK, Netherlands and Germany. This can be attributed to a combination of compatibilities like a shared political ideology (such as cherishing the principles of democracy) & common culture, which boils down to valuing freedom, individuality and enterprise.

Beyond that, there is something more fundamental, i.e., an economic affinity to in terms of appreciating the spirit of entrepreneurship, innovation and competitiveness. But, if one takes a deeper look, then one has to look at the composition of India’s export basket to these countries. India has become a low-cost destination for healthcare. At the same time, some of the merchandise that is being exported is low value added/light engineering. Some of these commodities could have the potential to do really well abroad such as leather, apparel & jewellery. So, India may be doing well because of liberalization & cross border linkages. But what really matters is that can the product create strong value add in terms of B2B market space or for the inhabitants of these export destinations.

Moving up the value chain: A key lesson from China

Foreign companies have been able to operate out of India & then there is some kind of technology transfer at a smaller scale. For example, Mercedes-Benz is able to source auto components from India and Nike has outsourced the process of producing shoes while investing in cutting edge technologies that render their products different from their peers. Indian companies get involved in the supply chain at the lower level as the country has a few advantages for scaling up such as low cost of procurement of inputs and low cost of production.

For Indian exporters or companies to boost their exports, they need to compete with China: a lot of Western countries, when they shifted their production base to China, they assumed that China will be a ‘tailor’ and not a ‘designer’. However, once China achieved scale, it started beating these first countries in terms of designing & moving up the scale.

Gauging a firm’s export readiness

A firm needs to first out as to what kind of excellence it has achieved in any sphere of business activity – a product, service or a part of the value chain. It’s one thing to establish a call center and another thing to become a call center excellence. Another important thing to consider for a firm is that is it ready to swim with sharks? They can test the waters by advertising their product in a market through advertising. This should help them gauge the reactions of their customers – their key pain points and delights.

Further, if a company is aspiring to be a top exporter, it needs to build its export competitiveness holistically. There are two ways to benchmark their practices: (i) Practices that a company excels at in the domestic market and; (ii) keeping a tab on what their competitor countries and companies are doing.

What is really missing in this situation is that Indian companies don’t have our own brand. Taking the example of jewellery, can India create a brand like Cartier or Tiffany? Probably not! Similarly, India may have fine leather but why is it not able to become Jimmy Choo of the world? Attaining an edge such as the precision that Swiss watch makers are known for or the craftsmanship of Italian designers or the scale of China is important. This would take some mastery in designing and creating some kind of symbolism.

Lastly, brands need to remember that customers are very intelligent these days; they can see through a brand. In this era of transparency, the consumers are not only interested in a product, they are interested in much more. From a play of consciousness, there is an emergence of conscience. So, customers have now started taking a keen interest in what goes behind a product in terms of processes, procurement, shipment, customer relations and so on. There are customer segments who are willing to pay not just for the product, but for what goes behind its creation. For example, there is a market for ethical products. To sum up, this is an era of discovery. An Indian exporter must think from a customer’s perspective. Develop a better product and experiment to cater to different customers.

Harsh V Verma is Professor at Faculty of Management Studies. He works specialized area of marketing like consumer behaviour, services marketing and brand management. He is Ph.D. from FMS university of Delhi and participated in GCPL Harvard Business School. He has published six books in this field.

Leave a comment