Iran has recently announced it will resume import of fabrics from countries producing the best quality material from India, which had earlier expressed readiness to export cloth to Iran once the sanctions were removed.

Experts contend that growing interest among foreign textile producers to export to Iran will benefit the domestic textile industry by creating a competitive market.

To reduce their dependence for growth on the European Union (EU) and American markets, Indian garment exporters are exploring business opportunities with Iran.

After setting a target of $47.5 billion at the start of the season, exports were no more than $38 billion for financial year 2015-16, from $40 billion the previous year. With a host of incentives and a Rs 6,000 crore package announced in the past few months to boost textile and apparel exports, the government has set a target of $50 billion for 2016-17.

Key Facts:

- Iran imported USD 2.2 billion of Textile & Apparel Products in 2016 from world.

- India exported USD 250 million worth of Textile & Apparel products to Iran in 2016.

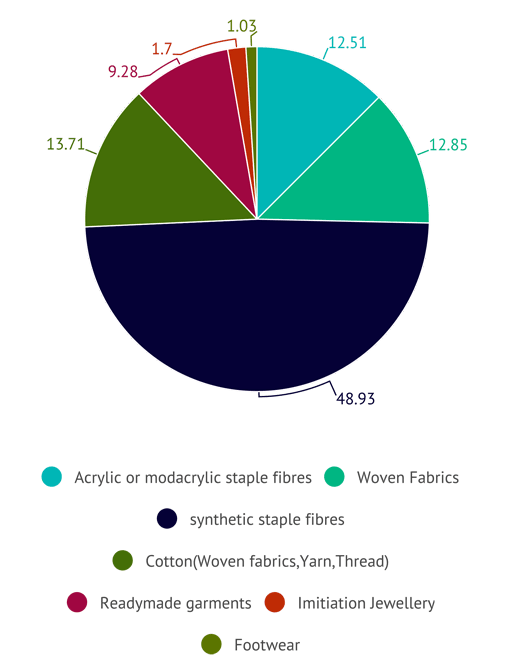

- Major Textile & Apparel products exported from India to Iran includes Woven Fabrics, Acrylic staple fibres, cotton, ready made garments, imitiation jewellery .

- Iran has recently announced it will resume import of fabrics from countries producing the best quality material from India, which had earlier expressed readiness to export cloth to Iran once the sanctions were removed.

- India is the 2th largest exporter of Textile raw materials products to Iran including cotton, silk, staple fibers etc.