A new gold rush in the making?

Gold demand and supply have both been severely impacted as a result of the COVID-19 led economic downturn and disruptions in global supply chains. However, while jewellery demand has declined, the prospects for gold as an investment safe have n in turbulent times have improved, leading to speculations of a bull rally.

Gold demand in Q1

The onset of COVID-19 has severely impacted gold’s demand in the form of jewellery, but it also boosted investment sentiment for gold as a safe haven. Demand for gold in Q1 2020 grew slightly by 1% YoY to reach 1,083.8 tonnes (+1% y-o-y). Gold-backed ETFs (gold ETFs) grew by 298 tonnes, to reach 3,185 tonnes. Total investment in bars and coins fell to 241.6 tonnes, declining by 6% YoY. While demand for bars dropped by 19%, demand for gold coins witnessed a surge by 36% due to safe-haven buying by Western retail investors. Jewellery demand was severely hit as anticipated, with quarterly demand dropping by 39% YoY to 325.8 tonnes, a record low.

Jewellery consumption witnesses sharp fall across regions

Jewellery demand fell by 41% YoY for India in Q1, 2020, reaching an eleven-year low of 73.9 tonnes. COVID-19 compounded the impact of higher domestic gold prices coupled with a slowing economy and a depreciating currency. Despite an early pick up due to the wedding season, high prices starting mid-February compelled consumers to hold back on purchases. Due to the lockdown, demand in March plunged by 60-80%.

The quarter witnessed the peak of the pandemic for China, whose demand for jewellery fell 65% y-o-y to 64 tonnes. The quarter also witnessed the first y-o-y decline in US jewellery demand since Q4 2016, thereby reversing healthy growth over the past three years.

Central bank gold purchases

Even as the volatile first quarter witnessed an unprecedented stimulus globally, central banks bought 145 tonnes, down 8% YoY, but an increase by 9% over the five-year quarterly average of 132.9 tonnes. Six central banks increased their gold reserves – by at least a tonne – in Q1 2020, compared to ten in Q1, 2019. The most significant purchases of at least one tonne came from recent buyers. Turkey added 72.7 tonnes in Q1, boosting gold reserves to 485.2 tonnes, making it the largest buyer during the quarter.Other central banks that increased their reserves by at least a tonne were UAE (7 tonnes), India (6.8 tonnes), Kazakhstan (2.8 tonnes) and Uzbekistan (2.2 tonnes).

Supply constraints

The onset of Coronavirus restrictions had the expected impact on mining operations, thereby impacting mining output. China, being the first to impose restrictions, saw a 12% y-o-y fall in Q1. These restrictions impacted employees’ ability to return to mining projects after Chinese New Year. However, operations had resumed at many places post-March. Peru (-17%), Argentina (-13%) and South Africa (-11%) also witnessed YoY declines. On the other hand, Ecuador (51% YoY), Burkino Faso (18% YoY), Bulgaria (18% YoY) and Canada (5% YoY) managed to increase output.

India’s gems and jewellery exports

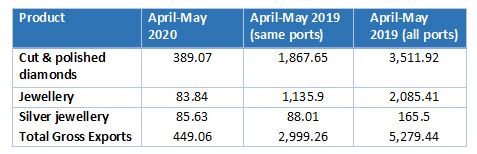

Gems and jewellery exports by India plunged by around 82% during April-May 2020 to reach US$ 449 million. For over a month, India’s gems and jewellery units were shut due to the lockdown and operations resumed in a limited manner after April 20. By April 30, the first export parcels had been shipped.

However, depressed demand in global markets is the major constraint for exporters. Gems and jewellery is one of the sectors where India has a trade surplus with China. Hong Kong accounts for around 27% of India’s total gems and jewellery exports, followed by UAE at 27% and US at 26% (as of 2019-20). Exports during 2019-20 witnessed a decline by 5.32% to reach US$ 30.96 billion, mainly due to slowdown in demand in major developed markets. COVID-19 has further exacerbated the situation.

India’s gems & jewellery exports

Source: GJEPC, data in US$ million

Bull rally in the making?

With the persistent uncertainty over the intensity of the COVID-19 pandemic as well as its impact on economies and markets, gold prices are expected to show a continued upward rally; given the yellow metal’s reputation as a safe haven for investment. The IMF has expected a deeper recession and slower recovery for the global economy at large, which could be a boon for gold as an asset class. Moreover, with central banks across the world resorting to monetary easing, interest rates are expected to stay low or negative.

Leave a comment